Annual Report 2009 - Dairygold

Annual Report 2009 - Dairygold

Annual Report 2009 - Dairygold

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Dairygold</strong> Co-Operative Society Limited <strong>Annual</strong> <strong>Report</strong> and Accounts <strong>2009</strong><br />

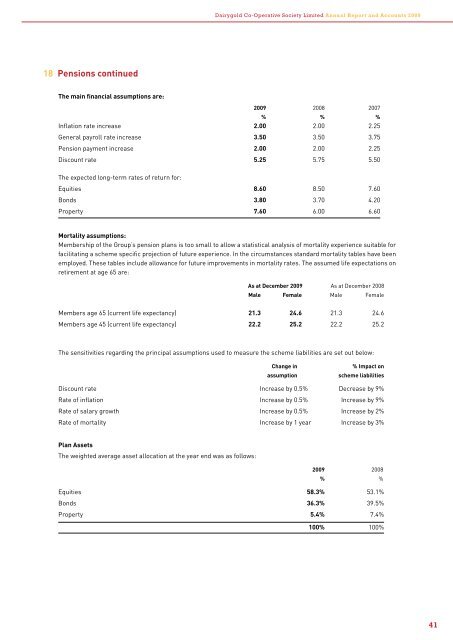

18 Pensions continued<br />

The main financial assumptions are:<br />

<strong>2009</strong> 2008 2007<br />

% % %<br />

Inflation rate increase 2.00 2.00 2.25<br />

General payroll rate increase 3.50 3.50 3.75<br />

Pension payment increase 2.00 2.00 2.25<br />

Discount rate 5.25 5.75 5.50<br />

The expected long-term rates of return for:<br />

Equities 8.60 8.50 7.60<br />

Bonds 3.80 3.70 4.20<br />

Property 7.60 6.00 6.60<br />

Mortality assumptions:<br />

Membership of the Group’s pension plans is too small to allow a statistical analysis of mortality experience suitable for<br />

facilitating a scheme specific projection of future experience. In the circumstances standard mortality tables have been<br />

employed. These tables include allowance for future improvements in mortality rates. The assumed life expectations on<br />

retirement at age 65 are:<br />

As at December <strong>2009</strong> As at December 2008<br />

Male Female Male Female<br />

Members age 65 (current life expectancy) 21.3 24.6 21.3 24.6<br />

Members age 45 (current life expectancy) 22.2 25.2 22.2 25.2<br />

The sensitivities regarding the principal assumptions used to measure the scheme liabilities are set out below:<br />

Change in<br />

assumption<br />

% Impact on<br />

scheme liabilities<br />

Discount rate Increase by 0.5% Decrease by 9%<br />

Rate of inflation Increase by 0.5% Increase by 9%<br />

Rate of salary growth Increase by 0.5% Increase by 2%<br />

Rate of mortality Increase by 1 year Increase by 3%<br />

Plan Assets<br />

The weighted average asset allocation at the year end was as follows:<br />

<strong>2009</strong> 2008<br />

% %<br />

Equities 58.3% 53.1%<br />

Bonds 36.3% 39.5%<br />

Property 5.4% 7.4%<br />

100% 100%<br />

41