Summary Guide - Human Resources - University of Pittsburgh

Summary Guide - Human Resources - University of Pittsburgh

Summary Guide - Human Resources - University of Pittsburgh

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

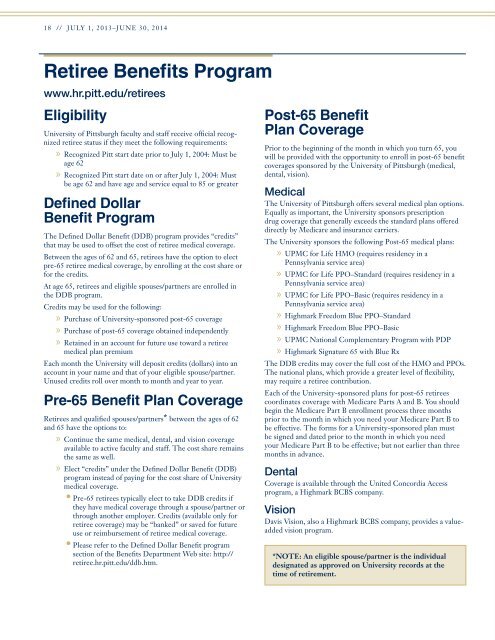

18 // july 1, 2013–june 30, 2014 july 1, 2013–june 30, 2014 \\ 19<br />

Retiree Benefits Program<br />

www.hr.pitt.edu/retirees<br />

Eligibility<br />

<strong>University</strong> <strong>of</strong> <strong>Pittsburgh</strong> faculty and staff receive <strong>of</strong>ficial recognized<br />

retiree status if they meet the following requirements:<br />

»»<br />

Recognized Pitt start date prior to July 1, 2004: Must be<br />

age 62<br />

»»<br />

Recognized Pitt start date on or after July 1, 2004: Must<br />

be age 62 and have age and service equal to 85 or greater<br />

Defined Dollar<br />

Benefit Program<br />

The Defined Dollar Benefit (DDB) program provides “credits”<br />

that may be used to <strong>of</strong>fset the cost <strong>of</strong> retiree medical coverage.<br />

Between the ages <strong>of</strong> 62 and 65, retirees have the option to elect<br />

pre-65 retiree medical coverage, by enrolling at the cost share or<br />

for the credits.<br />

At age 65, retirees and eligible spouses/partners are enrolled in<br />

the DDB program.<br />

Credits may be used for the following:<br />

»»<br />

Purchase <strong>of</strong> <strong>University</strong>-sponsored post-65 coverage<br />

»»<br />

Purchase <strong>of</strong> post-65 coverage obtained independently<br />

»»<br />

Retained in an account for future use toward a retiree<br />

medical plan premium<br />

Each month the <strong>University</strong> will deposit credits (dollars) into an<br />

account in your name and that <strong>of</strong> your eligible spouse/partner.<br />

Unused credits roll over month to month and year to year.<br />

Pre-65 Benefit Plan Coverage<br />

Retirees and qualified spouses/partners* between the ages <strong>of</strong> 62<br />

and 65 have the options to:<br />

»»<br />

Continue the same medical, dental, and vision coverage<br />

available to active faculty and staff. The cost share remains<br />

the same as well.<br />

»»<br />

Elect “credits” under the Defined Dollar Benefit (DDB)<br />

program instead <strong>of</strong> paying for the cost share <strong>of</strong> <strong>University</strong><br />

medical coverage.<br />

• Pre-65 retirees typically elect to take DDB credits if<br />

they have medical coverage through a spouse/partner or<br />

through another employer. Credits (available only for<br />

retiree coverage) may be “banked” or saved for future<br />

use or reimbursement <strong>of</strong> retiree medical coverage.<br />

• Please refer to the Defined Dollar Benefit program<br />

section <strong>of</strong> the Benefits Department Web site: http://<br />

retiree.hr.pitt.edu/ddb.htm.<br />

Post-65 Benefit<br />

Plan Coverage<br />

Prior to the beginning <strong>of</strong> the month in which you turn 65, you<br />

will be provided with the opportunity to enroll in post-65 benefit<br />

coverages sponsored by the <strong>University</strong> <strong>of</strong> <strong>Pittsburgh</strong> (medical,<br />

dental, vision).<br />

Medical<br />

The <strong>University</strong> <strong>of</strong> <strong>Pittsburgh</strong> <strong>of</strong>fers several medical plan options.<br />

Equally as important, the <strong>University</strong> sponsors prescription<br />

drug coverage that generally exceeds the standard plans <strong>of</strong>fered<br />

directly by Medicare and insurance carriers.<br />

The <strong>University</strong> sponsors the following Post-65 medical plans:<br />

»»<br />

UPMC for Life HMO (requires residency in a<br />

Pennsylvania service area)<br />

»»<br />

UPMC for Life PPO–Standard (requires residency in a<br />

Pennsylvania service area)<br />

»»<br />

UPMC for Life PPO–Basic (requires residency in a<br />

Pennsylvania service area)<br />

»»<br />

Highmark Freedom Blue PPO–Standard<br />

»»<br />

Highmark Freedom Blue PPO–Basic<br />

»»<br />

UPMC National Complementary Program with PDP<br />

»»<br />

Highmark Signature 65 with Blue Rx<br />

The DDB credits may cover the full cost <strong>of</strong> the HMO and PPOs.<br />

The national plans, which provide a greater level <strong>of</strong> flexibility,<br />

may require a retiree contribution.<br />

Each <strong>of</strong> the <strong>University</strong>-sponsored plans for post-65 retirees<br />

coordinates coverage with Medicare Parts A and B. You should<br />

begin the Medicare Part B enrollment process three months<br />

prior to the month in which you need your Medicare Part B to<br />

be effective. The forms for a <strong>University</strong>-sponsored plan must<br />

be signed and dated prior to the month in which you need<br />

your Medicare Part B to be effective; but not earlier than three<br />

months in advance.<br />

Dental<br />

Coverage is available through the United Concordia Access<br />

program, a Highmark BCBS company.<br />

Vision<br />

Davis Vision, also a Highmark BCBS company, provides a valueadded<br />

vision program.<br />

*NOTE: An eligible spouse/partner is the individual<br />

designated as approved on <strong>University</strong> records at the<br />

time <strong>of</strong> retirement.<br />

Benefits For Pre-65 and<br />

Post-65 Retirees<br />

Life Insurance<br />

The <strong>University</strong> provides life insurance, based on eligibility as an<br />

active employee, equal to $1,500 for each year <strong>of</strong> service up to a<br />

maximum <strong>of</strong> $15,000. If you have additional life insurance needs,<br />

the <strong>University</strong> <strong>of</strong>fers both conversion and portability provisions<br />

for basic and optional coverages, respectively, that were in force<br />

immediately prior to your retirement.<br />

Long-term Care<br />

Long-term care may be continued into retirement. Upon retirement,<br />

the <strong>University</strong> will notify the insurance carrier, Unum, to<br />

<strong>of</strong>fer you conversion information. Premiums do not increase due<br />

to age or retiree status and will be paid directly to Unum.<br />

Education Benefits<br />

Staff should refer to <strong>University</strong> Policy 07-11-02, or call the<br />

Benefits Department at 412-624-8160.<br />

Faculty should refer to <strong>University</strong> Policy 02-07-02, or call<br />

Faculty Records at 412-624-4232.<br />

Retirement Income Plan<br />

You should begin to review your TIAA-CREF and/or Vanguard<br />

retirement accounts or Defined Benefit Pension Plan participation<br />

prior to retirement. Licensed financial counselors from<br />

TIAA-CREF and Vanguard are available for one-on-one<br />

appointments to review your accounts and discuss potential<br />

investment strategies, income options, inflation and taxes, planning<br />

tools, and resources for services.<br />

TIAA-CREF<br />

General Web Site: www.tiaa-cref.org/pitt<br />

Telephone Counseling: 1-800-682-9139<br />

Personal Appointment: 1-877-209-3136<br />

Appointment Web Site: www.tiaa-cref.org/moc<br />

The Vanguard Group<br />

General Web Site: www.vanguard.com<br />

Telephone Counseling: 1-800-523-1188<br />

Personal Appointment: 1-800-662-0106 ext. 14500<br />

Appointment Web Site: www.meetvanguard.com<br />

Noncontributory Defined Benefit<br />

Pension Plan<br />

Participants in this plan should contact the <strong>University</strong> <strong>of</strong><br />

<strong>Pittsburgh</strong> Pension Administration Center at 1-866-283-0208 to<br />

review the following:<br />

»»<br />

Participation<br />

»»<br />

Vesting status<br />

»»<br />

Eligibility for payments upon retirement<br />

»»<br />

Benefit begin date<br />

»»<br />

Benefit amounts<br />

Benefits Service Center<br />

The <strong>University</strong> <strong>of</strong> <strong>Pittsburgh</strong> partners with a benefits service<br />

center to handle retiree benefit administration:<br />

»»<br />

The <strong>University</strong> remains responsible for the overall<br />

management <strong>of</strong> the program.<br />

»»<br />

The center handles general program administration<br />

and the day-to-day operations <strong>of</strong> the <strong>University</strong>’s retiree<br />

benefits program, including billing.<br />

After the decision to retire is made and <strong>of</strong>ficially processes, the<br />

center will send the enrollment packet to your home address.<br />

What Should I Do If I Want<br />

To Retire?<br />

Contact the Benefits Department to set up a one-on-one session<br />

for you and your spouse/partner if you are considering retiring<br />

and would like to discuss the topics mentioned in this brochure.<br />

»»<br />

Your department requires advance notification <strong>of</strong> a retirement.<br />

The length <strong>of</strong> time your department needs varies by<br />

department.<br />

»»<br />

Your department will then begin the processing <strong>of</strong> your<br />

employee record. Once the processing is complete, the<br />

benefits service center will mail a benefits enrollment<br />

packet to your home address.<br />

»»<br />

The enrollment packet includes all <strong>of</strong> the forms necessary<br />

to enroll in the retiree coverages. This packet will need to<br />

be completed and sent back to the benefits service center<br />

to the address indicated.<br />

»»<br />

The Benefits Department will complete verification forms<br />

required by TIAA-CREF and/or the Vanguard Group as<br />

well as forms for Medicare Part B obtained from the Social<br />

Security Administration.