The Berkeley MFE.pdf - Master of Financial Engineering Program

The Berkeley MFE.pdf - Master of Financial Engineering Program

The Berkeley MFE.pdf - Master of Financial Engineering Program

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

THE HAAS <strong>MFE</strong> FACULTY<br />

Passionate Scholars and Teachers<br />

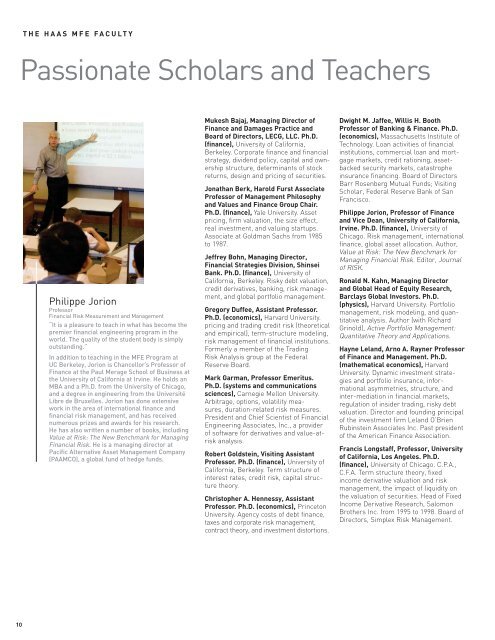

Philippe Jorion<br />

Pr<strong>of</strong>essor<br />

<strong>Financial</strong> Risk Measurement and Management<br />

“It is a pleasure to teach in what has become the<br />

premier financial engineering program in the<br />

world. <strong>The</strong> quality <strong>of</strong> the student body is simply<br />

outstanding.”<br />

In addition to teaching in the <strong>MFE</strong> <strong>Program</strong> at<br />

UC <strong>Berkeley</strong>, Jorion is Chancellor’s Pr<strong>of</strong>essor <strong>of</strong><br />

Finance at the Paul Merage School <strong>of</strong> Business at<br />

the University <strong>of</strong> California at Irvine. He holds an<br />

MBA and a Ph.D. from the University <strong>of</strong> Chicago,<br />

and a degree in engineering from the Université<br />

Libre de Bruxelles. Jorion has done extensive<br />

work in the area <strong>of</strong> international finance and<br />

financial risk management, and has received<br />

numerous prizes and awards for his research.<br />

He has also written a number <strong>of</strong> books, including<br />

Value at Risk: <strong>The</strong> New Benchmark for Managing<br />

<strong>Financial</strong> Risk. He is a managing director at<br />

Pacific Alternative Asset Management Company<br />

(PAAMCO), a global fund <strong>of</strong> hedge funds.<br />

Mukesh Bajaj, Managing Director <strong>of</strong><br />

Finance and Damages Practice and<br />

Board <strong>of</strong> Directors, LECG, LLC. Ph.D.<br />

(finance), University <strong>of</strong> California,<br />

<strong>Berkeley</strong>. Corporate finance and financial<br />

strategy, dividend policy, capital and ownership<br />

structure, determinants <strong>of</strong> stock<br />

returns, design and pricing <strong>of</strong> securities.<br />

Jonathan Berk, Harold Furst Associate<br />

Pr<strong>of</strong>essor <strong>of</strong> Management Philosophy<br />

and Values and Finance Group Chair.<br />

Ph.D. (finance), Yale University. Asset<br />

pricing, firm valuation, the size effect,<br />

real investment, and valuing startups.<br />

Associate at Goldman Sachs from 1985<br />

to 1987.<br />

Jeffrey Bohn, Managing Director,<br />

<strong>Financial</strong> Strategies Division, Shinsei<br />

Bank. Ph.D. (finance), University <strong>of</strong><br />

California, <strong>Berkeley</strong>. Risky debt valuation,<br />

credit derivatives, banking, risk management,<br />

and global portfolio management.<br />

Gregory Duffee, Assistant Pr<strong>of</strong>essor.<br />

Ph.D. (economics), Harvard University.<br />

pricing and trading credit risk (theoretical<br />

and empirical), term-structure modeling,<br />

risk management <strong>of</strong> financial institutions.<br />

Formerly a member <strong>of</strong> the Trading<br />

Risk Analysis group at the Federal<br />

Reserve Board.<br />

Mark Garman, Pr<strong>of</strong>essor Emeritus.<br />

Ph.D. (systems and communications<br />

sciences), Carnegie Mellon University.<br />

Arbitrage, options, volatility measures,<br />

duration-related risk measures.<br />

President and Chief Scientist <strong>of</strong> <strong>Financial</strong><br />

<strong>Engineering</strong> Associates, Inc., a provider<br />

<strong>of</strong> s<strong>of</strong>tware for derivatives and value-atrisk<br />

analysis.<br />

Robert Goldstein, Visiting Assistant<br />

Pr<strong>of</strong>essor. Ph.D. (finance), University <strong>of</strong><br />

California, <strong>Berkeley</strong>. Term structure <strong>of</strong><br />

interest rates, credit risk, capital structure<br />

theory.<br />

Christopher A. Hennessy, Assistant<br />

Pr<strong>of</strong>essor. Ph.D. (economics), Princeton<br />

University. Agency costs <strong>of</strong> debt finance,<br />

taxes and corporate risk management,<br />

contract theory, and investment distortions.<br />

Dwight M. Jaffee, Willis H. Booth<br />

Pr<strong>of</strong>essor <strong>of</strong> Banking & Finance. Ph.D.<br />

(economics), Massachusetts Institute <strong>of</strong><br />

Technology. Loan activities <strong>of</strong> financial<br />

institutions, commercial loan and mortgage<br />

markets, credit rationing, assetbacked<br />

security markets, catastrophe<br />

insurance financing. Board <strong>of</strong> Directors<br />

Barr Rosenberg Mutual Funds; Visiting<br />

Scholar, Federal Reserve Bank <strong>of</strong> San<br />

Francisco.<br />

Philippe Jorion, Pr<strong>of</strong>essor <strong>of</strong> Finance<br />

and Vice Dean, University <strong>of</strong> California,<br />

Irvine. Ph.D. (finance), University <strong>of</strong><br />

Chicago. Risk management, international<br />

finance, global asset allocation. Author,<br />

Value at Risk: <strong>The</strong> New Benchmark for<br />

Managing <strong>Financial</strong> Risk. Editor, Journal<br />

<strong>of</strong> RISK.<br />

Ronald N. Kahn, Managing Director<br />

and Global Head <strong>of</strong> Equity Research,<br />

Barclays Global Investors. Ph.D.<br />

(physics), Harvard University. Portfolio<br />

management, risk modeling, and quantitative<br />

analysis. Author (with Richard<br />

Grinold), Active Portfolio Management:<br />

Quantitative <strong>The</strong>ory and Applications.<br />

Hayne Leland, Arno A. Rayner Pr<strong>of</strong>essor<br />

<strong>of</strong> Finance and Management. Ph.D.<br />

(mathematical economics), Harvard<br />

University. Dynamic investment strategies<br />

and portfolio insurance, informational<br />

asymmetries, structure, and<br />

inter-mediation in financial markets,<br />

regulation <strong>of</strong> insider trading, risky debt<br />

valuation. Director and founding principal<br />

<strong>of</strong> the investment firm Leland O’Brien<br />

Rubinstein Associates Inc. Past president<br />

<strong>of</strong> the American Finance Association.<br />

Francis Longstaff, Pr<strong>of</strong>essor, University<br />

<strong>of</strong> California, Los Angeles. Ph.D.<br />

(finance), University <strong>of</strong> Chicago. C.P.A.,<br />

C.F.A. Term structure theory, fixed<br />

income derivative valuation and risk<br />

management, the impact <strong>of</strong> liquidity on<br />

the valuation <strong>of</strong> securities. Head <strong>of</strong> Fixed<br />

Income Derivative Research, Salomon<br />

Brothers Inc. from 1995 to 1998. Board <strong>of</strong><br />

Directors, Simplex Risk Management.<br />

10