core standards for individual long term care insurance policies

core standards for individual long term care insurance policies

core standards for individual long term care insurance policies

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Date: 7/13/10<br />

Under review by the Product Standards Committee<br />

Higlighted changes are those added since the 7/6 draft.<br />

(ii)<br />

(iii)<br />

(iv)<br />

Extended <strong>term</strong> <strong>insurance</strong><br />

Shortened benefit period, or<br />

Other similar offerings approved <strong>for</strong> use by the Interstate Insurance Product Regulation<br />

Commission.<br />

(3) A shortened benefit period non<strong>for</strong>feiture benefit shall provide paid-up <strong>long</strong>-<strong>term</strong> <strong>care</strong> <strong>insurance</strong> coverage<br />

after lapse as follows:<br />

(a)<br />

(b)<br />

(c)<br />

The same benefits (amounts and frequency in effect at the time of lapse but not increased<br />

thereafter) shall be payable <strong>for</strong> a qualifying claim, but the lifetime maximum dollars or days of<br />

benefits shall be de<strong>term</strong>ined as specified in Item (3)(b), below;<br />

The standard non<strong>for</strong>feiture credit shall be described in the policy and shall be equal to 100% of the<br />

sum of all premiums paid, including the premiums paid prior to any changes in benefits. The<br />

company may offer additional shortened benefit period options, as <strong>long</strong> as the benefits <strong>for</strong> each<br />

duration equal or exceed the standard non<strong>for</strong>feiture credit <strong>for</strong> that duration. However, the<br />

minimum non<strong>for</strong>feiture credit shall not be less than thirty (30) times the daily nursing home<br />

benefit at the time of lapse. In either event, the calculation of the non<strong>for</strong>feiture credit shall be<br />

subject to the limitation in Item (4), below;<br />

The policy shall state that non<strong>for</strong>feiture credits may be used <strong>for</strong> all <strong>care</strong> and services qualifying <strong>for</strong><br />

benefits under the <strong>term</strong>s of the policy, up to the limits specified in the policy;<br />

(4) The contingent benefit on lapse benefit contained in a <strong>long</strong>-<strong>term</strong> <strong>care</strong> policy, or added by rider,<br />

endorsement, or amendment to a <strong>long</strong>-<strong>term</strong> <strong>care</strong> policy at issue, shall be subject to the following<br />

requirements:<br />

(a)<br />

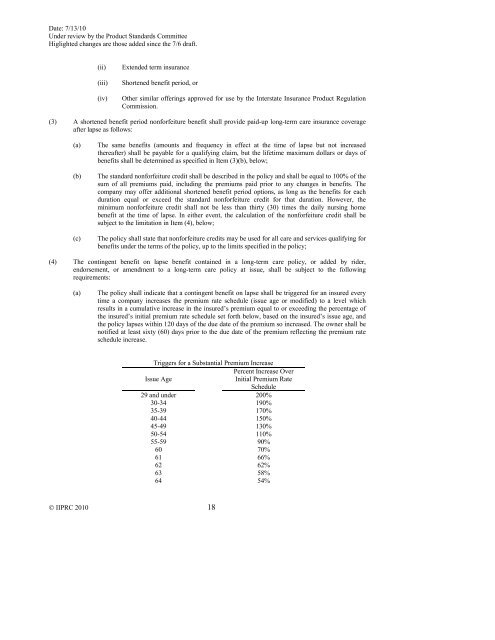

The policy shall indicate that a contingent benefit on lapse shall be triggered <strong>for</strong> an insured every<br />

time a company increases the premium rate schedule (issue age or modified) to a level which<br />

results in a cumulative increase in the insured’s premium equal to or exceeding the percentage of<br />

the insured’s initial premium rate schedule set <strong>for</strong>th below, based on the insured’s issue age, and<br />

the policy lapses within 120 days of the due date of the premium so increased. The owner shall be<br />

notified at least sixty (60) days prior to the due date of the premium reflecting the premium rate<br />

schedule increase.<br />

Triggers <strong>for</strong> a Substantial Premium Increase<br />

Percent Increase Over<br />

Issue Age<br />

Initial Premium Rate<br />

Schedule<br />

29 and under 200%<br />

30-34 190%<br />

35-39 170%<br />

40-44 150%<br />

45-49 130%<br />

50-54 110%<br />

55-59 90%<br />

60 70%<br />

61 66%<br />

62 62%<br />

63 58%<br />

64 54%<br />

© IIPRC 2010 18