Amity SRI Company Profile - Halma & Smith

Amity SRI Company Profile - Halma & Smith

Amity SRI Company Profile - Halma & Smith

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

This information is for Investment Professionals only and should not be relied upon by private investors.<br />

Ecclesiastical <strong>SRI</strong> Expert Briefing – June 2013<br />

<strong>Amity</strong> Fund <strong>SRI</strong> <strong>Company</strong> <strong>Profile</strong>s<br />

Introduction<br />

The Ecclesiastical range of <strong>SRI</strong> screened ‘<strong>Amity</strong>’ funds hold over 250 different company stocks and debt instruments across their<br />

portfolios. As well as having a strong and compelling investment case, each holding must be researched and approved by the <strong>SRI</strong> team.<br />

In this Expert Briefing our <strong>SRI</strong> team outlines the case for two UK mid-cap stocks which, although not familiar names, are quietly reinventing<br />

their business models around a sustainability agenda: <strong>Halma</strong> (<strong>Amity</strong> UK) and DS <strong>Smith</strong> (<strong>Amity</strong> UK & <strong>Amity</strong> International).<br />

<strong>Halma</strong><br />

<strong>Halma</strong> can trace its history back to 1894, beginning life as The Nahalma Tea Estate<br />

<strong>Company</strong> in Ceylon, and later switching to rubber production. Listed in 1972, by which<br />

time it had long exited commodities, <strong>Halma</strong> became focused instead on a series of<br />

mechanical and electrical engineering companies. Today it employs just over 4,000 people, and operates through 40 subsidiary<br />

businesses in 23 countries; its markets centre on specialty safety, health and environmental technologies.<br />

<strong>Halma</strong> operates in four discrete sectors: process safety, infrastructure safety, medical and environmental & analysis.<br />

Four Business Segments<br />

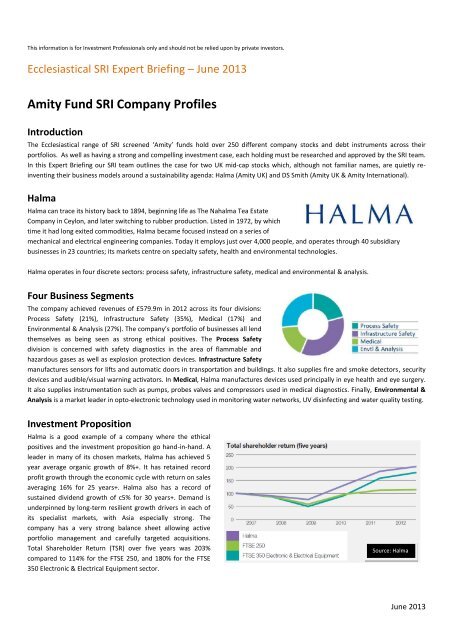

The company achieved revenues of £579.9m in 2012 across its four divisions:<br />

Process Safety (21%), Infrastructure Safety (35%), Medical (17%) and<br />

Environmental & Analysis (27%). The company’s portfolio of businesses all lend<br />

themselves as being seen as strong ethical positives. The Process Safety<br />

division is concerned with safety diagnostics in the area of flammable and<br />

hazardous gases as well as explosion protection devices. Infrastructure Safety<br />

manufactures sensors for lifts and automatic doors in transportation and buildings. It also supplies fire and smoke detectors, security<br />

devices and audible/visual warning activators. In Medical, <strong>Halma</strong> manufactures devices used principally in eye health and eye surgery.<br />

It also supplies instrumentation such as pumps, probes valves and compressors used in medical diagnostics. Finally, Environmental &<br />

Analysis is a market leader in opto-electronic technology used in monitoring water networks, UV disinfecting and water quality testing.<br />

Investment Proposition<br />

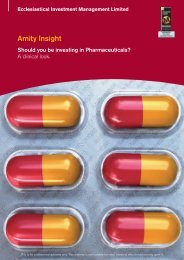

<strong>Halma</strong> is a good example of a company where the ethical<br />

positives and the investment proposition go hand-in-hand. A<br />

leader in many of its chosen markets, <strong>Halma</strong> has achieved 5<br />

year average organic growth of 8%+. It has retained record<br />

profit growth through the economic cycle with return on sales<br />

averaging 16% for 25 years+. <strong>Halma</strong> also has a record of<br />

sustained dividend growth of c5% for 30 years+. Demand is<br />

underpinned by long-term resilient growth drivers in each of<br />

its specialist markets, with Asia especially strong. The<br />

company has a very strong balance sheet allowing active<br />

portfolio management and carefully targeted acquisitions.<br />

Total Shareholder Return (TSR) over five years was 203%<br />

compared to 114% for the FTSE 250, and 180% for the FTSE<br />

350 Electronic & Electrical Equipment sector.<br />

Source: <strong>Halma</strong><br />

June 2013

Key Products<br />

<strong>Halma</strong> is one of the world’s leading manufacturers of fire detectors, protecting people in large buildings such as schools, hospitals and<br />

offices. Over 3 million are sold annually in more than 100 countries. <strong>Halma</strong> gas detectors include portable products to protect entire<br />

industrial sites from gas leaks and flammable or toxic gases. A particular application is detectors used in confined spaces such as<br />

tunnels. <strong>Halma</strong> manufactures non-chemical water treatment systems based on UV technology for disinfecting drinking and waste<br />

water, swimming pools, and industrial water supplies, such as food processing and electronics manufacture. The company is a leading<br />

maker of leak detection instrumentation in underground water pipes, sold to utilities world-wide. The company’s medical specialism is<br />

ophthalmic instrumentation used by eye surgeons and optometrists to test vision and diagnose disease. Principal products include<br />

examination lenses, ophthalmoscopes, and pressure testing instrumentation.<br />

<strong>Halma</strong> has developed a specialist portfolio of businesses which contribute towards resource efficiency, monitoring changes in the<br />

environment, reducing energy, saving water, minimising waste and checking emissions and leaks. The company’s own footprint is<br />

relatively modest, and is subject to reduction targets in the areas of energy, waste and water. Approximately 22% of Group revenues<br />

are currently ISO14001 accredited, and this is being further developed. Despite strong growth the Group has managed to reduce<br />

carbon emissions by 9% over two years.<br />

<strong>Halma</strong> Positive <strong>Amity</strong> Score<br />

The company scores positively across seven of the nine <strong>Amity</strong> pillars, particularly healthcare and environmental performance &<br />

management. Ecclesiastical Investment Management has supported all recent governance proposals and does not view executive pay<br />

as problematic.<br />

Business Practices Community Governance<br />

Education Environmental Healthcare<br />

n/a STRONG STRONG<br />

Human Rights Labour Relations Urban Regeneration<br />

n/a<br />

DS <strong>Smith</strong><br />

David S. <strong>Smith</strong> began life in 1940 as a manufacturer of packaging cartons, and was listed on<br />

the London Stock Exchange in 1986. The company remained a dedicated paper packaging<br />

producer until the late 1980s when it acquired two plastic packaging businesses. The<br />

company is now a leading manufacturer and supplier of corrugated packaging in Europe,<br />

and plastic packaging world-wide, employing over 10,000 people globally. Our interest in<br />

DS <strong>Smith</strong> is linked however to its recent transformation as the leading supplier of recycled<br />

packaging for consumer goods. Consequently virgin paper manufacturing is being wound down in favour of a focused business strategy<br />

manufacturing from recycled product; a business model for sustainable growth.<br />

Three Business Segments<br />

The company achieved revenues of £1.9bn across its three core divisions in the financial year 2011/12: UK Packaging, Continental<br />

European Corrugated Packaging and Plastic Packaging. DS <strong>Smith</strong> excites us<br />

because its entire business model is now centred on manufacturing from<br />

recycled waste, as the company states, this provides the raw material or ‘urban<br />

forest’ to grow a sustainable packaging business. The virtuous cycle allows both<br />

DS <strong>Smith</strong> and the end user to reduce waste and carbon emissions with lower<br />

associated energy costs throughout the supply chain.<br />

June 2013

Sustainability Assured<br />

In 2011/12 DS <strong>Smith</strong> recovered 1.8m tonnes of waste packaging from contracts with the likes of Tesco, Sainsbury M&S and Wm.<br />

Morrison. The company’s integrated model sees it collect and process waste direct from customers, which provides the raw material<br />

for its paper mills. In the UK, all raw fibre used in the manufacture of its corrugated case material (CCM) is sourced from waste product<br />

and this model is being replicated in continental Europe. Approximately 1.1 tonnes of waste are required to produce 1 tonne of new<br />

product, so there is very little waste. In plastic packaging, DS <strong>Smith</strong> has developed environmentally friendly liquids packaging, with the<br />

outer shell made from 100% recycled fibre and uses up to 70% less plastic than regular ‘blow-moulded’ jugs. The bottle is 100%<br />

recyclable and compostable.<br />

Investment Proposition<br />

DS <strong>Smith</strong>’s transition to a global leader in<br />

recycled products has seen strong underlying<br />

revenue growth and higher operating profit<br />

margins; the cost of capital employed has<br />

reduced to 5% of revenue, down from 8%.<br />

Operating profit margin was 7.2% - up 90 basis<br />

points in 2011/12. Operating profit increased<br />

from £75m in 2009 to £142m in 2012. An additional £13m in procurement savings were achieved. Return on average capital employed<br />

increased to an impressive 14.6%, at the top end of its 12-15% target range. The company exhibits strong cash flow and a robust<br />

balance sheet allowing for dividends to grow by 31% in 2011.<br />

Sustainability Performance<br />

DS <strong>Smith</strong> supports our focus on companies with business models tuned towards holistic sustainability propositions, and this approach<br />

is paying dividends in the company’s own environmental performance, given its diversion of product from landfill. Carbon emissions<br />

were reduced by 3% in absolute terms in 2012, and 16% relative to revenue. DS <strong>Smith</strong> has set a target to reduce emissions, waste to<br />

landfill and water consumption by 20% over 10 years from 2010 and this is broadly on track. Nearly half of the company’s own waste is<br />

recycled, with only 12% now directed to landfill and this is reducing year on year.<br />

DS <strong>Smith</strong> Positive <strong>Amity</strong> Score<br />

Source: FT: 5 year comparison DS <strong>Smith</strong> vs. FTSE250<br />

The company scores positively across six of the nine <strong>Amity</strong> pillars, particularly environmental performance, labour practices (health &<br />

safety) and corporate governance.<br />

Business Practices Community Governance<br />

GOOD<br />

Education Environmental Healthcare<br />

n/a STRONG n/a<br />

Human Rights Labour Relations Urban Regeneration<br />

GOOD<br />

n/a<br />

Conclusion<br />

<strong>Halma</strong> and DS <strong>Smith</strong> represent two UK Mid-Cap stocks in the FTSE350 that we regard very positively. Both are long-established<br />

businesses with strong performance track records, but recently both have structured themselves to seize opportunities in the<br />

sustainability market-place. These businesses therefore represent not only strong corporate responsibility plays, but have business<br />

models strategically centred on sustainability itself. Both also represent compelling and interesting long-term investment stories.<br />

June 2013

Ecclesiastical’s <strong>Amity</strong> <strong>SRI</strong> Team<br />

We operate a specialist in-house Socially Responsible Investment (<strong>SRI</strong>) team who carry out thematic and stockspecific<br />

research to identify ethically responsible investment ideas. Headed up by our Senior Socially Responsible<br />

Investment Analysts Ketan Patel, CFA, and Neville White, the team are also responsible for creating an on-going<br />

dialogue with companies. This allows us to engage in discussion on a variety of ethical and socially responsible<br />

investment issues. For investors, it’s an added layer of assurance that client money is being invested in companies<br />

that are operating in a socially responsible and sustainable way.<br />

Ecclesiastical - Ethical Investment Specialist<br />

Since launching the <strong>Amity</strong> UK Fund in 1988, Ecclesiastical has taken a leadership role in ethical<br />

investments, through our ongoing research, engagement practices and our strong fund<br />

performance. Consequently, we were delighted to receive the Moneyfacts Award for Best Ethical<br />

Investment Provider 2012. This is the fourth consecutive year we have won this award. We are<br />

particularly pleased to win this award as it is voted for by the Financial Adviser community. In 2012,<br />

the <strong>Amity</strong> UK Fund was awarded Best Ethical Investment Fund in the inaugural Investment Week<br />

Climate Change and Ethical Investment Awards, and this year we were awarded Money Observer<br />

Best Ethical-<strong>SRI</strong> Bond Fund for the <strong>Amity</strong> Sterling Bond Fund. Today we offer four <strong>SRI</strong> funds under our<br />

<strong>Amity</strong> banner, covering the major markets and investment classes.<br />

Further information<br />

For further information on Ecclesiastical’s <strong>SRI</strong> range of <strong>Amity</strong> Funds please contact your Ecclesiastical Business<br />

Development Manager, visit www.ecclesiastical.com/ifa or call our IFA support team on 0845 604 4056.<br />

Please note that the value of an investment and the income from it can fall as well as rise as a result of market and currency fluctuations, you may not get back<br />

the amount originally invested. Ecclesiastical Investment Management Limited (EIM) Reg. No. 2519319. Registered in England at Beaufort House, Brunswick<br />

Road, Gloucester, GL1 1JZ, UK. EIM is authorised and regulated by the Financial Conduct Authority.<br />

June 2013