2009 Annual Report - Brittany's Hope

2009 Annual Report - Brittany's Hope

2009 Annual Report - Brittany's Hope

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

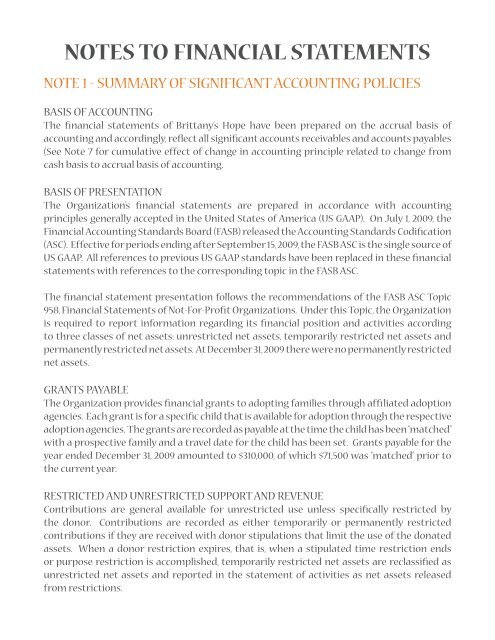

NOTES TO FINANCIAL STATEMENTSNOTE 1 - SUMMARY OF SIGNIFICANT ACCOUNTING POLICIESBASIS OF ACCOUNTINGThe financial statements of Brittany’s <strong>Hope</strong> have been prepared on the accrual basis ofaccounting and accordingly, reflect all significant accounts receivables and accounts payables(See Note 7 for cumulative effect of change in accounting principle related to change fromcash basis to accrual basis of accounting.BASIS OF PRESENTATIONThe Organization’s financial statements are prepared in accordance with accountingprinciples generally accepted in the United States of America (US GAAP). On July 1, <strong>2009</strong>, theFinancial Accounting Standards Board (FASB) released the Accounting Standards Codification(ASC). Effective for periods ending after September 15, <strong>2009</strong>, the FASB ASC is the single source ofUS GAAP. All references to previous US GAAP standards have been replaced in these financialstatements with references to the corresponding topic in the FASB ASC.The financial statement presentation follows the recommendations of the FASB ASC Topic958, Financial Statements of Not-For-Profit Organizations. Under this Topic, the Organizationis required to report information regarding its financial position and activities accordingto three classes of net assets: unrestricted net assets, temporarily restricted net assets andpermanently restricted net assets. At December 31, <strong>2009</strong> there were no permanently restrictednet assets.GRANTS PAYABLEThe Organization provides financial grants to adopting families through affiliated adoptionagencies. Each grant is for a specific child that is available for adoption through the respectiveadoption agencies. The grants are recorded as payable at the time the child has been “matched”with a prospective family and a travel date for the child has been set. Grants payable for theyear ended December 31, <strong>2009</strong> amounted to $310,000, of which $71,500 was “matched” prior tothe current year.RESTRICTED AND UNRESTRICTED SUPPORT AND REVENUEContributions are general available for unrestricted use unless specifically restricted bythe donor. Contributions are recorded as either temporarily or permanently restrictedcontributions if they are received with donor stipulations that limit the use of the donatedassets. When a donor restriction expires, that is, when a stipulated time restriction endsor purpose restriction is accomplished, temporarily restricted net assets are reclassified asunrestricted net assets and reported in the statement of activities as net assets releasedfrom restrictions.