2nd Quarterly Report 2005/2006 - International Entertainment ...

2nd Quarterly Report 2005/2006 - International Entertainment ...

2nd Quarterly Report 2005/2006 - International Entertainment ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>International</strong> <strong>Entertainment</strong> Corporation • Interim <strong>Report</strong> <strong>2005</strong>/06<br />

5. Taxation<br />

No provision for Hong Kong profits tax has been made as the Group had no assessable<br />

profits for the three months and six months ended 30 September <strong>2005</strong> (for the three<br />

months and six months ended 30 September 2004: nil).<br />

Taxation arising in other jurisdictions is calculated at the rates prevailing in the relevant<br />

jurisdiction.<br />

No provision for deferred taxation has been recognised as the amount involved is<br />

insignificant.<br />

6. Dividend<br />

The Board does not recommend the payment of any dividend for the six months ended<br />

30 September <strong>2005</strong> (for the six months ended 30 September 2004: nil).<br />

7. Loss per share<br />

The calculation of the basic loss per share for the three months and six months ended<br />

30 September <strong>2005</strong> is based on the respective unaudited consolidated loss attributable<br />

to equity holders of approximately HK$12,896,000 and HK$12,684,000 (three months<br />

and six months ended 30 September 2004: HK$2,698,000 and HK$6,731,000) and<br />

the weighted average number of shares of 235,831,447 (three months and six months<br />

ended 30 September 2004: 204,831,447 and 170,317,785) in issue during the periods.<br />

Loss per share for six months ended 30 September 2004 has been adjusted for the<br />

share consolidation of every 100 ordinary shares of HK$0.01 each into one share of<br />

HK$1.00 each, which became effective on 22 April 2004.<br />

The computation of diluted loss per share for the three months and six months ended<br />

30 September <strong>2005</strong> did not assume the exercise of the subsidiary’s outstanding share<br />

options existed during the six months ended 30 September <strong>2005</strong> since their exercise<br />

would reduce loss per share. For the three months and six months ended 30 September<br />

2004, no diluted loss per share has been presented as there were no options in issue.<br />

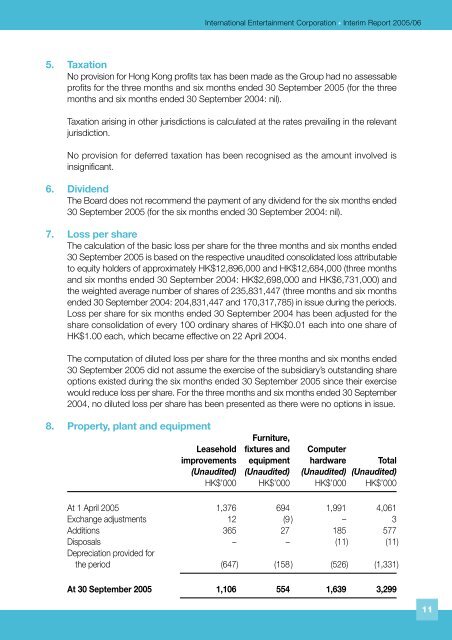

8. Property, plant and equipment<br />

Furniture,<br />

Leasehold fixtures and Computer<br />

improvements equipment hardware Total<br />

(Unaudited) (Unaudited) (Unaudited) (Unaudited)<br />

HK$’000 HK$’000 HK$’000 HK$’000<br />

At 1 April <strong>2005</strong> 1,376 694 1,991 4,061<br />

Exchange adjustments 12 (9 ) – 3<br />

Additions 365 27 185 577<br />

Disposals – – (11) (11)<br />

Depreciation provided for<br />

the period (647) (158 ) (526) (1,331)<br />

At 30 September <strong>2005</strong> 1,106 554 1,639 3,299<br />

11