BUSINESS TERMS AND CONDITIONS - Magyar Nemzeti Bank

BUSINESS TERMS AND CONDITIONS - Magyar Nemzeti Bank

BUSINESS TERMS AND CONDITIONS - Magyar Nemzeti Bank

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

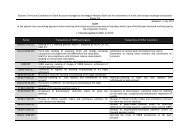

the time when due. It does not necessarily mean that the business partner or the other participantis insolvent, for it may be able to pay the sum owed at a later time.b) ‘operational risk’ means when unexpected losses occur due to inadequate or faulty operation ofthe computer systems or internal processes, due to human error or to mistakes on the part ofmanagement, the heads and members of the supervisory board or executive officers;c) ‘legal risk’ means any event where the relevant law enforcement bodies interpret the law in wayscontradicting with the rules laid down in the business terms and conditions that cannot beforeseen by the participants, hence rendering the provisions of the business terms and conditionsinapplicable;d) ‘system risk’ means when a participant is unable to satisfy its obligations in the VIBER or is unableto carry out its responsibilities in due time, and thereby triggering a series of events to depriveother participants of the ability to satisfy their obligations. If this process results in a liquiditycrisis that has the capacity to jeopardise financial stability, it constitutes a system risk.Given that in VIBER payment and settlement orders are executed gross, i.e. when the funds necessaryare in fact available, the “risk of default” that is typical of net settlement (where payment ordersaccepted by the system during the day cannot be executed due to insufficient funds) does not exist. Onthe other hand, there exists a liquidity risk (temporary, intraday liquidity shortage) and system risk(liquidity crisis), for which the VIBER features the following management functions: VIBER participants are given the option to request an intraday credit line (on a voluntary basis,subject to special rules in terms of eligibility); PVP payment orders; VIBER features central queue management and an algorithm for abolishing gridlock; VIBER manages 99 priorities, available to participants in a prearranged scheme; participants are given real time notice upon the completion of their payment and settlementorders, regarding the opening of a queue and on any event of import in the VIBER; queries can be made with a SWIFT message, and the VIBER Monitor is also available for betterliquidity management.MNB functions as a management agent in providing services to KELER and GIRO Zrt. as marketinfrastructures. Settlement of DVP securities transactions on the securities side may be hinderedby the liquidity shortage of the VIBER participant affected (that is handled as explained above), aswell as any operational error.VIBER members‟ orders submitted for intraday multiple clearing shall not be executed during ICSmultiple intraday clearing sessions if the necessary funds are not available. Lack of funds on the part ofan VIBER participant may, through failure to execute the orders sent by it, hinder the execution of thepayee (beneficiary) VIBER member‟s orders as well (because, as a result, the beneficiary VIBER is facinglack of funds as well). (This risk is presented in detail in the ICS Business Regulations)The operational risks that may arise in VIBER, and the related procedures are made available in Annex4/a of the Business Terms and Conditions.15. PAYMENT ORDERS MANAGED BY THE VIBER15.1. Types of VIBER orders35/47