Doing Business in Belgium - RSM International

Doing Business in Belgium - RSM International

Doing Business in Belgium - RSM International

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

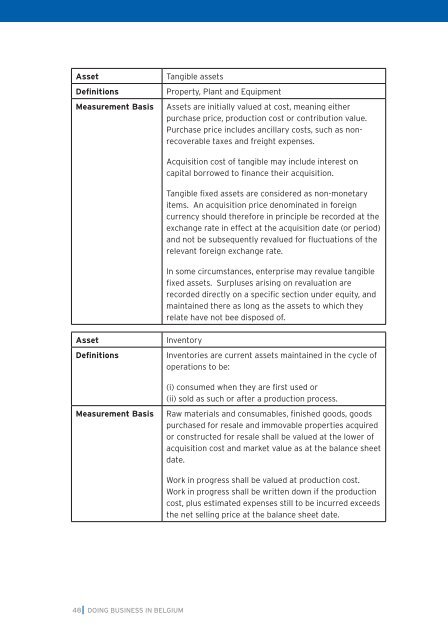

Asset<br />

Def<strong>in</strong>itions<br />

Measurement Basis<br />

Asset<br />

Def<strong>in</strong>itions<br />

Measurement Basis<br />

Tangible assets<br />

Property, Plant and Equipment<br />

Assets are <strong>in</strong>itially valued at cost, mean<strong>in</strong>g either<br />

purchase price, production cost or contribution value.<br />

Purchase price <strong>in</strong>cludes ancillary costs, such as nonrecoverable<br />

taxes and freight expenses.<br />

Acquisition cost of tangible may <strong>in</strong>clude <strong>in</strong>terest on<br />

capital borrowed to f<strong>in</strong>ance their acquisition.<br />

Tangible fixed assets are considered as non-monetary<br />

items. An acquisition price denom<strong>in</strong>ated <strong>in</strong> foreign<br />

currency should therefore <strong>in</strong> pr<strong>in</strong>ciple be recorded at the<br />

exchange rate <strong>in</strong> effect at the acquisition date (or period)<br />

and not be subsequently revalued for fluctuations of the<br />

relevant foreign exchange rate.<br />

In some circumstances, enterprise may revalue tangible<br />

fixed assets. Surpluses aris<strong>in</strong>g on revaluation are<br />

recorded directly on a specific section under equity, and<br />

ma<strong>in</strong>ta<strong>in</strong>ed there as long as the assets to which they<br />

relate have not bee disposed of.<br />

Inventory<br />

Inventories are current assets ma<strong>in</strong>ta<strong>in</strong>ed <strong>in</strong> the cycle of<br />

operations to be:<br />

(i) consumed when they are first used or<br />

(ii) sold as such or after a production process.<br />

Raw materials and consumables, f<strong>in</strong>ished goods, goods<br />

purchased for resale and immovable properties acquired<br />

or constructed for resale shall be valued at the lower of<br />

acquisition cost and market value as at the balance sheet<br />

date.<br />

Work <strong>in</strong> progress shall be valued at production cost.<br />

Work <strong>in</strong> progress shall be written down if the production<br />

cost, plus estimated expenses still to be <strong>in</strong>curred exceeds<br />

the net sell<strong>in</strong>g price at the balance sheet date.<br />

7. Invest<strong>in</strong>g <strong>in</strong> <strong>Belgium</strong><br />

7.1. General <strong>in</strong>formation about <strong>in</strong>vest<strong>in</strong>g <strong>in</strong> <strong>Belgium</strong><br />

7.1.1. Top EU regions: Brussels, Flanders, Wallonia: lead<strong>in</strong>g<br />

<strong>in</strong>vestment dest<strong>in</strong>ation<br />

<strong>Belgium</strong> has a clearly <strong>in</strong>ternational outlook due to its geographical location,<br />

multicultural population and history. For centuries, it has been a crossroads and<br />

trad<strong>in</strong>g hub, reta<strong>in</strong><strong>in</strong>g the best of Lat<strong>in</strong>, Germanic and Anglo-Saxon cultures. The<br />

people of <strong>Belgium</strong> enjoy a f<strong>in</strong>e reputation for their high level of productivity, loyalty,<br />

openness and multil<strong>in</strong>gual skills.<br />

<strong>Belgium</strong> is a federal state consist<strong>in</strong>g of three regions: Brussels, Flanders and Wallonia.<br />

Each region has a great deal of autonomy, mak<strong>in</strong>g <strong>Belgium</strong> one of the most modern<br />

states <strong>in</strong> the world. The regions’ powers and responsibilities <strong>in</strong>clude trade, the<br />

economy, employment, <strong>in</strong>dustry, agriculture and the environment. They each pursue<br />

a dynamic economic policy.<br />

These policies are bear<strong>in</strong>g fruit. Foreign Direct Investment magaz<strong>in</strong>e (a F<strong>in</strong>ancial<br />

Times publication) recently ranked Flanders and Wallonia among the top 5 most<br />

attractive regions <strong>in</strong> Europe. Among large cities, Brussels ranked <strong>in</strong> the top 10<br />

for <strong>in</strong>frastructure, quality of life and human resources. This comb<strong>in</strong>ed regional<br />

performance makes <strong>Belgium</strong> one of the most attractive countries <strong>in</strong> Europe, offer<strong>in</strong>g<br />

an environment rich <strong>in</strong> opportunities, stable economic growth and a strong currency<br />

(<strong>Belgium</strong> was one of the first European countries to commit to the euro).<br />

7.1.2. An Intelligent Tax system<br />

While all commercial companies resident <strong>in</strong> <strong>Belgium</strong> are subject to corporate <strong>in</strong>come<br />

tax, we can help you f<strong>in</strong>d the best fiscal mechanisms allow<strong>in</strong>g you to get your project<br />

off the ground. There is an <strong>in</strong>telligent tax solution for your project.<br />

The authorities are well aware of how important it is to enhance upfront legal<br />

certa<strong>in</strong>ty for potential and exist<strong>in</strong>g <strong>in</strong>vestors. Accord<strong>in</strong>gly, Belgian tax legislation<br />

provides economic players with a generally applicable advance ‘rul<strong>in</strong>g’ practice. This<br />

procedure is smooth, rapid and efficient. The rul<strong>in</strong>g is issued with<strong>in</strong> three months<br />

and the rul<strong>in</strong>g decision is legally b<strong>in</strong>d<strong>in</strong>g for up to five years. The rul<strong>in</strong>g <strong>in</strong>cludes the<br />

various fiscal measures that can be used to lower the tax base or cost. The nom<strong>in</strong>al<br />

tax rate is 33.99%.<br />

For small and medium-sized enterprises (SMEs) with a taxable profit not exceed<strong>in</strong>g<br />

322,500 euro, the tax rate drops to 24.98% at the lower end of the tax scale. Legal<br />

mechanisms make it possible to lower the nom<strong>in</strong>al rate.<br />

48<br />

DOING BUSINESS IN BELGIUM<br />

DOING BUSINESS IN BELGIUM<br />

49