KOTRA INDUSTRIES BERHAD - Kotra Pharma

KOTRA INDUSTRIES BERHAD - Kotra Pharma

KOTRA INDUSTRIES BERHAD - Kotra Pharma

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>KOTRA</strong> <strong>INDUSTRIES</strong> <strong>BERHAD</strong><br />

(Incorporated in Malaysia)<br />

Company No. : 497632 – P<br />

NOTES TO THE FINANCIAL STATEMENTS<br />

FOR THE FINANCIAL YEAR ENDED 30 JUNE 2007<br />

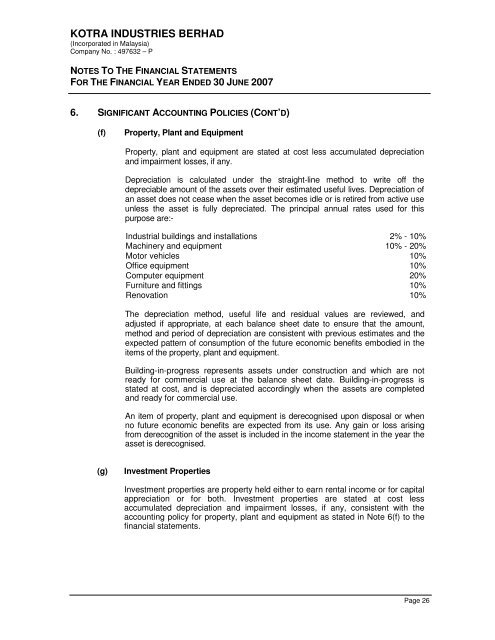

6. SIGNIFICANT ACCOUNTING POLICIES (CONT’D)<br />

(f)<br />

Property, Plant and Equipment<br />

Property, plant and equipment are stated at cost less accumulated depreciation<br />

and impairment losses, if any.<br />

Depreciation is calculated under the straight-line method to write off the<br />

depreciable amount of the assets over their estimated useful lives. Depreciation of<br />

an asset does not cease when the asset becomes idle or is retired from active use<br />

unless the asset is fully depreciated. The principal annual rates used for this<br />

purpose are:-<br />

Industrial buildings and installations 2% - 10%<br />

Machinery and equipment 10% - 20%<br />

Motor vehicles 10%<br />

Office equipment 10%<br />

Computer equipment 20%<br />

Furniture and fittings 10%<br />

Renovation 10%<br />

The depreciation method, useful life and residual values are reviewed, and<br />

adjusted if appropriate, at each balance sheet date to ensure that the amount,<br />

method and period of depreciation are consistent with previous estimates and the<br />

expected pattern of consumption of the future economic benefits embodied in the<br />

items of the property, plant and equipment.<br />

Building-in-progress represents assets under construction and which are not<br />

ready for commercial use at the balance sheet date. Building-in-progress is<br />

stated at cost, and is depreciated accordingly when the assets are completed<br />

and ready for commercial use.<br />

An item of property, plant and equipment is derecognised upon disposal or when<br />

no future economic benefits are expected from its use. Any gain or loss arising<br />

from derecognition of the asset is included in the income statement in the year the<br />

asset is derecognised.<br />

(g)<br />

Investment Properties<br />

Investment properties are property held either to earn rental income or for capital<br />

appreciation or for both. Investment properties are stated at cost less<br />

accumulated depreciation and impairment losses, if any, consistent with the<br />

accounting policy for property, plant and equipment as stated in Note 6(f) to the<br />

financial statements.<br />

Page 26