Fallback and Recovery Specification (FRS)

Fallback and Recovery Specification (FRS)

Fallback and Recovery Specification (FRS)

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

OWNER<br />

DG TAXUD<br />

ISSUE DATE<br />

01/12/2009<br />

TAXATION AND CUSTOMS UNION DG<br />

EMCS COMPUTERISATION PROJECT<br />

PHASE 2<br />

SUBJECT:<br />

Framework Contract: TAXUD/2008/CC/095<br />

VERSION<br />

3.11-EN<br />

<strong>Fallback</strong> <strong>and</strong> <strong>Recovery</strong> <strong>Specification</strong> (<strong>FRS</strong>)<br />

ECP2-FITSDEV2-SC03-<strong>FRS</strong>

DG TAXUD – EXCISE COMPUTERISATION PROJECT REF: ECP2-FITSDEV2-SC03-<strong>FRS</strong><br />

FALLBACK AND RECOVERY SPECIFICATION (<strong>FRS</strong>) VERSION: 3.11-EN<br />

[This page has been left intentionally blank.]<br />

ECP2-FITSDEV2-SC03-<strong>FRS</strong>v3.11.doc Page 2 of 53

DG TAXUD – EXCISE COMPUTERISATION PROJECT REF: ECP2-FITSDEV2-SC03-<strong>FRS</strong><br />

FALLBACK AND RECOVERY SPECIFICATION (<strong>FRS</strong>) VERSION: 3.11-EN<br />

DOCUMENT HISTORY<br />

Document History<br />

Edi. Rev. Date Description Action (*) Pages<br />

0 00 08/05/2004 Create I All<br />

0 01 20/08/2004 Corrected Chapter 6 U 34 +<br />

0 02 20/08/2004 Added paragraph 7.1 U 36+<br />

0 03 22/08/2004 Added paragraph 7.1.2 U 36+<br />

0 04 01/10/2004<br />

Updated after SEVE quality<br />

review, SfR<br />

U All<br />

0 05 10/11/2004 SfR visibility check point U All<br />

0 06 30/11/2004 SfR visibility check point U All<br />

0 07 21/01/2005<br />

Updated after SEVE quality<br />

review, SfR<br />

U All<br />

1 00 21/03/2005 Updated for SfA U All<br />

1 01 18/04/2005 SfA v 1.b U All<br />

1 02 29/04/2005 SfA verification U All<br />

1 03 17/03/2006 Updated for internal review U All<br />

1 04 20/03/2006 Updated after MS comments U All<br />

1 05 27/03/2006 SfR U All<br />

2 00 04/05/2006 SfA U All<br />

2 11 02/07/2007 Internal review, SfR U All<br />

3 00 30/07/2007 SfA U All<br />

3 01 18/01/2008<br />

Incorporating changes imposed<br />

by the Trigger Nb #159.<br />

Submitted for review to<br />

Taxation <strong>and</strong> Customs Union<br />

DG.<br />

ECP2-FITSDEV2-SC03-<strong>FRS</strong>v3.11.doc Page 3 of 53<br />

U<br />

As<br />

Required

DG TAXUD – EXCISE COMPUTERISATION PROJECT REF: ECP2-FITSDEV2-SC03-<strong>FRS</strong><br />

FALLBACK AND RECOVERY SPECIFICATION (<strong>FRS</strong>) VERSION: 3.11-EN<br />

DOCUMENT HISTORY<br />

3 02 25/02/2008<br />

3 03 07/03/2008<br />

3 04 28/05/2008<br />

3 05 25/06/2008<br />

3 06 25/02/2009<br />

3 07 02/04/2009<br />

Submitted for Acceptance to<br />

Taxation <strong>and</strong> Customs Union<br />

DG.<br />

Re-Submitted for Acceptance<br />

to Taxation <strong>and</strong> Customs<br />

Union DG.<br />

Incorporating changes imposed<br />

by the RFA Nb #178.<br />

Submitted for review to<br />

Taxation <strong>and</strong> Customs Union<br />

DG.<br />

Submitted for Acceptance to<br />

Taxation <strong>and</strong> Customs Union<br />

DG.<br />

Incorporating changes imposed<br />

by the RFA Nb #234. More<br />

specifically:<br />

� Implementing <strong>FRS</strong><br />

v3.05 WDs.<br />

� Performing alignment<br />

with revised MAP<br />

(CED 529).<br />

� Performing alignment<br />

with revised Directive<br />

(2008/118/EC).<br />

Submitted for review to<br />

Taxation <strong>and</strong> Customs Union<br />

DG.<br />

Incorporating Reviewers<br />

Comments.<br />

Submitted for Acceptance to<br />

Taxation <strong>and</strong> Customs Union<br />

DG.<br />

ECP2-FITSDEV2-SC03-<strong>FRS</strong>v3.11.doc Page 4 of 53<br />

U<br />

U<br />

U<br />

U<br />

I, U<br />

U<br />

As<br />

Required<br />

As<br />

Required<br />

As<br />

Required<br />

As<br />

Required<br />

As<br />

Required<br />

As<br />

Required

DG TAXUD – EXCISE COMPUTERISATION PROJECT REF: ECP2-FITSDEV2-SC03-<strong>FRS</strong><br />

FALLBACK AND RECOVERY SPECIFICATION (<strong>FRS</strong>) VERSION: 3.11-EN<br />

DOCUMENT HISTORY<br />

3 08 06/04/2009<br />

3 09 04/11/2009<br />

3 10 20/11/2009<br />

3 11 01/12/2009<br />

Incorporating DG TAXUD's<br />

verification comments.<br />

Submitted for information to<br />

DG TAXUD.<br />

Updated after MS comments.<br />

Submitted for review to<br />

Taxation <strong>and</strong> Customs Union<br />

DG.<br />

Incorporating Reviewers<br />

Comments.<br />

Submitted for Acceptance to<br />

Taxation <strong>and</strong> Customs Union<br />

DG.<br />

Incorporating DG TAXUD's<br />

verification comments.<br />

Submitted for information to<br />

DG TAXUD.<br />

(*) Action: I = Insert, R = Replace, U = Update, D = Delete<br />

ECP2-FITSDEV2-SC03-<strong>FRS</strong>v3.11.doc Page 5 of 53<br />

U<br />

U<br />

U<br />

U<br />

As<br />

Required<br />

As<br />

Required<br />

As<br />

Required<br />

As<br />

Required

DG TAXUD – EXCISE COMPUTERISATION PROJECT REF: ECP2-FITSDEV2-SC03-<strong>FRS</strong><br />

FALLBACK AND RECOVERY SPECIFICATION (<strong>FRS</strong>) VERSION: 3.11-EN<br />

TABLE OF contents<br />

Table of contents<br />

DOCUMENT HISTORY ..................................................................................................................................... 3<br />

TABLE OF CONTENTS ...................................................................................................................................... 6<br />

1 INTRODUCTION ......................................................................................................................................... 9<br />

1.1 PURPOSE OF THE DOCUMENT.................................................................................................................... 9<br />

1.2 FIELD OF APPLICATION ............................................................................................................................. 9<br />

1.3 INTENDED READERSHIP .......................................................................................................................... 10<br />

1.4 STRUCTURE OF THE DOCUMENT ............................................................................................................. 10<br />

1.5 APPLICABLE AND REFERENCE DOCUMENTS............................................................................................ 11<br />

1.5.1 Applicable Documents................................................................................................................... 11<br />

1.5.2 Reference Documents .................................................................................................................... 11<br />

1.6 SPECIFIC GLOSSARY ............................................................................................................................... 12<br />

1.7 ASSUMPTIONS ........................................................................................................................................ 13<br />

2 HOW TO READ THIS DOCUMENT ? ................................................................................................... 14<br />

2.1 WHAT AN EXCEPTION MEANS................................................................................................................. 14<br />

2.2 DISCOVERING AND CHARACTERIZING EXCEPTIONS ................................................................................ 14<br />

2.3 PROPOSING BUSINESS RESPONSES TO EXCEPTIONS ................................................................................. 16<br />

3 EXCEPTIONS TYPOLOGY ..................................................................................................................... 20<br />

3.1 INFORMATION EXCHANGE EXCEPTIONS ................................................................................................. 20<br />

3.1.1 Exceptions at physical level .......................................................................................................... 20<br />

3.1.2 Exceptions at semantic level.......................................................................................................... 21<br />

3.2 PROCESS EXCEPTIONS ............................................................................................................................ 22<br />

3.2.1 Exceptions at physical level .......................................................................................................... 22<br />

3.2.2 Exceptions at semantic level.......................................................................................................... 23<br />

4 MANAGEMENT OF DATA ...................................................................................................................... 24<br />

4.1 OWNERSHIP AND HOLDING OF DATA ...................................................................................................... 24<br />

4.2 RECTIFICATION OF DATA........................................................................................................................ 24<br />

4.2.1 Rectification at entry level ............................................................................................................. 25<br />

4.2.2 Rectification at application level ................................................................................................... 25<br />

4.2.3 Control of rectifications ................................................................................................................ 26<br />

5 SOLUTION ELEMENTS .......................................................................................................................... 27<br />

5.1 PREVENTION OF EXCEPTIONS ................................................................................................................. 27<br />

5.1.1 PR01: Pre-validation of entered information ................................................................................ 28<br />

5.1.2 PR02: Ensure permanent availability of EMCS applications ....................................................... 28<br />

5.1.3 PR03: Atomicity of EBP processing .............................................................................................. 28<br />

5.1.4 PR04: Use of timers ...................................................................................................................... 28<br />

5.1.5 PR05: Enqueue message for further automatic recovery .............................................................. 29<br />

5.1.6 PR06: Business acknowledgement ................................................................................................ 29<br />

5.1.7 PR07: Follow-up ‘open’ information ............................................................................................ 30<br />

5.2 ADMINISTRATIVE PROCEDURES ............................................................................................................. 30<br />

5.2.1 AP01: Enquire on information ...................................................................................................... 31<br />

5.2.2 AP04: Broadcast information on unavailability ........................................................................... 31<br />

5.2.3 AP05: Perform internal controls ................................................................................................... 31<br />

5.2.4 AP06: Take a business decision .................................................................................................... 32<br />

5.2.5 AP07: Transfer issue to support .................................................................................................... 32<br />

5.2.6 AP08: Exchange information outside EMCS ................................................................................ 33<br />

5.3 FALLBACK SOLUTION ELEMENTS ........................................................................................................... 33<br />

5.3.1 FB01: Use alternate communication medium ............................................................................... 34<br />

ECP2-FITSDEV2-SC03-<strong>FRS</strong>v3.11.doc Page 6 of 53

DG TAXUD – EXCISE COMPUTERISATION PROJECT REF: ECP2-FITSDEV2-SC03-<strong>FRS</strong><br />

FALLBACK AND RECOVERY SPECIFICATION (<strong>FRS</strong>) VERSION: 3.11-EN<br />

TABLE OF contents<br />

5.3.2 FB02: Revert to manual without subsequent input ....................................................................... 35<br />

5.3.3 FB03: Revert to manual with subsequent input ............................................................................ 35<br />

5.3.4 FB04: No intervention – wait ........................................................................................................ 35<br />

5.3.5 FB06: Notify administration ......................................................................................................... 36<br />

5.3.6 FB08: Notify economic operator ................................................................................................... 37<br />

5.4 RECOVERY SOLUTION ELEMENTS ........................................................................................................... 37<br />

5.4.1 RC03: Restart or replace technical component ............................................................................ 37<br />

5.4.2 RC04: Enter data using the normal procedure ............................................................................. 38<br />

5.4.3 RC05: No intervention – accept exception .................................................................................... 38<br />

5.4.4 RC06: Collate electronic record with the fallback form ............................................................... 38<br />

5.4.5 RC07: Replay information exchange ............................................................................................ 39<br />

5.4.6 RC10: Re-apply undone changes .................................................................................................. 39<br />

6 PAPER FALLBACK SYSTEM ................................................................................................................. 40<br />

6.1 OVERVIEW ............................................................................................................................................. 40<br />

6.2 ROLES AND RESPONSIBILITIES ................................................................................................................ 40<br />

6.2.1 Unavailability at consignor’s premises (location A) ..................................................................... 41<br />

6.2.2 Unavailability at MSA of dispatch (location B) ............................................................................ 41<br />

6.2.3 Unavailability at MSA of destination (location C) ........................................................................ 41<br />

6.2.4 Unavailability at consignee’s premises (location D) .................................................................... 42<br />

6.3 FALLBACK PAPER FORMS ....................................................................................................................... 42<br />

6.4 FALLBACK COMMUNICATION MEDIA ...................................................................................................... 42<br />

6.5 MAIN BUSINESS CASES FALLBACK PROCEDURES .................................................................................... 43<br />

6.5.1 Submission of AAD ........................................................................................................................ 43<br />

6.5.2 Cancellation of AAD ..................................................................................................................... 44<br />

6.5.3 Report of receipt ............................................................................................................................ 44<br />

6.5.4 Change of destination.................................................................................................................... 45<br />

6.5.5 Splitting ......................................................................................................................................... 46<br />

6.5.6 Interruption ................................................................................................................................... 47<br />

6.5.7 Control .......................................................................................................................................... 47<br />

6.5.8 Administrative cooperation ........................................................................................................... 48<br />

6.6 RECOVERY FROM PAPER FALLBACK PROCEDURES ................................................................................. 48<br />

6.6.1 Means to recover ........................................................................................................................... 48<br />

6.6.2 Deferred mode ............................................................................................................................... 49<br />

6.6.3 Summary of intermediate operations ............................................................................................ 49<br />

7 UNAVAILABILITY OF SEED INFORMATION ................................................................................... 50<br />

8 SPECIFIC PROVISIONS DURING THE ROLLOUT OF EMCS ........................................................ 51<br />

8.1 FALLBACK AND RECOVERY DURING MIGRATION PERIOD 1 ................................................................... 51<br />

8.1.1 Unavailability of the automatic triggering of risk assessment ...................................................... 51<br />

8.1.2 Exportation of goods in an MSA different from the MSA of dispatch ........................................... 51<br />

8.1.3 Unavailability of the control report .............................................................................................. 52<br />

8.1.4 Unavailability of the event report ................................................................................................. 52<br />

8.1.5 Interruption of a movement ........................................................................................................... 53<br />

ECP2-FITSDEV2-SC03-<strong>FRS</strong>v3.11.doc Page 7 of 53

DG TAXUD – EXCISE COMPUTERISATION PROJECT REF: ECP2-FITSDEV2-SC03-<strong>FRS</strong><br />

FALLBACK AND RECOVERY SPECIFICATION (<strong>FRS</strong>) VERSION: 3.11-EN<br />

TABLE OF figures<br />

Table of figures<br />

FIGURE 1 APPENDIX A - EXCEPTIONS ................................................................................................... 18<br />

FIGURE 2 E-AAD MANAGEMENT INFORMATION FLOWS ....................................................................... 40<br />

FIGURE 3 SUBMISSION OF AAD – FALLBACK ADMINISTRATIVE CIRCUIT .............................................. 43<br />

FIGURE 4 CANCELLATION OF AAD – FALLBACK ADMINISTRATIVE CIRCUIT......................................... 44<br />

FIGURE 5 REPORT OF RECEIPT – FALLBACK ADMINISTRATIVE CIRCUIT ................................................. 44<br />

FIGURE 6 CHANGE OF DESTINATION – FALLBACK ADMINISTRATIVE CIRCUIT ....................................... 45<br />

FIGURE 7 SPLITTING – FALLBACK ADMINISTRATIVE CIRCUIT ............................................................... 46<br />

FIGURE 8 INTERRUPTION – FALLBACK ADMINISTRATIVE CIRCUIT ........................................................ 47<br />

FIGURE 9 CONTROL – FALLBACK ADMINISTRATIVE CIRCUIT ................................................................ 47<br />

FIGURE 10 ADMINISTRATIVE COOPERATION – REQUEST FOR ASSISTANCE .............................................. 48<br />

FIGURE 11 ADMINISTRATIVE COOPERATION – SPONTANEOUS INFORMATION AND REPLY TO A REQUEST<br />

FOR ASSISTANCE ................................................................................................................... 48<br />

Table of tables<br />

TABLE 1 APPLICABLE DOCUMENTS ...................................................................................................... 11<br />

TABLE 2 REFERENCE DOCUMENTS ....................................................................................................... 12<br />

TABLE 3 SPECIFIC GLOSSARY OF ACRONYMS USED IN THE <strong>FRS</strong> .......................................................... 13<br />

ECP2-FITSDEV2-SC03-<strong>FRS</strong>v3.11.doc Page 8 of 53

DG TAXUD – EXCISE COMPUTERISATION PROJECT REF: ECP2-FITSDEV2-SC03-<strong>FRS</strong><br />

FALLBACK AND RECOVERY SPECIFICATION (<strong>FRS</strong>) VERSION: 3.11-EN<br />

Introduction<br />

1 Introduction<br />

1.1 Purpose of the document<br />

The purpose of this document is to provide the necessary information to correctly take<br />

charge of the continuity <strong>and</strong> integrity of EMCS business where unexpected circumstances<br />

arise, but also to consider related functional, organisational, procedural <strong>and</strong> security<br />

requirements.<br />

It is a part of the Functional Excise System <strong>Specification</strong> [R6]. It aims to identify<br />

exceptions, i.e. conditions that may make it impossible to use EMCS in its customary<br />

way, <strong>and</strong> to determine how the business must react to these conditions.<br />

From the analysis of individual exceptions, the document identifies the business<br />

responses that must be given to these exceptions.<br />

Only international business responses given in this <strong>FRS</strong> are imperative; national <strong>and</strong>/or<br />

local business responses are to be considered as suggestions.<br />

To that end, the <strong>FRS</strong> considers:<br />

� preventing exceptions from happening through detection <strong>and</strong> prevention measures <strong>and</strong><br />

preparing the system for complementary solutions;<br />

� falling back from normal working processes to downgraded operations so as to ensure<br />

continuity of business while acquiring the information necessary for a safe recovery;<br />

in particular, manual fallback solutions are suggested in case of EMCS unavailability<br />

(to be started after a certain time depending on the case), <strong>and</strong> related paper based<br />

procedures are described;<br />

� recovering the follow-up information to reconstruct the exact history of a movement,<br />

at least the useful part of it, into electronic records.<br />

The analysis of <strong>FRS</strong> exceptions also leads to identify a series of requirements, on which<br />

could depend the implementation of the identified business responses.<br />

Additional procedures required to cope with exceptions are identified also.<br />

Even though the approach is business oriented, one cannot underestimate the fact that<br />

most EMCS processes will be automated, <strong>and</strong> that one of the main sources of exception<br />

will be the unavailability of these automated processes.<br />

Even in that case, the <strong>FRS</strong> only considers the functional consequences of such<br />

exceptions, <strong>and</strong> how they are h<strong>and</strong>led by the business. It never addresses the technical<br />

implications of an exception. However, the <strong>FRS</strong> identifies a series of requirements on<br />

which depends the implementation of the identified business responses.<br />

1.2 Field of application<br />

The field of application of the <strong>FRS</strong> is the whole scope of the FESS [R6]; the <strong>FRS</strong> must be<br />

understood as a full part of the FESS [R6] with explicit requirements.<br />

As stated in the previous section, the <strong>FRS</strong>:<br />

ECP2-FITSDEV2-SC03-<strong>FRS</strong>v3.11.doc Page 9 of 53

DG TAXUD – EXCISE COMPUTERISATION PROJECT REF: ECP2-FITSDEV2-SC03-<strong>FRS</strong><br />

FALLBACK AND RECOVERY SPECIFICATION (<strong>FRS</strong>) VERSION: 3.11-EN<br />

Introduction<br />

� only identifies fallback solutions for a target system in which all MSAs use the EMCS<br />

application;<br />

� addresses some cases of migration period 1 (defined in the Phasing <strong>and</strong> Scope<br />

<strong>Specification</strong> (PSS) [R3]), where some Member States <strong>and</strong>/or economic operators will<br />

not be equipped yet with the computerised EMCS while other ones will already be<br />

operational. It shall be noted that no specific provisions (as defined in Chapter 8)<br />

apply to the fallback <strong>and</strong> recovery procedures of EMCS during the rollout of EMCS<br />

Phase 3, since according to the updated Master Plan [R7], there will be no coexistence<br />

of FS1 <strong>and</strong> FS2 (all MSAs will enter the EMCS Phase 3 operations at<br />

milestone Mc).<br />

1.3 Intended readership<br />

The intended readership for this document is the same as for the FESS [R6]; it includes:<br />

� any person/service involved in the functional <strong>and</strong> technical specification or<br />

implementation of EMCS (including as well Member States representatives <strong>and</strong><br />

software design teams or development teams, …);<br />

� any person/service in charge of defining the procedures <strong>and</strong> h<strong>and</strong>books that will apply<br />

to the operation of the EMCS systems, both in the Common Domain <strong>and</strong> in the<br />

National Domains;<br />

� any other authorised body concerned with EMCS including the Excise Committee, the<br />

ECWP, the ECP Steering Committee, <strong>and</strong> the professional organisations of economic<br />

operators.<br />

1.4 Structure of the document<br />

This document contains the following chapters:<br />

� Chapter 1 "Introduction" is the present general introduction;<br />

� Chapter 2 "How to read this document ?" highlights the way of using this document<br />

by describing the concepts <strong>and</strong> the way they are implemented;<br />

� Chapter 3 "Exceptions typology" gives a general description of the categories of<br />

exceptions identified for EMCS;<br />

� Chapter 4 "Management of data" highlights the notions of ownership <strong>and</strong> holding of<br />

data <strong>and</strong> their impact on rectification <strong>and</strong> further controls;<br />

� Chapter 5 "Solution elements" presents the generic solution elements involved in the<br />

construction of business responses to EMCS exceptions;<br />

� Chapter 6 "Paper fallback system" explains roles, responsibilities <strong>and</strong> fallback means<br />

to be used for some specific exceptions. In that context, main business cases <strong>and</strong><br />

electronic recovery are presented;<br />

� Chapter 7 "Unavailability of SEED information" presents fallback <strong>and</strong> recovery<br />

solution for this reference database;<br />

� Chapter 8 "Specific provisions during the rollout of EMCS" is focused on Migration<br />

Period 1 <strong>and</strong> FS2 as defined in the PSS [R3].<br />

ECP2-FITSDEV2-SC03-<strong>FRS</strong>v3.11.doc Page 10 of 53

DG TAXUD – EXCISE COMPUTERISATION PROJECT REF: ECP2-FITSDEV2-SC03-<strong>FRS</strong><br />

FALLBACK AND RECOVERY SPECIFICATION (<strong>FRS</strong>) VERSION: 3.11-EN<br />

Introduction<br />

This document is further completed with a series of Appendices:<br />

� Appendix A, entitled "Exceptions <strong>and</strong> Solution elements", contains the detailed list of<br />

all individual exceptions that have been qualified worth a processing during the<br />

analysis, <strong>and</strong> the scenario of solution elements assigned to each exception;<br />

� Appendix B, entitled "Information exchanges to be acknowledged", lists the EMCS<br />

Information Exchanges that must be explicitly acknowledged, according to the<br />

prevention solution element “PR06 - business acknowledgement”;<br />

� Appendix C, entitled "Summary of Solution elements", lists the solution elements that<br />

contribute to solve the issues raised by the exceptions <strong>and</strong> gives the links with the<br />

complementary requirements resulting from the analysis;<br />

� Appendix D, entitled "Summary of Requirements", gives the list <strong>and</strong> contents of all<br />

the requirements resulting from the analysis of the <strong>FRS</strong> (in addition of those of the<br />

FESS [R6] with the links to the solution elements described in the present document.<br />

1.5 Applicable <strong>and</strong> reference documents<br />

1.5.1 Applicable Documents<br />

Ref. Identifier Title Version Issued<br />

A1 TAXUD/2008/CC<br />

/095<br />

A2 TAXUD/2008/DE<br />

/123<br />

Framework Contract 15/09/2008<br />

Specific Agreement n° 03<br />

(SC03) for Lot ESS based on<br />

[A1]<br />

A3 DIRECTIVE Directive 2008/118/EC<br />

concerning the general<br />

arrangements for excise duty<br />

<strong>and</strong> repealing Directive<br />

92/12/EEC.<br />

1.5.2 Reference Documents<br />

Table 1 applicable documents<br />

28/11/2008<br />

16/12/2008<br />

Ref. Identifier Title Version Issued<br />

R1 ECP1-ESS-SEP Security Policy (SEP) 2.02 13/12/2004<br />

R2 ECP1-ESS-GLT Glossary of Terms 1.01-EN 14/11/2004<br />

R3 ECP1-ESS-PSS Phasing <strong>and</strong> Scope<br />

<strong>Specification</strong> (PSS)<br />

R4 ECP1-ESS-SESS Security Excise System<br />

<strong>Specification</strong> (SESS)<br />

R5 ECP2-EMCS-<br />

DDNEA<br />

Design Document for<br />

National Excise Applications<br />

2.12 28/09/2007<br />

2.00 02/10/2006<br />

2.19 05/02/2009<br />

ECP2-FITSDEV2-SC03-<strong>FRS</strong>v3.11.doc Page 11 of 53

DG TAXUD – EXCISE COMPUTERISATION PROJECT REF: ECP2-FITSDEV2-SC03-<strong>FRS</strong><br />

FALLBACK AND RECOVERY SPECIFICATION (<strong>FRS</strong>) VERSION: 3.11-EN<br />

Introduction<br />

Ref. Identifier Title Version Issued<br />

R6 ECP1-ESS-FESS Functional Excise System<br />

<strong>Specification</strong> (FESS)<br />

3.00 08/11/2007<br />

R7 MAP Master Plan 2.9 06/04/2009<br />

1.6 Specific glossary<br />

Table 2 reference documents<br />

Below are listed all acronyms of interest that are used in the <strong>FRS</strong> document, <strong>and</strong> whether<br />

they are referenced in the GLT [R2].<br />

Acronym Translation<br />

Found in<br />

GLT<br />

AAD Administrative Accompanying Document yes<br />

ARC AAD Reference Code yes<br />

CCN/CSI Common Communication Network/Common System Interface yes<br />

ECWP Excise Computerisation Working Party yes<br />

EBP Elementary Business Process yes<br />

ECP Excise Computerisation Project yes<br />

ECS Export Control System no<br />

EEC European Economic Community no<br />

ELO Excise Liaison Office yes<br />

EMCS Excise Movement <strong>and</strong> Control System yes<br />

FESS Functional Excise System <strong>Specification</strong>s yes<br />

FMS Functional Message Structure yes<br />

<strong>FRS</strong> <strong>Fallback</strong> <strong>and</strong> <strong>Recovery</strong> <strong>Specification</strong> yes<br />

GLT Glossary of Terms yes<br />

IE Information Exchange yes<br />

IT Information Technology yes<br />

LRN Local Reference Number no<br />

MRN Movement Reference Number no<br />

MS Member State no<br />

ECP2-FITSDEV2-SC03-<strong>FRS</strong>v3.11.doc Page 12 of 53

DG TAXUD – EXCISE COMPUTERISATION PROJECT REF: ECP2-FITSDEV2-SC03-<strong>FRS</strong><br />

FALLBACK AND RECOVERY SPECIFICATION (<strong>FRS</strong>) VERSION: 3.11-EN<br />

Introduction<br />

Acronym Translation<br />

Found in<br />

GLT<br />

MSA Member State Administration yes<br />

N/A Not Applicable no<br />

NACK Non-ACKnowledgement service message yes<br />

SAD Single Administrative Document no<br />

SEED System for Exchange of Excise Data yes<br />

SEP Security Policy yes<br />

STD State Transition Diagram yes<br />

TAXUD Directorate-General Taxation <strong>and</strong> Customs Union yes<br />

UC Use Case yes<br />

1.7 Assumptions<br />

Table 3 specific glossary of acronyms used in the <strong>FRS</strong><br />

This <strong>Fallback</strong> <strong>and</strong> <strong>Recovery</strong> <strong>Specification</strong> is written according to the following<br />

assumptions:<br />

1. legal <strong>and</strong> regulatory provisions are respected by all involved parties; irregularities <strong>and</strong><br />

infringements pertain to the processing of inquiries;<br />

2. roles <strong>and</strong> responsibilities never change; if, for some reason, an intermediate acts by<br />

delegation of a partner (for instance, an excise officer enters a report of receipt on<br />

behalf of the consignee), the responsibility rests with the delegating actor;<br />

3. if the normal communication medium between an economic operator <strong>and</strong> its MSA<br />

fails, alternate communication media (fax, digital memory medium or paper) will<br />

always be available.<br />

ECP2-FITSDEV2-SC03-<strong>FRS</strong>v3.11.doc Page 13 of 53

DG TAXUD – EXCISE COMPUTERISATION PROJECT REF: ECP2-FITSDEV2-SC03-<strong>FRS</strong><br />

FALLBACK AND RECOVERY SPECIFICATION (<strong>FRS</strong>) VERSION: 3.11-EN<br />

How to read this document ?<br />

2 How to read this document ?<br />

Apart from your role in the EMCS project (business actor, software designer or<br />

developer, software test team member…), you need to know how to exploit the richness<br />

of this document.<br />

2.1 What an exception means<br />

Any condition that may make it impossible to use EMCS in its customary way, is called<br />

here “exception”. The purpose of this document is to determine how the business must<br />

react to these exceptions.<br />

An analytical approach is used to detect as many potential exceptions as possible <strong>and</strong> to<br />

define the responses to these exceptions.<br />

All exceptions identified during the analysis phase have been studied in order to derive a<br />

number of generic responses.<br />

The use of specific responses will then be limited to the few cases where no generic<br />

response is applicable.<br />

2.2 Discovering <strong>and</strong> characterizing exceptions<br />

Exceptions identification <strong>and</strong> qualification is done by systematically exploring the flows<br />

described in the use cases defined in the FESS [R6] <strong>and</strong> by identifying the situations that<br />

would make it impossible to follow the expected path until the end of the flow (including<br />

the effect of a failure of resources); this allows to explore separately each information<br />

exchange, once from the point of view of the sender <strong>and</strong> once from the point of view of<br />

the receiver;<br />

For each identified exception, the following points are examined:<br />

� Plausibility;<br />

� Business impact;<br />

� Security impact;<br />

� Time constraints.<br />

Qualification of exceptions against plausibility, business impact, security impact <strong>and</strong> time<br />

constraints results in a decision whether the exception is worth a processing.<br />

Plausibility<br />

The plausibility of each identified exception is first questioned to determine whether the<br />

exception is worth identifying a business response. This is done by examining whether,<br />

from a business point of view, this exception could really happen. The level of<br />

plausibility is not considered. In other words, an exception is either considered plausible<br />

(even if its level of plausibility is low) or non plausible. Non plausible exceptions are<br />

kept for documentation purposes but are not further analysed.<br />

ECP2-FITSDEV2-SC03-<strong>FRS</strong>v3.11.doc Page 14 of 53

DG TAXUD – EXCISE COMPUTERISATION PROJECT REF: ECP2-FITSDEV2-SC03-<strong>FRS</strong><br />

FALLBACK AND RECOVERY SPECIFICATION (<strong>FRS</strong>) VERSION: 3.11-EN<br />

How to read this document ?<br />

Business impact<br />

By impact, one must underst<strong>and</strong> not only the impact of the exception itself on the<br />

business but also the impact of any solution element that any partner has to carry out<br />

following the exception.<br />

The business impact is an evaluation of the geographical scope of the possible impact of<br />

the exception on the business of EMCS. It is evaluated for each exception found<br />

plausible. There are three possible classes of impact:<br />

� international business impact, if the occurrence of this exception affects the EMCS<br />

business in at least two Member States;<br />

� national business impact, if the occurrence of this exception affects the EMCS only in<br />

the country where this exception has occurred;<br />

� local business impact, if the occurrence of this exception only affects the business of<br />

the excise office where this exception has occurred, <strong>and</strong>/or the business of an<br />

economic operator;<br />

� no business impact.<br />

If there is a business impact at several levels (e.g. an international <strong>and</strong> a national business<br />

impact), only the widest one is considered.<br />

The objective is not to define the relative importance of an exception for the business<br />

(national business impact on economic operators may be more important than<br />

international impact), but to identify the maximum scope (international or national)<br />

applicable for the h<strong>and</strong>ling of this exception.<br />

In turn, each MSA should define its own exceptions (at national level).<br />

Security impact<br />

The impact of each plausible exception on the security of the business is evaluated. It<br />

results from one among several situations:<br />

� the exception itself creates a breach of security;<br />

� the business response to the exception itself may create a breach of security;<br />

� the exception results from an attempt at fraud.<br />

A “security breach” area is qualified according to whether it affects one of the following:<br />

� availability of the system;<br />

� data confidentiality;<br />

� data integrity;<br />

� risk of fraud.<br />

It is possible that the same exception impacts several security areas. Only that estimated<br />

the most important is displayed; in particular a risk of fraud always prevails on the other<br />

area.<br />

For more information about security related aspects, please refer to the SEP [R1] <strong>and</strong> to<br />

the SESS [R4].<br />

ECP2-FITSDEV2-SC03-<strong>FRS</strong>v3.11.doc Page 15 of 53

DG TAXUD – EXCISE COMPUTERISATION PROJECT REF: ECP2-FITSDEV2-SC03-<strong>FRS</strong><br />

FALLBACK AND RECOVERY SPECIFICATION (<strong>FRS</strong>) VERSION: 3.11-EN<br />

How to read this document ?<br />

Time constraint<br />

Where an exception is qualified worth a processing, it is considered whether it must be<br />

satisfactorily dealt with within a limited period of time, <strong>and</strong> this time limit is identified as<br />

far as possible.<br />

For each exception, in particular, response time classes (interactive, asynchronous,<br />

scheduled, up to MSA, asynchronous/scheduled or N/A) <strong>and</strong> response time classes that<br />

have been introduced in <strong>FRS</strong> (none, business limit, national limit, national provisions),<br />

the constraint takes into account performance requirements defined in Appendix A of the<br />

FESS [R6].<br />

2.3 Proposing business responses to exceptions<br />

Following the exceptions identification <strong>and</strong> qualification phase exposed above, the<br />

possible business responses were studied for all individual exceptions that were found<br />

plausible.<br />

If exceptions have an international business impact, the business responses must take into<br />

account international business constraints shared by all MSAs. It is therefore expected<br />

that these responses will be considered as st<strong>and</strong>ard responses, to be used by all<br />

participants to EMCS.<br />

In order to cover the global scope of the FESS [R6], the same approach is applied to<br />

exceptions with a national impact.<br />

In this case, however, business responses are only suggested, <strong>and</strong> will have to be adjusted<br />

by each MSA, based on their own legal, contractual or organisational requirements.<br />

The business response to an exception is either generic or specific:<br />

� A generic response is a st<strong>and</strong>ard response that relates to a whole series of exceptions.<br />

Whenever one of these exceptions is encountered, the related generic response applies,<br />

regardless of the specific aspects of the exception;<br />

� A specific response relates to a single exception, <strong>and</strong> is designed to be used only<br />

when this specific exception is encountered.<br />

As much as possible, business responses found for each business exception should be<br />

made generic, i.e. reusable by other exceptions.<br />

Business responses are defined as a set of identified <strong>and</strong> chronologically ordered solution<br />

elements.<br />

Main solution elements categories are:<br />

� Prevention measures systematically applied in the course of a normal activity flow<br />

with the aim of preventing or at least reducing the occurrence of an exception, or<br />

preparing elements that would later help in applying further (post exception)<br />

measures;<br />

� Administrative procedures, which are used in order to further document an<br />

exception; for example, the possibility for querying on missing information or taking a<br />

business decision;<br />

ECP2-FITSDEV2-SC03-<strong>FRS</strong>v3.11.doc Page 16 of 53

DG TAXUD – EXCISE COMPUTERISATION PROJECT REF: ECP2-FITSDEV2-SC03-<strong>FRS</strong><br />

FALLBACK AND RECOVERY SPECIFICATION (<strong>FRS</strong>) VERSION: 3.11-EN<br />

How to read this document ?<br />

� <strong>Fallback</strong> solution elements, which are used in order to ensure the continuation of the<br />

business when an exception is encountered; the objective is to avoid delaying urgent<br />

excise business; they include, for example, the switch to a manual procedure when an<br />

automated process becomes unavailable;<br />

� <strong>Recovery</strong> solution elements, which are used to correct defective data resulting from<br />

errors that have occurred in the system, from mistakes made by users, or from the<br />

application of fallback solutions; they include, for example, the introduction of results<br />

in the system after an automated job has been temporarily replaced by a manual<br />

procedure, or complete replay of the manual procedure to obtain the actual business<br />

result.<br />

Most generally, the convenient response to a given exception is a combination of<br />

individual business responses. While identifying appropriate business responses to<br />

exceptions, several situations may be encountered:<br />

� the current exception is satisfactorily processed by starting a normal business use<br />

case; the use case becomes the normal response for the current exception;<br />

� the current exception is satisfactorily processed by an existing generic business<br />

response; the generic business response becomes the normal response for the current<br />

exception; if several generic business responses apply, they are compared <strong>and</strong> the most<br />

appropriate one is selected;<br />

� the current exception is satisfactorily processed by an existing specific business<br />

response defined for another exception; the specific solution then becomes a new<br />

generic business response with two particular applications;<br />

� the current exception solution is almost satisfactorily processed by an existing generic<br />

business response; the question whether a variant of the generic business response<br />

must be created has to be considered;<br />

� there is no satisfactory business response, neither generic nor specific, to deal with the<br />

current exception; a specific business response is defined with the view to make it<br />

generic in the future, i.e. by avoiding specific features.<br />

In addition, the detailed implementation of the same business response widely depends on<br />

the circumstances <strong>and</strong> on the context. This procedure has been followed to define the<br />

solutions presented in this document. It must be re-used in the future in the case new<br />

exceptions have to be analysed.<br />

Chapter 3 „Exceptions typology‟ describes generic exceptions that occur during<br />

information exchanges or during business processes. This gives a typology of individual<br />

exceptions listed in Appendix A, <strong>and</strong> presented as below:<br />

ECP2-FITSDEV2-SC03-<strong>FRS</strong>v3.11.doc Page 17 of 53

DG TAXUD – EXCISE COMPUTERISATION PROJECT REF: ECP2-FITSDEV2-SC03-<strong>FRS</strong><br />

FALLBACK AND RECOVERY SPECIFICATION (<strong>FRS</strong>) VERSION: 3.11-EN<br />

How to read this document ?<br />

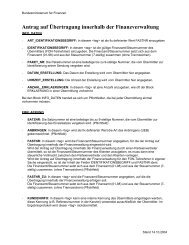

Figure 1 Appendix A - Exceptions<br />

In Appendix A, each identified exception is:<br />

� presented regarding a specific use case (�);<br />

� identified per EBP (�) <strong>and</strong> per actor/location (�);<br />

� uniquely identified (�), <strong>and</strong> labelled with a short description text (�);<br />

� qualified against plausibility, business <strong>and</strong> security impacts, <strong>and</strong> time constraint (�);<br />

� followed by a set of clearly identified <strong>and</strong> chronologically ordered solution elements<br />

(�- note that alternatives are also identified) forming together the business response to<br />

the exception, including most of the time a specific note regarding the concerned<br />

exception;<br />

� if relevant, a label indicates that the exception is specific to “Migration period 1” (�).<br />

ECP2-FITSDEV2-SC03-<strong>FRS</strong>v3.11.doc Page 18 of 53

DG TAXUD – EXCISE COMPUTERISATION PROJECT REF: ECP2-FITSDEV2-SC03-<strong>FRS</strong><br />

FALLBACK AND RECOVERY SPECIFICATION (<strong>FRS</strong>) VERSION: 3.11-EN<br />

How to read this document ?<br />

In Appendix A, the exceptions are grouped by use cases.<br />

The use cases are presented in the same order as in the FESS [R6] :<br />

Section II : UC2.01, UC2.10, UC2.06, UC2.07, UC2.33, UC2.17, UC2.12, UC2.13,<br />

UC2.34, UC2.05, UC2.36, UC2.51, UC2.52, UC2.44, UC 2.43, UC2.46.<br />

Section III : UC1.14, UC1.15, UC1.16, UC1.30, UC1.11, UC1.04, UC1.05, UC1.06,<br />

UC1.13, UC3.16.<br />

Section IV : UC3.24, UC3.03, UC3.05, UC2.14, UC3.01, UC3.07, UC 3.09, UC3.29,<br />

UC3.14.<br />

Section V : UC0.07.<br />

The business responses are described in detail in Chapter 5 “Solution elements”; they are<br />

summarised in Appendix C <strong>and</strong> associated to individual exceptions in Appendix A.<br />

Note that the numbers contained in the identification of solution elements (e.g. FB06) are<br />

not related to any chronological order when used in a business response.<br />

Only the sequential numbering of solution elements in Appendix A indicates a<br />

chronological order of appliance.<br />

ECP2-FITSDEV2-SC03-<strong>FRS</strong>v3.11.doc Page 19 of 53

DG TAXUD – EXCISE COMPUTERISATION PROJECT REF: ECP2-FITSDEV2-SC03-<strong>FRS</strong><br />

FALLBACK AND RECOVERY SPECIFICATION (<strong>FRS</strong>) VERSION: 3.11-EN<br />

Exceptions typology<br />

3 Exceptions typology<br />

This chapter contains a general description of the categories of exceptions <strong>and</strong> of the<br />

common characteristics of these categories. This categorisation has been the main<br />

guideline to discover exceptions throughout the analysis of the process flows. These<br />

exceptions are listed in Appendix A where they are presented along with the response<br />

scenarios that eventually allow restoring the good functioning of the system.<br />

The main categories are based on the origin <strong>and</strong> place of occurrence of these exceptions,<br />

namely:<br />

� Information Exchange; or<br />

� Processing.<br />

Although useful to systematically analyse the process flows to detect exceptions, these<br />

categories have not been found relevant in deeper analysis.<br />

3.1 Information Exchange exceptions<br />

All information exchanges are subject to the same types of exception, regardless of the<br />

business context in which information has to be exchanged.<br />

Regardless of the scope (national or international) of an information exchange, or of the<br />

communication medium used (message exchanged through a communication network,<br />

paper based, phone, fax, e-mail...) exceptions happen at two levels:<br />

� Physical: failure of the communication medium itself, or loss of the information to be<br />

exchanged;<br />

� Semantic: the content of the information exchange does not have any business<br />

signification to the receiver.<br />

Whatever its level, an exception will have the same functional result: a failure of the<br />

information exchange.<br />

Note that most possible exceptions listed in this section are actually detected by the<br />

business process that receives <strong>and</strong> verifies information, in particular paragraph 3.1.2<br />

„Exceptions at semantic level‟. However, as they apply to the information itself, we<br />

preferred keeping them in this section.<br />

3.1.1 Exceptions at physical level<br />

3.1.1.1 Unavailability of the communication medium<br />

Most generally, if the normal communication medium fails, information cannot be<br />

exchanged through normal EMCS procedures.<br />

However, for some exchanges, it has been found important to define alternate<br />

communication channels, either because the normal channel is felt particularly fragile or<br />

because the permanence of the exchange is essential for the good functioning of EMCS.<br />

ECP2-FITSDEV2-SC03-<strong>FRS</strong>v3.11.doc Page 20 of 53

DG TAXUD – EXCISE COMPUTERISATION PROJECT REF: ECP2-FITSDEV2-SC03-<strong>FRS</strong><br />

FALLBACK AND RECOVERY SPECIFICATION (<strong>FRS</strong>) VERSION: 3.11-EN<br />

Exceptions typology<br />

3.1.1.2 Loss of information to be exchanged<br />

For some reason, the addressee never receives the contents of an information exchange. If<br />

this is the case, different situations must be considered:<br />

1. The lost information was expected.<br />

The addressee expects to receive certain information within a given time limit, <strong>and</strong> this<br />

information is lost: this is typically the case if information is exchanged in response to<br />

another information exchange.<br />

For example, if the report of receipt of an e-AAD does not arrive in due time. Most<br />

generally, but not always, such missing information is automatically detected through<br />

a timer or equivalent mechanism.<br />

2. A response to the lost information was expected.<br />

If the lost information was not expected from the addressee, but the sender expects to<br />

receive a specific response to this information exchange within a certain delay. This<br />

situation is similar to the situation described in the example above, except that, in this<br />

case, it is the initial information exchange that is lost (in this example: the e-AAD<br />

never reached the consignee), instead of its response; that is to say that the e-AAD<br />

itself is lost.<br />

The result will be the same: the consignor will not receive the expected report of<br />

receipt.<br />

3. The lost information was not expected.<br />

If the lost information was not expected from the addressee, <strong>and</strong> the sender does not<br />

expect to receive a specific response to this information exchange, the exception<br />

remains undetected until the lost information becomes needed.<br />

3.1.2 Exceptions at semantic level<br />

Several defects are capable of making it impossible for the receiver of an information<br />

exchange to underst<strong>and</strong> the business signification of the received information; typically:<br />

� the message refers to an object that is not known to the receiver;<br />

� the content of the received information is not consistent with already known<br />

information (e.g. a report of receipt is received from an economic operator who is not<br />

the consignee of the e-AAD).<br />

3.1.2.1 Unknown object<br />

The typical case of unknown object is where a received information exchange refers to an<br />

ARC that is not known to the receiver. This results from a preceding error (the e-AAD<br />

did not reach the receiver), from a mistake (wrong ARC has been input) or from a fraud<br />

(use of a forged ARC).<br />

Similar cases are where a complementary submission of a control report or of an event<br />

report refers to a non-existent report identifier or where a response to a request refers to a<br />

non-existent correlation id.<br />

ECP2-FITSDEV2-SC03-<strong>FRS</strong>v3.11.doc Page 21 of 53

DG TAXUD – EXCISE COMPUTERISATION PROJECT REF: ECP2-FITSDEV2-SC03-<strong>FRS</strong><br />

FALLBACK AND RECOVERY SPECIFICATION (<strong>FRS</strong>) VERSION: 3.11-EN<br />

Exceptions typology<br />

In most cases, the incoming information exchange must simply be rejected, <strong>and</strong> the<br />

sender has to be notified (through a NACK message) about this rejection <strong>and</strong> its motives.<br />

The further h<strong>and</strong>ling of the exception depends on the nature of the defect. However, some<br />

particular situations may necessitate a more complex processing.<br />

3.1.2.2 Inconsistent data<br />

Data sent in an information exchange will not be consistent with data already available to<br />

the receiver in the following cases:<br />

1. the information exchange contains data based on a version of registration or reference<br />

data different from the version used by the receiver;<br />

2. the information exchange contains fixed data on an EMCS movement that does not<br />

correspond to the equivalent data already known by the receiver on this exchange.<br />

3.2 Process exceptions<br />

Being generally automated, there are many reasons for business processes to fail similarly<br />

to information exchanges.<br />

3.2.1 Exceptions at physical level<br />

3.2.1.1 Unavailability of a component<br />

If some component that makes up the business process fails, processing of information<br />

becomes impossible.<br />

This includes the availability of necessary information as well. For instance, if the<br />

consultation of SEED information by the application is currently impossible, basic<br />

processes such as the submission of an e-AAD or of a change of destination becomes<br />

impossible.<br />

3.2.1.2 Corruption of information<br />

This situation happens when, for any reason, the automatic processing does not properly<br />

process information <strong>and</strong> hence output of a use case does not conform to the expected<br />

result. It is the case, for instance, where a component encounters a r<strong>and</strong>om error.<br />

This should not happen, <strong>and</strong> detection of such cases is considered difficult.<br />

If the processing carries on despite the error, this latter is propagated throughout the<br />

whole history of the movement, possibly corrupting other movements. In many cases, the<br />

error will be detected a posteriori, possibly after several operations will have been<br />

completed on the same movement.<br />

ECP2-FITSDEV2-SC03-<strong>FRS</strong>v3.11.doc Page 22 of 53

DG TAXUD – EXCISE COMPUTERISATION PROJECT REF: ECP2-FITSDEV2-SC03-<strong>FRS</strong><br />

FALLBACK AND RECOVERY SPECIFICATION (<strong>FRS</strong>) VERSION: 3.11-EN<br />

Exceptions typology<br />

3.2.2 Exceptions at semantic level<br />

3.2.2.1 Non conformance of the implemented processing<br />

Non conformance of the implemented processing with the functional specification is<br />

supposed to be prevented, if not completely expelled by a careful certification of each<br />

application before leaving it entering into operation. However, particular situations lead<br />

to discover cases that escape the described functionality. This is detected in a further step<br />

of the same process or in a further process, possibly in a later use case.<br />

The resolution process should:<br />

1. immediately solve the current exception (incident) by any available means;<br />

2. define a workaround to avoid further occurrences of the exception <strong>and</strong> issue the<br />

relevant use recommendations;<br />

3. report the incident to the relevant authority (national support or common domain<br />

support);<br />

4. design a stable <strong>and</strong> definitive solution <strong>and</strong> include it in a further release of the<br />

software (or hardware).<br />

Such incidents being unexpected by nature, they are not identified in the <strong>FRS</strong>.<br />

3.2.2.2 Disparity between the functional specification <strong>and</strong> the actual business need<br />

This case comes under maintenance of the specification, either corrective (for instance<br />

giving a more precise description of the expected functionality <strong>and</strong> adding test cases to<br />

the certification tools), or evolutionary (defining new particular cases <strong>and</strong> the way they<br />

have to be processed).<br />

ECP2-FITSDEV2-SC03-<strong>FRS</strong>v3.11.doc Page 23 of 53

DG TAXUD – EXCISE COMPUTERISATION PROJECT REF: ECP2-FITSDEV2-SC03-<strong>FRS</strong><br />

FALLBACK AND RECOVERY SPECIFICATION (<strong>FRS</strong>) VERSION: 3.11-EN<br />

Management of data<br />

4 Management of data<br />

4.1 Ownership <strong>and</strong> holding of data<br />

In EMCS, each piece of information has:<br />

� an owner, i.e. the user who submitted the information; most times, it is an economic<br />

operator, either registered, <strong>and</strong> in that case he enters the information himself, or nonregistered,<br />

<strong>and</strong> in that case another user, possibly an official, enters it on his behalf;<br />

� a holder, i.e. the MSA that is responsible for keeping the reference version of<br />

information <strong>and</strong> for transferring it to any authorised partner whenever required; in<br />

principle it is the MSA that initially validated it, also called initiating MSA.<br />

The general principles that govern management of data are the following:<br />

� the owner is responsible for the accuracy of the submitted information;<br />

� only the owner of a data item is authorised to submit any update to that item, if<br />

updating is allowed;<br />

� if the case arises, the person (in particular, the official) who enters data on behalf of<br />

the owner is not responsible for the given information but only for entering exactly<br />

what the owner requested;<br />

� the holder MSA is responsible for formally validating submitted information <strong>and</strong> to<br />

report errors to the owner;<br />

� the holder MSA is not entitled to change anything to the information held, unless he is<br />

the owner as well;<br />

� the holder MSA is responsible for keeping information correct.<br />

Example:<br />

Upon submission of an e-AAD, the MSA of dispatch formally validates the submitted<br />

information <strong>and</strong> returns back the errors to the consignor, if any.<br />

The consignor (owner of the e-AAD) is responsible for correcting errors <strong>and</strong> resubmitting<br />

the e-AAD.<br />

If no errors are found, the MSA of dispatch becomes the holder of the e-AAD. In<br />

addition, the MSA of dispatch allocates an ARC to the e-AAD; the MSA of dispatch is<br />

therefore the owner of the ARC.<br />

This example shows how the same data group may be built from data items with different<br />

owners.<br />

4.2 Rectification of data<br />

If, as a result of errors or mistakes, the information entered into EMCS needs to be<br />

rectified, the general business principle is that rectification information can only be<br />

cancelled or amended by its owner <strong>and</strong> that the rectification is validated by the holder of<br />

data. For convenience, it may be acceptable that the holder updates the information on<br />

behalf of the owner, but only with his explicit agreement.<br />

ECP2-FITSDEV2-SC03-<strong>FRS</strong>v3.11.doc Page 24 of 53

DG TAXUD – EXCISE COMPUTERISATION PROJECT REF: ECP2-FITSDEV2-SC03-<strong>FRS</strong><br />

FALLBACK AND RECOVERY SPECIFICATION (<strong>FRS</strong>) VERSION: 3.11-EN<br />

Management of data<br />

Invalid or outdated information is never deleted but marked for history purpose, including<br />

where it results from mistakes. Necessary rectification of information is limited to a part<br />

of information <strong>and</strong> is changed only through well identified ways.<br />

Rectification is required at two levels:<br />

� at entry level: when information is submitted but not yet approved <strong>and</strong> stored;<br />

� at application level: when information has been entered into EMCS <strong>and</strong>, in most cases,<br />

immediately <strong>and</strong> automatically disseminated to all concerned partners, either<br />

economic operators or MSAs.<br />

4.2.1 Rectification at entry level<br />

No information should be accepted <strong>and</strong> recorded within EMCS unless it has been<br />

submitted to a formal validation. The rules of formal validation are detailed in the<br />

description of each concerned use case.<br />

This applies both where information is submitted by an economic operator <strong>and</strong> where it is<br />

submitted by an official.<br />

MSA may find it useful to locally store a part of information they are preparing to send to<br />

their partners (for instance administrative cooperation messages); details of rectification<br />

depend on the organisation of each MSA <strong>and</strong> will have to be defined at the national level.<br />

MSAs are never allowed to rectify information of which they are not the owner; if they<br />

detect any anomaly that justifies a rectification, the MSA requires the owner of<br />

information, usually an economic operator, to perform the relevant rectification<br />

operation.<br />

4.2.2 Rectification at application level<br />

Once information has been recorded in EMCS, it should only be corrected by using<br />

defined use cases.<br />

The System specification offers a range of functions that result in the ability to update a<br />

part of information. However, some information can only be rectified by cancellation <strong>and</strong><br />

possible replacement of an e-AAD.<br />

Example 1:<br />

If, at submission time, an e-AAD is validated based on erroneous information, it is<br />

possible for the consignor to immediately cancel it (UC2.10) <strong>and</strong> resubmit the correct<br />

information (UC2.01). A new ARC is then allocated.<br />

This is possible only where the goods have not yet left the place of dispatch.<br />

Example 2:<br />

If at submission time, the consignor made a mistake when typing the excise number of<br />

the consignee, which could not be prevented by the initial checking, he may immediately<br />

issue a change of destination (UC2.05).<br />

ECP2-FITSDEV2-SC03-<strong>FRS</strong>v3.11.doc Page 25 of 53

DG TAXUD – EXCISE COMPUTERISATION PROJECT REF: ECP2-FITSDEV2-SC03-<strong>FRS</strong><br />

FALLBACK AND RECOVERY SPECIFICATION (<strong>FRS</strong>) VERSION: 3.11-EN<br />

Management of data<br />

4.2.3 Control of rectifications<br />

All cases that support rectification should be specifically monitored by the MSA.<br />

Successive states of any entity involved in EMCS are systematically kept for history by<br />

the initiating MSA. This includes all rectifications performed during the life cycle of that<br />

entity. Information is communicated to concerned partners according to the general<br />

process of the use cases used for rectification.<br />

In addition, all operations are logged for audit <strong>and</strong> statistics purpose.<br />

ECP2-FITSDEV2-SC03-<strong>FRS</strong>v3.11.doc Page 26 of 53

DG TAXUD – EXCISE COMPUTERISATION PROJECT REF: ECP2-FITSDEV2-SC03-<strong>FRS</strong><br />

FALLBACK AND RECOVERY SPECIFICATION (<strong>FRS</strong>) VERSION: 3.11-EN<br />

Solution elements<br />

5 Solution elements<br />

Solution elements are the basic components of the overall business responses that relate<br />

to the identified exceptions. Whenever one of these exceptions is encountered, the related<br />

generic responses apply, regardless of the specific aspects of the exception.<br />

This chapter presents generic solution elements to build the business responses to EMCS<br />

exceptions.<br />

5.1 Prevention of exceptions<br />

PR01 Pre-validation of entered information<br />

PR02 Ensure permanent availability of EMCS applications<br />

PR03 Atomicity of EBP processing<br />

PR04 Use of timers<br />

PR05 Enqueue message for further automatic recovery<br />

PR06 Business acknowledgement<br />

PR07 Follow-up „open‟ information<br />

As a general rule, it is easier to prevent an exception from happening than to try to solve<br />

it after it has occurred. Therefore, when there are indications that some means exist to<br />

prevent an exception or reduce its consequences, these means are to be identified <strong>and</strong><br />

become a part of the solution.<br />

A prevention solution element is characterised by:<br />

� a place of prevention that identifies the responsibility of the measure; prevention<br />

should be performed as close as possible to the source of the cause <strong>and</strong> to the possible<br />

point of correction;<br />

� a type of prevention such as assistance <strong>and</strong> control of input at user interface, integrity<br />

control at receipt of a message, control of internal consistency before sending a<br />

message, etc.<br />

A major characteristic of EMCS is that it mainly consists of automatic sequences of<br />

processes entrusted to different IT systems <strong>and</strong> that are automatically chained.<br />

Consequently, there is generally no intermediate actor enabled to verify to correct<br />

movement information during the processing of a use case.<br />

At the end of a use case, the new information must be known <strong>and</strong> consistent amongst all<br />

involved locations throughout the whole system.<br />

Consequently, there must be general mechanisms to:<br />

� ensure that only correct data are entered into the system;<br />

� ensure that the normal sequence of states is respected.<br />

ECP2-FITSDEV2-SC03-<strong>FRS</strong>v3.11.doc Page 27 of 53

DG TAXUD – EXCISE COMPUTERISATION PROJECT REF: ECP2-FITSDEV2-SC03-<strong>FRS</strong><br />

FALLBACK AND RECOVERY SPECIFICATION (<strong>FRS</strong>) VERSION: 3.11-EN<br />

Solution elements<br />

5.1.1 PR01: Pre-validation of entered information<br />

Any capture of data must be submitted to formal validation at time of keying in, i.e.<br />

before any further validation by the system. This is a major requirement of the system.<br />

Example:<br />

Upon submission of an e-AAD, the application of the consignor includes as many<br />

controls as possible to ensure semantic validity of each field (e.g. conformance to<br />

business rules) <strong>and</strong> consistency among fields, possibly by reference to available<br />

databases.<br />

5.1.2 PR02: Ensure permanent availability of EMCS applications<br />

EMCS is characterised by very strong availability requirements. Some functions such as<br />

the submission of an e-AAD have been quoted with a "permanent" availability<br />

requirement where a given interruption of the service should not last more than 15<br />

minutes <strong>and</strong> many other ones with a "high" availability requirement where a given<br />

interruption cannot last more than one hour.<br />

5.1.3 PR03: Atomicity of EBP processing<br />

Most EBPs described in the FESS [R6] are thought as business transactions, i.e. a set of<br />

actions that must be either completed or aborted together. The mechanism is defined at<br />

business level, i.e. there is no assumption on the way it shall be implemented.<br />

This response does not address specific exceptions but it is a prerequisite that has been<br />

used in the discovery of exceptions. Its role is to avoid considering in detail the possible<br />

exceptions that arise inside the process <strong>and</strong> to concentrate on the interconnection of each<br />

elementary process with the other ones: incoming <strong>and</strong> outgoing information exchanges,<br />

access to external information, functioning of timers.<br />

5.1.4 PR04: Use of timers<br />

Timers are introduced to ensure that a reminder is issued when a specific event has not<br />

arisen in due time.<br />

The mechanism is defined at business level, i.e. there is no assumption on the way it shall<br />

be implemented.<br />

This response does not address specific exceptions but it is a prerequisite for some other<br />

solution elements. A few major cases are described in the FESS [R6] itself, because they<br />

include coordination mechanisms including international information exchanges.<br />

Conversely, a range of deadlines are to be defined at national level such as the maximum<br />

duration of the storage of a message in a waiting queue when that response is being used<br />

(PR05 - enqueue message for further automatic recovery).<br />

Example:<br />

The storage of a message submitted to business acknowledgement is linked to a<br />

maximum waiting time. This waiting time should be associated with a timer to awake the<br />

ECP2-FITSDEV2-SC03-<strong>FRS</strong>v3.11.doc Page 28 of 53

DG TAXUD – EXCISE COMPUTERISATION PROJECT REF: ECP2-FITSDEV2-SC03-<strong>FRS</strong><br />

FALLBACK AND RECOVERY SPECIFICATION (<strong>FRS</strong>) VERSION: 3.11-EN<br />

Solution elements<br />

suspended processing (FB04 - no intervention - wait) <strong>and</strong> take complementary steps<br />

whenever the expected event has not arisen (in that case, return of the business<br />

acknowledgement).<br />

5.1.5 PR05: Enqueue message for further automatic recovery<br />

A safe storage of information may help in preparing further recovery where it has reached<br />

an identified level such as:<br />

� arrival of an information exchange regarding a checking failure into a given location;<br />

� positive checking of a submitted message; or<br />

� just before sending an information exchange.<br />

In each case, if the following processing fails, it will be possible to restart from the point<br />

of storage to resume the process.<br />

This solution element is a prerequisite for the business acknowledgement processing<br />

described below (PR06 - business acknowledgement).<br />

Example 1:<br />

When a submitted draft e-AAD arrives in the MSA of dispatch, it is convenient to<br />

securely store it before starting its formal checking; therefore, in case of breakdown<br />

during the checking (e.g. sudden unavailability of resources), the checking can be<br />

resumed when the failure is corrected.<br />

Example 2:<br />

When a submitted e-AAD has been found valid but before allocating the ARC, it is<br />

convenient to securely store it before starting the allocation of the ARC <strong>and</strong> performing<br />

the related actions; therefore, in case of breakdown during these actions (e.g. sudden<br />

unavailability of resources), they can be resumed when the failure is corrected.<br />

Example 3:<br />

When a valid e-AAD is ready to be sent to the MSA of destination, <strong>and</strong> in connection<br />

with the required business acknowledgement, it is convenient to securely store it before<br />

sending it <strong>and</strong> until the business acknowledgement arrives. This makes it possible to<br />

replay the information exchange if neither positive nor negative acknowledgement has<br />

been received in a given time limit.<br />

5.1.6 PR06: Business acknowledgement<br />

It is important for the EMCS business to ensure that an Information Exchange will not be<br />

lost between two MSAs because of a failure or because of a too long transmission delay.<br />

This is particularly uneasy to discover.<br />

It is therefore essential, at least for the essential Information Exchanges, that the sending<br />

MSA has a confirmation that the recipient MSA has correctly received <strong>and</strong> processed that<br />

exchange.<br />

The solution element, named business acknowledgement, consists in a positive<br />

acknowledgement message (ACK) sent back to the issuing MSA. This message<br />

acknowledges that:<br />

ECP2-FITSDEV2-SC03-<strong>FRS</strong>v3.11.doc Page 29 of 53

DG TAXUD – EXCISE COMPUTERISATION PROJECT REF: ECP2-FITSDEV2-SC03-<strong>FRS</strong><br />

FALLBACK AND RECOVERY SPECIFICATION (<strong>FRS</strong>) VERSION: 3.11-EN<br />

Solution elements<br />

� the recipient MSA has correctly received the sent Information Exchange;<br />

� it has already completed the actions pursuant to it or it commits itself to complete<br />

these actions.<br />

This response has the drawback to add a part of traffic into the Common Domain<br />

network. Therefore it has not been made systematic <strong>and</strong> is reserved to very essential<br />