June 1979 - International Philippine Philatelic Society

June 1979 - International Philippine Philatelic Society

June 1979 - International Philippine Philatelic Society

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

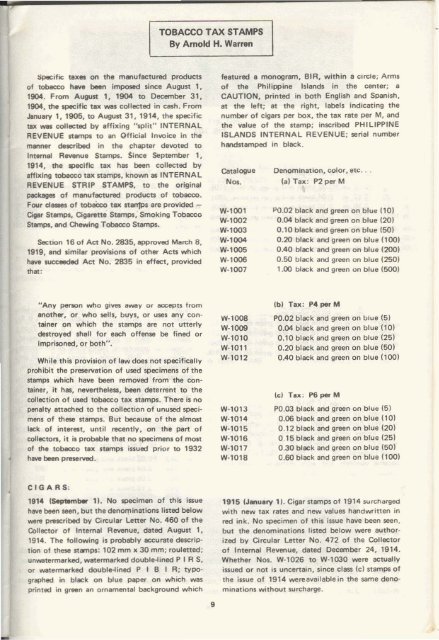

TOBACCO TAX STAMPSBy Arnold H. Warren::ipecific taxes on the manufactured productsof tobacco have been imposed since August 1,1904. From August 1, 1904 to December 31,1904. the specific tax was collected in cash. FromJanuary 1, 1905. to August 31, 1914, the specificwe was collected by affixing "split" INTERNALREVENUE stamps to an Official Invoice in themwmer described in the chapter devoted toInternal Revenue Stamps. Since September 1,1914, the specific tax has been collected byaffixing tobac:co tax stamps, known as INTERNALREVENUE STRIP STAMPS, to the originalpackages of manufactured products of tobacco.Four dasses of tobaCc:o tax stalTJPs are provided Cigar Stamps, Cigarene Stamps, Smoking TobaccoStamps, lWld Olewing Tobacco Stamps.Sac:tton 16 of Act No. 2835, approved March 8.1919, and similar provisions of other Acts whichhave succ:eeded Act No. 2835 in effect, providedthat:featured a monogram, BIR, within a circle; Armsof the <strong>Philippine</strong> Islands in the center; aCAUTION, printed in both English and Spanish.at the left; at the right, labels indicating thenumber of cigars per box, the tax rate per M, andthe value of the stamp; inscribed PHILIPPINEISLANDS INTERNAL REVENUE; serial numberhandstamped in black.CatalogueNos.W-'OO,W-'OO2W-,0O3W-'OO4W-l005W-'OO6W-,007Denomination, color. etc...(al Tax: P2 per MPO.02 black and green on blue {1010.04 black and green on blue (2010.10 black and green on blue (50)0.20 black and green on blue (10010.40 black and green on blue (20010.50 black and green on blue (250)1.00 black and green on blue (500)"Any person who gives away or accepts fromanother, or who sells, buys, or uses any containeron which the stamps are not utterlydestroyed shall for each offense be fined orimprisoned, or both".While this provision of law does not specificallyprohibit the preselVation of used specimens of thestamps which have been removed from the con·tainer, it has, nevertheleS$, been deterrent to thecollection of used tobacco tax stamps. There is nopenalty attached to the collection of unused speci·mens of these stamps. But because of the almostlack of interest, untit recently. on the part ofcollectors, it is probable that no specimens of mostof the tobacco tax stamps issued prior to 1932have been preserved.W-l00aW-'009W-'010W-'O,lW-l0'2W-,013W-,014W-'015W-'016W-'017w-,o,afbi Tax: P4 per MPO.02 black and green on blue (510.04 black and green on blue (10)0.10 black and green on blue (25)0.20 black and green on blue (50)0,40 black and green on blue (100)leI Tax: P6perMPO.03 black and green on blue (5)0.06 black and green on blue (10)0.12 black and green on blue (20)0.15 black and green on blue (25)0.30 black and green on blue (50)0.60 black and green on blue (100)C IG A R S,1914 (Se~m_ 1). No specimen of this issuehave been seen, but the denor'!linations listed belowwere prescribed by Circular Letter No. 460 of theCollector of Intemal Revenue. dated August 1.1914. The following is probably accurate descriptionof these stamps: 102 mm x 30 mm; rouletted;unwatermarked. watermarked double-lined P IRS.or watermarked double-lined P I B I R; typo·graphed in black on blue paper on which wasprinted in green an ornamental background which1915 IJanuary 1). Cigar stamps of 1914 surchargedwith new tax rates and new values handwritten inred ink. No specimen of this issue have been seen.but the denominations listed below were author·ized by Circular Letter No. 472 of the Collectorof Internal Revenue, dated December 24, 1914.Whether Nos. W·l026 to W·l030 ......ere actuallyissued or not is uncertain. since class (c) stamps ofthe issue of 1914 wereavailable in the same denominationswithout surcharge.9