BUILDING EXPECTATION - Lundquist College of Business ...

BUILDING EXPECTATION - Lundquist College of Business ...

BUILDING EXPECTATION - Lundquist College of Business ...

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

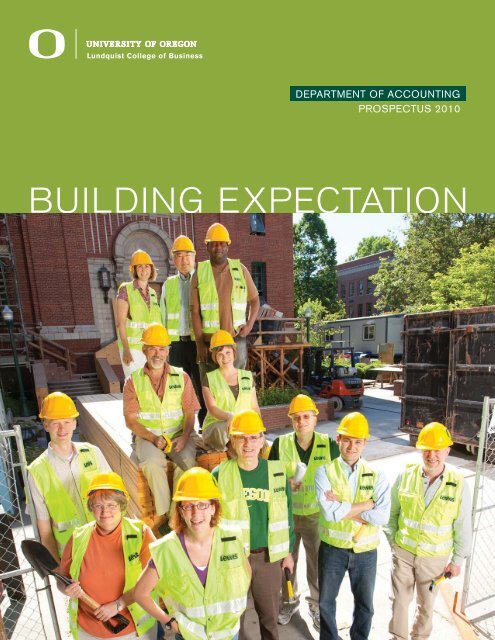

DEPARTMENT OF ACCOUNTINGPROSPECTUS 2010<strong>BUILDING</strong> <strong>EXPECTATION</strong>

HELLO from DaveRemodeling a house can be stressful,even under the best <strong>of</strong> circumstances.Dawn and I once spent severalmonths with a torn-up kitchen and arefrigerator in the middle <strong>of</strong> our livingroom. Although it was awkward, itdid make snacking while watchingtelevision much easier, and in the endwe loved our beautiful new kitchen.The accounting department is currentlyundergoing a similar remodelingexperience as we renovate andupgrade both Gilbert Hall (soon to beAnstett Hall, thanks to the generoussupport <strong>of</strong> Accounting Circle memberHope Anstett) and our undergraduateaccounting curriculum.The remodel <strong>of</strong> Gilbert Hall will result ina fabulous new learning center, a focalpoint for our undergraduate accountingstudents and tutors and a home forBeta Alpha Psi. The new space will alsoallow us to bring all <strong>of</strong> our accountingfaculty <strong>of</strong>fices closer together in onelocation, and should make the facultymore accessible to students. Whilewe are all a little cramped during theconstruction process, with every sparecloset in Lillis and Peterson convertedinto temporary <strong>of</strong>fice space, the result,when construction is over, will be wellworth the wait.We also roll out our new undergraduatecurriculum this year, expanding ourIntermediate Accounting <strong>of</strong>ferings fromtwo to three courses. This expansionwill allow us to cover more topics,and to also spend more time goingdeeper into more complex areas,such as accounting for income taxes.But equally important, the expansionallows us to fully integrate the study<strong>of</strong> International Financial ReportingStandards with our current focus onU.S. generally accepted accountingprinciples. The faculty is excited aboutthis change, which was brought aboutin part through suggestions fromthe Accounting Advisory Board andthe Accounting Circle. As with anyremodeling, the process has been a lot<strong>of</strong> work for those faculty members whohave had to “remodel” these courses,but the end result will allow us to turnout an undergraduate accountingmajor who is much better trainedto understand financial accountingstandards in a global economy.Our remodeling effort is also reflectedin the rebuilding <strong>of</strong> our faculty.Since I came to the UO in 2005 thedepartment has added eight newfaculty members (six tenure-track andtwo instructors), promoted five people(three senior instructors, one associatepr<strong>of</strong>essor, and one pr<strong>of</strong>essor), andhad two people granted tenure. Thedepartment is currently very well placedto move forward with a great group <strong>of</strong>enthusiastic young faculty members.We hope all <strong>of</strong> you will stop by the<strong>Lundquist</strong> <strong>College</strong> sometime duringthis remodeling year and see theconstruction activity, both in GilbertHall and in our classrooms. We maylook a little stressed out at times, andhave plaster dust in our hair, but weare excited and looking forward to thefuture.Sincerely,David A. GuentherScharpf Pr<strong>of</strong>essor <strong>of</strong> Accounting andHead, Department <strong>of</strong> Accounting1

ACCOUNTING DEPARTMENT ADVISORYBOARD AND THE ACCOUNTING CIRCLE<strong>BUILDING</strong> OUR ACCOUNTING NETWORKOur advisory board consists <strong>of</strong> twenty-sevenAccounting Circle members from publicaccounting and industry. This year, the board’sattention focused on the newly revisedundergraduate curriculum, changes in theuniversity budgeting and allocation process, the<strong>Lundquist</strong> <strong>College</strong> <strong>of</strong> <strong>Business</strong>’s diversity initiative,and the Accounting Alumni Network.Established in 1997, the AccountingCircle now consists <strong>of</strong> more than 100business leaders who actively supportexcellence in accounting education atthe University <strong>of</strong> Oregon. The circle isthe accounting department’s strongestlink to the accounting and businesscommunities. The circle serves avital fundraising mission, helping thedepartment obtain the resourcesneeded to continuously improve thequality <strong>of</strong> its faculty and curriculum.Each fall, the Accounting Circle gatherswith the accounting faculty for anupdate on department finances, todiscuss issues in accounting education,and to explore ways to better preparestudents to enter the pr<strong>of</strong>ession. Theday after our business meeting, we allattend the annual Accounting Circletailgate at Autzen Stadium and thencheer the Ducks on to another footballvictory.During the 2009–10 fiscal year, weestablished the Accounting Circleassociates level for our supporterswho are not quite ready to join the fullcircle. Associate members contributea minimum <strong>of</strong> $750 annually, while fullcircle members contribute a minimum<strong>of</strong> $1,500 annually.If you would like to get more involvedand become a member <strong>of</strong> theAccounting Circle, the AccountingCircle associates, or the advisoryboard, contact Michele Henney atmhenney@uoregon.edu.Trace Skopil: A Homegrown DuckBorn and raised in Eugene, Tracegraduated from UO with a bachelor<strong>of</strong> science in accounting andfinance in 1982 and started withMoss Adams that same year. Tracehas more than twenty-five years <strong>of</strong>extensive accounting and consultingexperience with a focus onconstruction. He leads the NationalAssociation <strong>of</strong> Credit Management’sEugene construction industry groupand is on the board <strong>of</strong> directors <strong>of</strong>the Greater Oregon Chapter <strong>of</strong> theConstruction Financial ManagementAssociation. Besides specializing inaudit, review, and compilation services,he lends his expertise to internalcontrol and accounting system studies,budgeting and forecasting, treasurymanagement, and cash-flow analysis.Trace’s experience gives him a uniqueperspective in understanding thedynamics <strong>of</strong> the audit process andthe challenges that today’s financialmanagers face.Trace is an active member <strong>of</strong> theEugene community, serving on theboard <strong>of</strong> directors for the OregonBach Festival and on the churchcouncil <strong>of</strong> Eastside Faith Center.He enthusiastically supports theaccounting department and has been amember <strong>of</strong> the Accounting Circle since2001. In 2008, the UO chapter <strong>of</strong> BetaAlpha Psi recognized Trace as thePr<strong>of</strong>essional <strong>of</strong> the Year.Having grown up in Eugene, Traceis a huge track-and-field fan and is arunner and biker himself. Trace andhis wife, Lisa, have two children, Erikand Bekah, and a golden retriever,Luke. The Skopil family loves totravel. In 2004, Trace and Lisacelebrated their twentieth weddinganniversary in a Parisian apartmentwith a view <strong>of</strong> the Eiffel Tower, onlytwo blocks away.Trace credits his parents for beinggreat role models. His first job wasmaking deliveries for his father’s drycleaning business, where he learnedthe value <strong>of</strong> a strong work ethic. “Ihave learned some great lessonsfrom both <strong>of</strong> my parents. My dadtaught me to work hard and treateveryone with respect, and my momtaught me to do my best, have fun,and always have a good attitude.”Anyone who knows Trace can sayhe puts these lessons into practiceevery day.2

ADVISORY BOARDDave AndertonErnst & YoungWarren BarnesKernutt Stokes Brandt &CompanyKelly BurkeErnst & YoungDavid DuganFEI CompanyPaul FarkasMoss Adams—EugeneAnn FergusonDeloitteAnnie FlatzIntel CorporationHelen GernonUniversity <strong>of</strong> OregonJohn GregorGregor Pr<strong>of</strong>essionalCorporationDoug GrieselJones & RothDavid GuentherUniversity <strong>of</strong> OregonMike HansonHanson & Company, PCDavid HaslipDeloitteBruce HeldtIsler CPAMichele HenneyUniversity <strong>of</strong> OregonDan McKenzieNikeRobert MesherGeffen Mesher & CompanyBlair MinnitiMoss Adams—PortlandTony PizzutiGeffen Mesher & CompanyScott RemingtonGrant ThorntonGary ReynoldsPerkins & CompanyChris RogersKPMGErik SandhuR&R PartnersJulie SchlendorfPricewaterhouseCoopersBruce ShepardLas Vegas GamingKarin WandtkeMcDonald JacobsMike WeberPricewaterhouseCoopersACCOUNTING CIRCLEMEMBERSHope AnstettAngela BeldingMentor Graphics CorporationJohn BensonCollins, Mason & CotéNorm BrendenHarvest DevelopmentLonnie BristErnst & YoungPhil BullockSymantec CorporationRich CallahanKPMGMatthew ClarkBlount InternationalRobin ClementUniversity <strong>of</strong> OregonNathan ColemanCharles CowdenCowden NealeMark CruzanErnst & YoungWendy DamePricewaterhouseCoopers(retired)Kyle DavidsonStoel RivesAngela DavisUniversity <strong>of</strong> OregonMelanie DittonVan Beek & CompanyDon DoerrPricewaterhouseCoopers(retired)Fritz DuncanJones & RothTerry EagerPricewaterhouseCoopers(retired)Alan EarhartPricewaterhouseCoopers(retired)Ken EhlersDavid EvansCTO ConsultingMark EvansDeloitte (retired)Monika FeinMoss Adams—PortlandSteve FeinMoss Adams—PortlandMick FriendPricewaterhouseCoopers(retired)David GirtMoss Adams—PortlandJohn HancockMoss Adams—PortlandMichael HartwigMoss Adams—EugeneBettina HaugenAmity Creek Elementary SchoolGreg HaugenDavid HawkinsKernutt Stokes Brandt &CompanyGordon HaycockGrant ThorntonWilliam HefterWilliam H. Hefter,CPADouglas HenneIsler NorthwestClifford HindsUnited ParcelService (retired)DannyHollingsheadPapé GroupGary HomsleyGrant ThorntonKennethIrinagaSGroup HoldingsUSALee JacobsonTerex CorporationBruce JohnsonUniversity <strong>of</strong> IowaGrant JonesPerkins & CompanyJoseph KarasMoss Adams—PortlandLee KellKell Alterman & RunsteinAlan KraneVan Beek & CompanyJohn KretchmerAmerican Licorice CompanyBob LallyTransPakDon LanceKernutt Stokes Brandt &CompanyCharles LandersPerkins & CompanyJim LanzarottaMoss Adams—EugeneRandy LundKPMGTim McCannKPMGNeal McLaughlinUmpqua Holdings CorporationLeeAnn Wilson MiyashiroFYI ConsultingShane MoncrieffJIBE ConsultingDale MorseUniversity <strong>of</strong> OregonHeidi NelsonPension Planners NorthwestWilliam NeunerNeuner, Davidson & CooleyDouglas OasDeloitteErik ParrishKernutt Stokes Brandt &CompanyBarry PostClassic Manufacturing NWLisa PrenticeInFocusKarin Wandtke on her trip to the Middle East,summer 2010.Dwayne RichardsonPricewaterhouseCoopersNorman RueckerWTASJames SandstromTrace SkopilMoss Adams—EugeneColin SladeTim SlapnickaPricewaterhouseCoopersSondria StephensDeloitteRichard StokesKernutt Stokes Brandt &CompanyDaniel SullivanUmpqua Holdings CorporationCharles SwankGrove Mueller & Swank, PCStephen TerryPricewaterhouseCoopersGlen UlmerKPMGJohn VandercookJohnstone SupplyAlan WadeEvergreen Forest ProductsBelinda WattersPricewaterhouseCoopersRobert WiseOregon Iron WorksScott WrightKernutt Stokes Brandt &CompanyDave ZechnichDeloitteACCOUNTINGCIRCLE ASSOCIATEMEMBERSBrett KummKPMGPaul TigerCleary Gottlieb Steen &Hamilton LLP3

FACULTY UPDATESRobinClementMy highlights forthe year includedserving on the searchcommittee for the newdean <strong>of</strong> the <strong>Lundquist</strong><strong>College</strong> <strong>of</strong> <strong>Business</strong>.Kees deKluyver is highlyexperienced as a deanand is very excited aboutleading LCB, his almaDavidGuentherAnother year, anothernew course to teach!Last year, I began teachingthe master <strong>of</strong> accountingcourse Taxation <strong>of</strong> FlowthroughEntities andcontinued teaching thecorporate tax course. Ialso chaired a dissertation.Our faculty recruitingwas again successful,and we are excited thatShane Heitzman joinedus in the fall. One <strong>of</strong> mypapers was published inThe Accounting Review,another was presentedat the annual meeting <strong>of</strong>the American AccountingAssociation in SanFrancisco, and anotherwill be presented at themater. In late January 2011,the AACSB (Association toAdvance Collegiate Schools<strong>of</strong> <strong>Business</strong>) maintenance<strong>of</strong> accreditation peer reviewteam will be at the college.Since the accountingdepartment has separateaccreditation, we all havebeen working to preparefor their visit. Over thesummer, I wrote a draft <strong>of</strong>the accreditation report,and the final draft will besent to our review teamin November. Personally, Ihad quite a bit <strong>of</strong> transition.Sadly, my dog, Taffy Sue,fourteen, and one <strong>of</strong> mycats, Hank, sixteen, passedaway. However, the housewas too quiet so I adopteda corgi puppy namedGracie Lu Sue. I am proudto say that she was clearlythe valedictorian <strong>of</strong> herpuppy class after crammingfor the final.University <strong>of</strong> Texas atAustin in November. I wasawarded a 2010 ResearchInnovation Award by theUniversity <strong>of</strong> Oregon (one<strong>of</strong> nine recipients). I havealso agreed to serve as aneditor for The AccountingReview beginning in 2011.Dawn and I spent twoweeks in Hong Kong lastJanuary, where I taught aPh.D. seminar.Ray KingI enjoyed my return to full-time teaching,especially teaching financial accounting toaspiring business majors (sophomores). Overthe year I assisted the LCB personnel committee inevaluating senior promotions and hiring for seniorpositions. I also served on the university’s ForeignStudies Programs Committee, which is focused onextending study abroad opportunities for UO students.MicheleHenneyAnd 2009–10becomes one forthe books! During theyear, I continued as theacademic director forthe Oregon ExecutiveMBA, ushering in classnumber twenty-five andhelping class twenty-fourmove toward graduation.This year I took on anew challenge—BA 101:Introduction to <strong>Business</strong>.This course is thestudents’ first exposure tobusiness concepts. It is thegateway into the <strong>College</strong><strong>of</strong> <strong>Business</strong>. I also taughtInternational Accountingto the MBAs and MAccsand EntrepreneurialAccounting to otherMBAs—students fromboth ends <strong>of</strong> the spectrum!I also continue to beinvolved with the OregonSociety <strong>of</strong> Certified PublicAccountants (OSCPA) asa member <strong>of</strong> the EmeraldEmpire Local ServiceAreas council and theEducational FoundationBoard, and I am a newlyappointed treasurer <strong>of</strong>the OSCPA Board <strong>of</strong>Directors. In 2010–11,I take on a new servicerole as the externalrelations manager for theaccounting department. Iplan to develop an alumniassociation to reconnectgrads with the department.I’ll be calling you. . . .4

Xuesong Hu2009–10 was avery challenging andproductive year forme. On the researchfront, I worked on severalprojects, one <strong>of</strong> which isin the second round <strong>of</strong>the review process, andthe other is a paper thatinvestigates whetherconditional conservatismreflects discretionarywrite-<strong>of</strong>fs, using evidencefrom book-tax differences.Several other projectsare in the early stages,which I hope to turn intohigh-quality researchpublications. Last year wasmy second year teachingFinancial AccountingTheory II (recently renamedIntermediate Accounting III),and I was very impressedLinda KrullIn the 2009–10academic year, Icontinued to teachIntroduction toFederal Taxationto undergraduateaccounting majors,master <strong>of</strong> accountingstudents, and MBAstudents. It’s a fun classto teach, and I enjoyhelping students thinkabout how taxes can beintegrated into businessby the dedication andmotivation demonstrated byaccounting major students.I take great pride inknowing that my teachingnot only helps studentsunderstand the material ina meaningful way, but alsopositively affects students’lives. On a personal note,our family added a newmember during this year:our daughter Isabelle Huwas born on January 25,2010. Her arrival addstremendous happiness toour family.decisions and the manydiscussions stimulated bythe topic. I look forward toteaching this class againin the 2010–11 academicyear, as well as developinga new PhD seminar intaxation.I continued my researchrelated to taxes andaccounting for taxes inan international setting.My coauthors and Ipresented our paperon how accounting forincome taxes affects firms’decisions to repatriateforeign subsidiary earningsat the University <strong>of</strong> Arizona,Arizona State University,and UC Davis. I alsobegan a new study thatexamines the locationand composition <strong>of</strong>unremitted foreign earningsdesignated as “permanentlyreinvested” abroad.DaleMorseIf retirementmeans riding <strong>of</strong>finto the sunset,I have done thatliterally twiceover the last year.During fall term Iflew to Australia,rented a car, anddrove 6,000 miles,visiting everynational park I couldfind. In the spring I flewback across the Pacificto trek in Nepal and enjoythe beaches <strong>of</strong> southernThailand. I managedto avoid the politicalturmoil in each <strong>of</strong> thoseAngela DavisI continue to teachthe first course <strong>of</strong>the intermediateaccounting sequenceto our undergraduates.I am looking forward tothe addition <strong>of</strong> a thirdcourse to our intermediatesequence this year, asit will allow for morediscussion <strong>of</strong> IFRS(International FinancialReporting Standards)and other topics in thiscourse. Last year, Ialso taught a doctoralseminar on accountingresearch related tovoluntary disclosures.My research focuseson improving ourunderstanding <strong>of</strong>managers’ voluntarydisclosures. I havecurrent projectsrelated to attributes <strong>of</strong>narrative disclosurescountries. In betweenthose trips, I taughtmanagerial accountingto undergraduate andgraduate students atOregon and executivesin the Oregon ExecutiveMBA program.in earnings press releases,management discussionand analysis in SEC filings,and earnings conferencecalls. I attended severalconferences last yearand had the opportunityto present my researchat the Twenty-fourthContemporary AccountingResearch Conferencein Montreal, Quebec,Canada, and at ColoradoState University.5

SteveMatsunagaLast year was aninteresting year, withmy son, Roy, in ourmaster <strong>of</strong> accountingprogram and taking myTaxes and <strong>Business</strong>Strategy course. Royalso served as thepresident <strong>of</strong> ourBeta Alpha Psichapter, and I amvery proud <strong>of</strong> hisaccomplishments.On the pr<strong>of</strong>essionalfront, I served onthe committeeoverseeing theredesign <strong>of</strong> thebusiness strategyclass that serves asthe capstone coursein our undergraduatebusiness curriculum. I amteaching that class for thefirst time this academicyear. This is my firstattempt to teach a classoutside <strong>of</strong> the accountingdiscipline. Coincidentally,my paper, coauthoredwith Angela Gore and EricYeung, was accepted forpublication in the StrategicManagement Journal.Ken NjorogeMy first year at Oregonflew by really fast.My family and I quicklylearned to enjoy beautifulEugene. I tremendouslyenjoyed teaching costaccounting to mostlyjuniors and seniors. Itwas very rewarding tolearn from, and relate to,highly motivated students.I enjoyed challengingmy students to deeplyappreciate cost accountingas a practical strategicmanagement tool. In myresearch, I began a projectthat compares the longtermforecasting ability <strong>of</strong>statistical models to that<strong>of</strong> analysts, and whethercombining such forecastscan improve performance.I presented this paperhere at Oregon and atthe University <strong>of</strong> Utah. Inaddition, I am finalizingwork on my dissertationresearch that developsa measure <strong>of</strong> accrualreliability. I also began aproject that examines theeffect <strong>of</strong> macroeconomicfactors and customersupplierrelations onfinancial reportingdecisions.Kyle PetersonI have had a greattime teaching theintroductory financialaccounting coursethe past two years.I’m moving on to greenerpastures (which mightmean more manure for meto step in) by teaching thebrand new intermediatefinancial course. I continueto conduct research onaccounting complexity,including coauthoredwork with one <strong>of</strong> our PhDstudents on accountingcomplexity and meetinganalysts’ expectations.I’ve started a few projectsexamining properties <strong>of</strong>revenue—one on analysts’revenue forecasts andanother on the persistence<strong>of</strong> revenue accruals. I alsoparticipated in the DeloitteTrueblood Seminar andhad the opportunityto present papers atRice University and theannual Western Regionmeeting <strong>of</strong> the AmericanAccounting Association.My wife and I had ourfourth child (a girl) inAugust.JoelSneedIn going through thepromotion processfor senior instructor,I spent considerabletime reflecting on bothmy value and my placewithin the department.During my twelve years <strong>of</strong>teaching, I have had bothfrustrating moments andchallenges; however, Ihave never wavered fromthe belief that teaching iswhat I was meant to dowith my life. I believe thatin every one <strong>of</strong> my classes,my students and I have anopportunity to grow andlearn. While each class isunique, one thing neverchanges—my desire tomake students successfulin their learning. I feel thatthis enthusiasm towardlearning defines me as ateacher. As you can see,this job brings me a greatdeal <strong>of</strong> satisfaction, and I’mproud each day in comingto work at the University <strong>of</strong>Oregon.6

MichaelTomcalIt was anotherexciting year at the<strong>Lundquist</strong> <strong>College</strong><strong>of</strong> <strong>Business</strong>! Nowmore than ever, wehave to make the bestuse <strong>of</strong> every opportunitywhile we endure thiseconomic decline.We began last fall bytaking our graduateand undergraduateaccounting studentson a successful tripto the OSCPA CareerShowcase in Portland.We followed up withthe Beta Alpha PsiMeet the Firms eventand concluded withBAP’s spring Meet theStudents event. All <strong>of</strong>our high-caliber studentsdemonstrated theireducational edge whilenetworking with businesspr<strong>of</strong>essionals from local,regional, and nationalfirms. I enjoy being a part<strong>of</strong> these opportunitiesfor our students! It isso rewarding to seetheir edge and abilityto bloom as they enterthe business world. I amlooking forward to thenew academic year aswe prepare to place anew group <strong>of</strong> studentson the path to excitingaccounting careers.WELCOME TO NEW TEAM MEMBERBruce Darling, BA, MBA, MAFIS, PhDInstructor <strong>of</strong> AccountingEDUCATIONPhD, AccountingMadison UniversityMBA, MAFISCleveland State UniversityBA, Mathematics<strong>College</strong> <strong>of</strong> WoosterACADEMICEXPERIENCEUniversity <strong>of</strong> OregonNorthwest Christian UniversityLane Community <strong>College</strong>Stark State <strong>College</strong>Lake Erie <strong>College</strong>BUSINESSEXPERIENCESelf-employed CPAAutomatic Data ProcessingComputer Service Bureau,Director <strong>of</strong> AccountingApplicationsPROFESSIONALCERTIFICATIONSCertified Public AccountantCertified in Financial ForensicsCertified BookkeeperCertified in FinancialManagementCertified ManagementAccountantCertified Internal AuditorWELCOME TO NEW TEAM MEMBERShane Heitzman, BS, MAcc, PhDAssistant Pr<strong>of</strong>essor <strong>of</strong> AccountingEDUCATIONMAcc, PhDUniversity <strong>of</strong> ArizonaBS, <strong>Business</strong> EconomicsEastern Oregon UniversityACADEMICEXPERIENCEUniversity <strong>of</strong> RochesterUniversity <strong>of</strong> ArizonaPUBLICATIONSJournal <strong>of</strong> Accounting andEconomicsJournal <strong>of</strong> Accounting ResearchJournal <strong>of</strong> Accounting, Auditing,and FinanceJournal <strong>of</strong> the American TaxationAssociationACADEMIC HONORSDeloitte and Touche DoctoralFellowshipAmerican Accounting Association/Deloitte and Touche DoctoralConsortium Fellow“I’m so happy andhonored to join such adistinguished programwith such outstandingfaculty members. Thereis nothing like beingat the top <strong>of</strong> yourpr<strong>of</strong>ession. After all theyears in industry andas a practicing publicaccountant, I look forwardto working full-timewith the students at theUniversity <strong>of</strong> Oregon.During my four yearshere as an adjunct atthe university, I’ve metmany excellent students,the best <strong>of</strong> any <strong>of</strong> theinstitutions I have taughtat. It’s very rewardingto help the students intheir studies and to seethem progress in theireducation.”“My research focuses onthe role <strong>of</strong> taxation oncorporate policy decisionsand asset prices, as wellas the dynamics <strong>of</strong> mergernegotiations and role <strong>of</strong>governance practices onacquisition pricing andoutcomes.My wife and I grew up inPortland, so it’s a greatopportunity to come backand raise our kids in astate we treasure. Not onlythat, I get to work witha phenomenal group <strong>of</strong>people for whom I havedeep respect, both asscholars and as humanbeings.”7

RESEARCH<strong>BUILDING</strong> THE BODYOF KNOWLEDGEThe Association <strong>of</strong> American Universities (AAU) comprises sixty-three universitieswith strong graduate programs and research opportunities. The UO is one <strong>of</strong> onlythirty-five public universities afforded AAU membership.Consistent with the research mission <strong>of</strong> this select group, the UO accountingfaculty conducts research in the fields <strong>of</strong> accounting and the accounting pr<strong>of</strong>ession.The list <strong>of</strong> publications includes books and articles that were either publishedduring 2009–10 or are forthcoming. In addition, the faculty has provided abstracts<strong>of</strong> selected working papers that may be <strong>of</strong> interest to our readers. Complete copies<strong>of</strong> these papers may be obtained by contacting the authors.PUBLICATIONS, 2009–10“The Effect <strong>of</strong> Tax-Exempt Investors and Risk on Stock Ownership andExpected Returns.” D. A. Guenther and R. Sansing, The AccountingReview, May 2010.“Determinants <strong>of</strong> CEO Pay: A Comparison <strong>of</strong> ExecuComp andNon-ExecuComp Firms.” B. Cadman, S. Klasa, and S. Matsunaga,The Accounting Review, September 2010.2009–10ResearchWorkshopsMelissa LewisUniversity <strong>of</strong> UtahPei HsuUniversity <strong>of</strong> OregonJin wook Chris KimUniversity <strong>of</strong> OregonSteve HuddartPennsylvania State UniversityKai Wai HuiHong Kong University <strong>of</strong> Scienceand TechnologyRich FrankelWashington UniversitySteven CrawfordRice UniversityJoshua FilzenUniversity <strong>of</strong> OregonLinda MyersUniversity <strong>of</strong> ArkansasTed MockUniversity <strong>of</strong> Southern California“The Role <strong>of</strong> Technical Expertise in Firm Governance Structure:Evidence from Chief Financial Officer Contractual Incentives.” A. Gore,S. Matsunaga, and E. Yeung, Strategic Management Journal, forthcoming.Faculty ResearchPresentations, 2009–10Angie Davis: “Managers’ Use <strong>of</strong> Language across Alternative DisclosureOutlets: Earnings Press Releases versus Management Discussion andAnalysis,” Colorado State University, May 2010.Linda Krull: “Is U.S. Multinational Intrafirm Dividend Policy Influenced byReporting Incentives?” University <strong>of</strong> Arizona, March 2010.Ken Njoroge: “Combining Model-based and Analyst Forecasts: Toward aBetter Proxy for Market Expectations,” University <strong>of</strong> Utah, April 2010.Kyle Peterson: “Forecasting the Top Line: Assessing Analysts’ RevenueForecasts,” Rice University, April 2010, and “Accounting Policy Disclosuresand Heterogeneous Beliefs,” Annual Western Region Meeting <strong>of</strong> theAmerican Accounting Association, May 2010.DISSERTATIONDEFENDEDSPRING 2010“Do International FinancialReporting Standards IncreaseEarnings Timeliness? Evidencefrom Mandatory IFRS Adoptionin the European Union” by KeanWilliam Wu8

ABSTRACTSEquity Grants to TargetCEOs in Deal NegotiationsBy Shane HeitzmanI investigate the determinants andconsequences <strong>of</strong> equity grants made totarget CEOs during deal negotiationsprior to a public merger announcement.Using a novel dataset on CEOinvolvement in deal negotiations, I findthat CEOs who negotiate for the targetare more likely to receive equity duringnegotiations than those who do not(that is, when an advisor or directornegotiates instead). This suggeststhat the board uses equity grants toincrease bargaining incentives whenthe CEO has influence over purchaseprice. These negotiation grants are alsosomewhat larger when there are moreindependent directors on the target’sboard. I also find some evidencethat negotiation grants are used tocompensate the CEO: when the boardhas fewer independent directors, aCEO that does not negotiate is morelikely to get negotiation period grantswhen the expected takeover premiumis high. My findings do not supportrecent claims that CEOs who getequity during negotiations negotiatesignificantly smaller premiums for theirshareholders.Capitalization <strong>of</strong> OperatingLeases and Future OperatingIncomeBy Roger C. Graham andRaymond D. KingOperating leases are used to acquirethe use <strong>of</strong> assets without acquiringlegal title. Accordingly, accountingprocedures require that firms valueoperating lease obligations at theright-<strong>of</strong>-use values <strong>of</strong> the leasedassets rather than the market values<strong>of</strong> the assets themselves. A firm’searnings are generated from the assetscontrolled by the firm, whether or notthe assets are recorded by the firm’saccounting system. In this study we testfor associations between current andfuture earnings and three estimates<strong>of</strong> operating lease asset values. Thethree estimates <strong>of</strong> lease asset valuesare (1) the present value <strong>of</strong> disclosedfuture minimum lease payments (theestimated right-<strong>of</strong>-use asset valuefrom the firms’ disclosed minimumcontractualleaseobligations);(2) the presentvalue <strong>of</strong>the currentoperating leasepayment (anestimate <strong>of</strong> thevalue <strong>of</strong> theassets underfirm control);and (3) thepresent value<strong>of</strong> the projectedfuture operatinglease paymentsextrapolatedfrom past leasecost patterns (an alternative estimate<strong>of</strong> the value <strong>of</strong> the assets under firmcontrol). We find that the right-<strong>of</strong>useleased asset value (measure 1)is strongly associated with currentand future earnings. However, thetwo measures <strong>of</strong> lease asset valuewhich reflect more information aboutthe values <strong>of</strong> the underlying assets(measures 2 and 3) are even morestrongly associated with current andfuture earnings than are the right<strong>of</strong>-useleased asset values. Thatis, capitalized values that reflectinformation about the total value <strong>of</strong>the asset to the firm have marginalexplanatory power beyond that <strong>of</strong>contractual lease payments alone.Dale Morse, Annie Flatz, and Colin Slade at the 2009 Accounting Circle fallmeeting. The Accounting Circle helps provide funding for accounting facultyresearch.The Role <strong>of</strong> Technical Expertisein Firm Governance Structure:Evidence from Chief FinancialOfficer Contractual IncentivesBy Angela Gore, Steve Matsunaga,and Eric YeungWe provide evidence that thepresence <strong>of</strong> technical expertise infirm governance structure reducesreliance on contractual incentives tocontrol the potential agency problemfor executives whose responsibilitiesrequire specialized knowledge.Specifically, we find that firms withfinancial expertise in the form <strong>of</strong> aboard finance committee, or a chiefexecutive <strong>of</strong>ficer (CEO) with a financialbackground, tend to use lower levels<strong>of</strong> incentive-based compensation fortheir chief financial <strong>of</strong>ficers (CFOs).Our findings suggest financial expertsprovide stronger oversight and directionwith regard to firm financial policiesand strategies, thereby allowingfirms to reduce reliance on incentivecompensation. Our study providesinsight into the role <strong>of</strong> technicalexpertise and board committees in firmgovernance, and into the benefits <strong>of</strong>common functional expertise within topmanagement teams.Accounting Complexity andMeeting ExpectationsBy Josh Filzen and Kyle PetersonWe examine whether firms withcomplex accounting are more likely tomeet or beat analysts’ expectations. Wemeasure accounting complexity usingthe residuals from a regression thatexplains accounting policy measurelength. Our results suggest that firmswith complex accounting are morelikely to just beat expectations thanjust miss expectations (i.e., they canmeet expectations at the margin).However, in general, complex firmsare more likely to have extremeabsolute forecast errors. Additionaltests reveal that the increasedpropensity to meet expectations is atleast partially driven by expectationsmanagement. However, theexpectations management is onesided;complex firms appear to walkdown expectations, but not prevent thewalk up <strong>of</strong> expectations. These resultssuggest managers take advantage <strong>of</strong>accounting complexity to meet analystexpectations in limited circumstances.9

PhD PROGRAMPhD Alumni Spotlight:Making a DifferencePhilip ShaneSince earninghis PhD inaccountingfrom theUniversity<strong>of</strong> Oregonin 1982,Phil hasserved on thefaculties <strong>of</strong>seven universities, living in sixdifferent states and two differentcountries. He has been apr<strong>of</strong>essor <strong>of</strong> accounting at theUniversity <strong>of</strong> Colorado since 1997and also serves on the faculty atthe University <strong>of</strong> Auckland.Over the last ten years, Phil’swork has been publishedin such esteemed journalsas The Accounting Review,Contemporary AccountingResearch, and the Journal <strong>of</strong>Accounting Research, just toname a few. His main researcharea is accounting-relatedcapital markets, and he haspresented his work around theworld. Phil’s prolific body <strong>of</strong>work was undoubtedly a factorin his recently being named anacademic research fellow by theFinancial Accounting StandardsBoard (FASB), charged withthe tasks <strong>of</strong> reviewing currentacademic research relevantto the accounting pr<strong>of</strong>ession,explaining it to the FASB, andstimulating new research toinform the FASB’s policy debates.Phil’s work in making adifference in academia and theaccounting pr<strong>of</strong>ession keeps himbusy. But when he has free time,he enjoys the outdoors, watchingmovies, and relaxing with friends.His heroes are his three adultchildren, Bob Dylan, and thecharacter “Shane” in the movieby that name. One <strong>of</strong> these days,perhaps he’ll find time to “comeback” to Oregon for a visit.Doctoral students in accounting, 2009–10 (clockwise from back row): Joshua Filzen, Nam Tran,Jing Huang, Pei Hui Hsu, and Jin wook Chris Kim.<strong>BUILDING</strong> THE ACADEMYThe accounting department operates an active PhD program designed to trainstudents for a successful career in academia. This fall we welcomed two newstudents, Shan Wang and Brian Williams, into our program. Both came directlyinto our PhD program after earning master’s degrees. Shan recently completedthe master <strong>of</strong> accountancy program at California State University, Fullerton, andnow has a second advanced degree to go with her master’s degree in chemistryfrom the University <strong>of</strong> California, Riverside. Brian earned his master’s degree inaccounting from Texas A&M University.Jing Jing Huang, Chris Kim, Pei Hui Hsu, Josh Filzen, and Nam Tran are continuingtheir studies in the program. We congratulate William Wu for graduating from ourprogram. Williams is currently looking for an academic position.The doctoral program relies heavily on the financial support provided by theAccounting Circle and our doctoral alumni. The funding allows us to compete forthe top students and provides additional research opportunities for our students.The funding allows our students to focus on developing their research skills andgenerating a research portfolio that will enhance their placement opportunities.We are always looking for strong candidates to join our program. Although doctoralprograms and subsequent academic careers are demanding, they provide rewards(monetary and otherwise) that few careers can match. If you are someone who wouldappreciate the thrill <strong>of</strong> discovery, the feeling <strong>of</strong> accomplishment <strong>of</strong> seeing your workin print, and the satisfaction that goes with being a positive influence in the lives <strong>of</strong>your students, we hope that you will consider our program. Additional informationregarding our program can be found on our website at lcb.uoregon.edu/phd, or bycontacting Steve Matsunaga at stevem@lcbmail.uoregon.edu or 541-346-3340.In support <strong>of</strong> increasing the number <strong>of</strong> doctoral students nationwide, the AmericanInstitute <strong>of</strong> Certified Public Accountants and some major accounting firms havecreated the Accounting Doctoral Scholars Program. Learn more online at adsphd.org.10

MAcc PROGRAMThe Tenth Master<strong>of</strong> AccountingClass Builds ona ThemeOne curricular highlight <strong>of</strong> the MAccyear was the winter session <strong>of</strong> theDeveloping the <strong>Business</strong> Pr<strong>of</strong>essionalcourse covering the topic “Accountingfor Sustainability.” We had severalspeakers, including the director <strong>of</strong>the UO’s sustainability <strong>of</strong>fice, SteveMital. The classes were focusedon building an understanding <strong>of</strong>the characteristics <strong>of</strong> a high-qualitycorporate responsibility (CR) report. Westudied the Global Reporting Initiativestandards, and students reviewed andprepared questions on Nike’s CR. Thework for the term culminated in a fieldtrip to Nike, thanks to the help <strong>of</strong> DanMcKenzie, UO graduate, AccountingCircle and advisory board member,and Nike assistant controller. A paneldiscussion on Nike’s efforts regardingsustainability was very informative, andthe students were actively engaged.2006 MAcc alum Carol Kaiser wasamong the panel members. It was aterrific term <strong>of</strong> learning more about thisemerging topic.On the marketing front, we launched anew website and developed a themefor the MAcc: “Reach, Discover, andAchieve.” The theme was chosenfrom suggestions solicited from theMAcc class. It is very descriptive <strong>of</strong> ourprogram, which challenges studentsto reach to discover new technicalThe MAcc class built team-working skills at theropes course, fall 2009.MAcc graduate teaching fellows, 2010–11.knowledge and skills as well as developpr<strong>of</strong>essional skills such as teamwork.Through these efforts, we hope theyachieve great things in their careers.Placement for the 2010 class was adefinite challenge. By graduation inJune, about 60 percent <strong>of</strong> domesticstudents were placed, down fromthe historic 100 percent placementrate. The economic climate clearlyaffected placement. But because <strong>of</strong>the skills the students developed byworking hand-in-hand with the LCBCareer Services <strong>of</strong>fice, those whowere not placed by graduation werevery optimistic about the prospect <strong>of</strong>securing a job in the near future.The 2010 class also inaugurated“MAcc Attack” events. They puttogether intramural basketball anddodge ball teams. Some <strong>of</strong> the teamswere co-MBA/MAcc and some weresole MAcc efforts. Other eventsincluded birthday celebrations, bowling,and end-<strong>of</strong>-midterm and end-<strong>of</strong>-termcelebrations. They even designeda MAcc T-shirt with the phrase “It’saccrual world.”As usual, thanks to all <strong>of</strong> the MAccprogram supporters! And onward to2011, the eleventh MAcc class!Robin P. ClementDirector, Master <strong>of</strong> Accounting Program11Reaching new heights at the MAcc ropes course.Master <strong>of</strong> AccountingAward Winners Class<strong>of</strong> 2010Department <strong>of</strong> AccountingAward for ExcellenceRoy MatsunagaFederation <strong>of</strong> Schools <strong>of</strong>Accountancy Student AwardAngel DavisBecker CPA ReviewScholarshipsTrever CampbellWendy GilmoreRoger CPA Review ScholarshipNancy LeungGraduate TeachingFellows 2010–11Erika BulayMargaret ClaflinTyler HarrisEileen HaugeKyle HauserDavid HouleMelissaMcMahonYizhou(Allison) PanMarsha TaylorMingyu Zhu

BETA ALPHA PSIBeingEngagedRoy MatsunagaBeta Alpha Psi President,2009–10Excerpted from a speech given at theAccounting Recognition EveningI am happy to report that this hasbeen a successful year for BetaAlpha Psi. After our victory at theNorthwest regional conferencein the Best Practices category <strong>of</strong>chapter sustainability, our teamtraveled to Brooklyn, New York, torepresent our chapter at the nationalcompetition. We took on seven <strong>of</strong>the best chapters in the country andwere awarded second place.The content <strong>of</strong> our presentationalso showed its value as weagain earned Superior Chapterstatus. Furthermore, last year theBuildingMomentumKellan DavisBeta Alpha Psi President,2010–11Excerpted from a speech given atthe Accounting Recognition EveningWe want to continue the positivemomentum we built this year inmembership growth. Having moremembers means having widernetworking circles, completingmore volunteer service, and <strong>of</strong>feringstronger competition with otherchapters. We will hold more variedvolunteer events for our membersso they can serve and learn abouttheir communities. One <strong>of</strong> our mostsuccessful events this year wasVolunteer Income Tax Assistanceand we hope to see even largerparticipation next year. In addition,we plan on holding more socialevents that help members reap thefull benefits <strong>of</strong> the organization bynational <strong>of</strong>fice unveiled an even higherdesignation: Gold Chapter. Thanksto the hard work <strong>of</strong> our talentedvideographers, we were one <strong>of</strong>fourteen chapters globally that receivedthis honor.I am proud <strong>of</strong> all this group hasaccomplished, and I celebrate thosewho have stepped up to take onchallenging new roles within theorganization and really make the mostmaking friends who share their classesand career interests.Many <strong>of</strong> our members have found theirplace in LCB through Beta Alpha Psi.They spend many hours attendingthe meetings and events, as well asnetworking. But there are still somemembers who just come to meetingsand call it good. This is somethingwe want to change. We want to seeour entire membership active in ourchapter through various opportunitiesthat are <strong>of</strong>fered. To increase the value<strong>of</strong> their involvement. It is in theseopportunities that the true value <strong>of</strong>Beta Alpha Psi lies. If you let it, itcan be a single line on your résumé,just like that term you made theDean’s List or sat silently on somecommittee. But as we all know, eachline on a résumé is only as strongas the stories and experiencesthat come with it. I’ve seen somany people in my two years asa BAP <strong>of</strong>ficer who have takenthis notion to heart and worked toget everything they could out <strong>of</strong>this fine organization. It’s not justabout being an <strong>of</strong>ficer or chairing acommittee, it’s about being engagedat meetings, getting to know yourfellow members, and putting <strong>of</strong>f thatslice <strong>of</strong> pizza until you’ve talked tothe presenters. I am proud to callmany <strong>of</strong> these people my friends,and I look forward to watching themcontinue to grow in the years tocome.<strong>of</strong> membership, we will continue tostrive for the rank <strong>of</strong> Gold Chapter,the highest honor a chaptercan receive. This means activeparticipation in the regional andnational conferences.All <strong>of</strong> these are our goals as achapter. But we also can’t forget thegoals <strong>of</strong> our members—to ultimatelyfind a job. To help in that endeavorwe plan to <strong>of</strong>fer them consistentopportunities to prepare for recruitingand job searching. We will make themeetings and events worthwhilefor our members by forming newrelationships with accountingpr<strong>of</strong>essionals while strengtheningthe ties with those who we alreadyknow. Beta Alpha Psi’s main goal isto serve as a middle agent betweenaccounting students who want jobsand accounting firms who wantemployees. This is a role that we takevery seriously and we strive to ensurethat students get the pr<strong>of</strong>essionalgrowth and the job opportunities thatthey desire to become successfulindividuals.12

SCHOLARSHIPSScott Remington presents the OSCPA EducationalFoundation Grant Thornton scholarships.Heidi Nelson presentsthe Pension PlannersNorthwest studentscholarship.Mike Weber presents the OSCPA EducationalFoundation PricewaterhouseCoopers scholarships.MASTER OF ACCOUNTINGAccounting Circle MAccStudent ScholarshipSin Ting (Katerina) CheukCatherine L. TiggermanScholarshipsKathryn AllanKimberly BarnettMei Li YuDeloitte ScholarshipsCorey GliddenDaniel KeulerDiana West McKalip MemorialScholarshipsYixin DongJulie M<strong>of</strong>fenbierErnst & Young AccountingExcellence AwardVincent HulstromGeffen Mesher ScholarshipBrian FloreyGlenn Schneider MemorialScholarshipSusan CarrGrant Thornton MAcc ScholarshipBryce BakerJoseph L. Anstett Memorial MAccScholarshipNevena DjordjevicKPMG Distinguished AchievementAwardTaylor LuellMAcc Alumni ScholarshipKuma NonguiermaMoss Adams Scholarship in Honor<strong>of</strong> William F. MeyerBria WetschPricewaterhouseCoopersLeadership ScholarshipKuma NonguiermaOSCPA Educational FoundationScholarshipsAnna L. May Fifth-Year EndowmentMarsha TaylorIsler CPADaniel KeulerJones & RothDavid HouleKernutt Stokes Brandt & CompanyKyle HauserKPMGErika BulayNevena DjordjevicMoss Adams LLP and EmeraldEmpire LSATaylor LuellPerkins & CompanyMargaret ClaflinPricewaterhouseCoopersMei Li YuPricewaterhouseCoopers andOSCPA Educational FoundationVincent HulstromUNDERGRADUATEC. Lyle Kelly Memorial ScholarshipsDenise AndersonTiffany PhillipsChung Yin SoXiaoning ZhaoGregor Endowment ScholarshipsDenise AndersonElham AnsariJon SteinbergLeah WinslowJohn and Catherine KnoxScholarshipsJordan NovingerMeghan SmithEdrice Wahed13Joseph L. Anstett MemorialUndergraduate ScholarshipsKellan DavisSteven NorwoodKenneth S. and Kenneth C. SmithMemorial ScholarshipsSarah BrillhartRyan DinglerKerry HinchSoyeon ParkKPMG Undergraduate ScholarshipAndrew Marshall<strong>Lundquist</strong> Accounting ScholarshipKyle MeachamOSCPA Endowment ScholarshipAustin JurgensPension Planners NorthwestStudent ScholarshipKerry HinchRobert and Robin MesherScholarshipsNick BottcherCecily DevotoOSCPA Educational FoundationScholarshipsAnna L. May EndowmentMelissa NelsonDeloitte & ToucheRaymond LeeErnst & YoungKyle MeachamGrant ThorntonKellan DavisAndrew MarshallMaginnis & CarreyLeah WinslowPerkins & CompanyDenise AndersonPricewaterhouseCoopersKathryn Kruger-HickmanJonathan SteinbergAlice Zhang

<strong>BUILDING</strong> <strong>EXPECTATION</strong><strong>BUILDING</strong> ANSTETT HALLmodern wiring, technology, and spaceto accommodate a growing facultyand student body, this overhaul is longoverdue. The dream to update thespace became a reality when HopeAnstett announced her $5 milliongift to help with the renovation and tomemorialize her late husband, JosephAnstett.Joe and Hope have been generoussupporters <strong>of</strong> the business collegeand the Department <strong>of</strong> Accounting. In2001, they gave $1 million to the LillisHall construction fund for the AnstettFamily Accounting Suite, and Joe wasa loyal member <strong>of</strong> the AccountingCircle. Hope has continued thisphilanthropic tradition, establishing ascholarship endowment in Joe’s namefor accounting and MBA students in2009 and in her gift this year for theGilbert renovation.Built in 1921, Gilbert Hall is thehistoric east wing <strong>of</strong> the Lillis <strong>Business</strong>Complex and the final portion <strong>of</strong> thecomplex to be renovated. In need <strong>of</strong>The UO and the business college holda very special place in Hope’s heart.She and Joe met as business studentsat the University <strong>of</strong> Oregon over fiftyyears ago; he studied accounting andshe studied business administration.They married the day after graduationin 1955. After serving in the U.S. Armyin Korea, Joe joined Hope in Las Vegasand started a successful thirty-sevenyearcareer with Silver State Disposal,Inc., working his way from accountantto president and chief executive <strong>of</strong>ficer.Construction on Gilbert Hall began lastApril and will continue until March 2011,when the building will be renamedAnstett Hall in the couple’s honor.The redesigned space will includea larger area for the Anstett FamilyAccounting Suite that will house severalfaculty <strong>of</strong>fices and a collaborativeworkspace for accounting students.The Department <strong>of</strong> Accounting facultyand students eagerly anticipate movinginto Anstett Hall and expect to do greatthings there.Building Pr<strong>of</strong>essionals through Beta Alpha PsiTen years ago the UO chapter <strong>of</strong>Beta Alpha Psi (BAP) launchedits first Volunteer Income TaxAssistance (VITA) program, freeto students and others in thesurrounding community. Since then,VITA has expanded its reach, filing206 tax returns this year comparedto 150 tax returns in 2000.Beta Alpha Psi has grown in otherways as well, and each year’sgroup <strong>of</strong> members has contributedits own unique style <strong>of</strong> being active.Over the last ten years, members haveenjoyed social events such as cosmicbowling, holiday potlucks, volleyball,s<strong>of</strong>tball, kickball, and even skydiving.They have provided services forbusiness and accounting students suchas hosting Meet the Firms and Meetthe Students events; <strong>of</strong>fering breakfastfor students during finals week; andhosting a tutoring program.They have given back to the communityby carving pumpkins with kids at theBAP <strong>of</strong>ficers, 2010–11YMCA; making Valentine’s Day cardsfor senior citizens; holding a car wash toraise funds for local children’s charities;and processing food donations at Foodfor Lane County. BAP pledges andmembers have taken part in studentand pr<strong>of</strong>essional mentoring programs,mock interviews, and CPA for a Dayactivities. They have published theirrésumés in the BAP Résumé Bookand worn “BAPwear” T-shirts. Theycreated partnerships with otherstudent-run groups in the college suchas the finance club, the AmericanMarketing Association, and AlphaKappa Psi.BAP members have won BestPractices competitions at regionaland national meetings. The UOchapter has earned recognition asDistinguished Chapter since 2001,Superior Chapter every year since2003, and won the Gold ChallengeAward in 2009. It achieved GoldChapter Status that same year—thehighest designation for chaptersaround the world—and is on the waytoward earning this again in 2010.Being involved with Beta Alpha Psimeans much more than attendingweekly meetings. Members are givenan invaluable experience, setting themapart from the norm and jumpstartingtheir careers long before graduation. Inthese experiences, BAP members and<strong>of</strong>ficers develop leadership skills andpr<strong>of</strong>essionalism, building pr<strong>of</strong>essionalsalong the way.14

DONOR HONOR ROLL, 2009–10We are pleased to recognize and thank the following alumni, friends, companies, and foundations for the commitmentand support they have shown the Department <strong>of</strong> Accounting during fiscal year 2009–10 (July 1, 2009, through June 30,2010). With their ongoing loyalty and generosity, we are confident that we can continue to build our future. Though wehave made every effort to ensure that all donors have been duly noted, errors are always possible. We apologize for anyomissions or inaccuracies.Tony Pizzuti presents the GeffenMesher Scholarship.Dave Haslip presents the DeloitteScholarships.Drew Corrigan presents theOSCPA Educational FoundationKPMG Scholarships.Dave Anderton presents theErnst & Young AccountingExcellence Award.Accounting Champions:$10,000 and OverHope AnstettNorm and Linda BrendenJ. Terry and Susan EagerDavid and Laury GirtDonald and Colleen GrecoJohn and Lori HancockKPMG FoundationMoss Adams FoundationDoug and Robin OasPricewaterhouse CoopersFoundationTrace and Melissa SkopilStephen and Sharon TerryAccounting Fellows:$5,000–$9,999Richard CallahanNathan and Jo Ann ColemanDeloitte FoundationWendy Dame and Don DoerrAlan and Joan EarhartDavid and Laura EvansFidelity Charitable Gift FundMick Friend and Lori BradfordJohn and Kyungsook GregorJones & RothJohn and Catherine KnoxJames and Kelly LanzarottaE. Blair and Terri MinnitiMoss Adams–EugeneMoss Adams–PortlandPricewaterhouse Coopers, LLPDwayne and Merritt RichardsonBruce and Elizabeth ShepardColin and Marianne SladeTim and Carolyn SlapnickaSondria StephensMike and Judy WeberAccounting Partners:$2,500–$4,999David and Kari AndertonJohn Benson and Diane AlbrachtPhillip and Cindy BullockMark and Diane CruzanDavid and Melissa DuganFritz and Tricia DuncanErnst & Young FoundationPaul and Virginia FarkasAnn and David FergusonGeffen Mesher & CompanyHelen Gernon and DennisStimpleGrant Thornton FoundationGrant Thornton, LLPGregor Pr<strong>of</strong>essional CorporationDoug and Barbara GrieselDavid and Dawn GuentherMike and Leslie HartwigDavid and Terah HaslipGreg and Bettina HaugenWilliam and Ann HefterBruce and Loi HeldtDoug and Lynn HenneCliff and Connie HindsIsler CPAW. Bruce Johnson and DianeRamseyGrant and Elaine JonesKernutt Stokes Brandt &CompanyJohn and Gail KretchmerRobert and Kimberly LallyRandy LundRobert and Robin MesherDale Morse and Leslie MittelbergJ. William and Patricia NeunerErik and Brittany ParrishPerkins & CompanyScott and Judith RemingtonGary and Susan ReynoldsM. Chris and Maria RogersNorman and Betty RueckerDaniel and Linda SullivanUmpqua BankJohn and Linda VandercookBelinda and James WattersScott and Kris WrightAccounting Investors:$1,000–$2,499Warren and Kathryn BarnesAngela BeldingStephen BellottiBlount InternationalLonnie BristMatthew and Danelle ClarkRobin ClementCharles and Virginia CowdenKyle DavidsonAngela Davis and Jeremy PigerSteven and Monika FeinAnn and Bill FlatzFrederick and Donna GentFrederick Gent TrustGeorge and Margaret GravesSerena HallDavid and Donna HawkinsGordon and Jody HaycockMichele HenneyDan and Anita HollingsheadJohn Gregor presents the Gregor Endowment Scholarships.Gary HomsleyIntel CorporationKenneth and Deborah IrinagaLee and Shari JacobsonJibe Consulting, Inc.Alan Krane and Melanie DittonDon and Marilyn LanceCharles and Barbara LandersTim McCannKeith McKalipDan and Christie McKenzieNeal and Danielle McLaughlinShane and Sally Moncrieff15

Morones Consulting, LLCHeidi NelsonOregon Iron Works, Inc.Pension Planners NorthwestTony and Kristine PizzutiLisa and Bill PrenticeR&R PartnersErik and Jennifer SandhuJames and Andrea SandstromJulie and John SchlendorfVirginia SmithGlen UlmerUnited Way <strong>of</strong> Lane CountyVirginia S. Smith TrustAlan Wade and LisaBiddiscombe-WadeJames WalkerKarin WandtkeR. Dale WhiteRobert and Susan WiseDavid and Karen ZechnichZechnich Family TrustJay and Kellie ZirkleDon Lance, Bruce Heldt, and Matt Clark atthe Accounting Circle fall meeting 2009.Accounting LoyaltyFund: $1–$999Holli AgeeRenee and Richard AlleySusan and John AndersonJeanne ArbowSarah AshrafRonald and Julia BabcockMatthew BartleyCharles BaumannChristina and Brian BauskeDaniel and Christina BayleyRonald and Patricia BedientAndrea BelzKaren and Steven BennettCarol and Carl BinderMelissa BlueDoralyn BocchiHarry Bose and Mardel James-BoseAndrew and Michelle BrackDale and Renee BracyChris and Ge<strong>of</strong>frey BremerTim BrittainJerol and Judith BrownKevin and Jennifer BrownMyron and Cindy BrownCharles and Nola BrumfieldDaniel and Keiko BryanJohn and Jennifer BullerBoni and Ward BuringrudKelly and Eric BurkeJon CampoKenneth and Janice CardwellDavison and Suzanne CastlesTimothy CathcartMandy and Joe ChanJosie and Raymond ChengAbner ChongGary ColbertJ. Jon Cook and MelissaStepovichMakenzie CornacchiaDeanna CrowleyBruce and Kathryn CunninghamJerry and Kristi CunninghamWilliam and Sharon DavisBrian and Stefany DayDee Dee Crowley CPA, LLCMartin DesmondShannon Dolan and Alan GildsKaren and John DosterCatherine EdnieKenneth and Catherine EhlersLisa EilerEllis Family TrustDelbert and Jessie EllisLaura Ellis-WestwellBrian and Denise EnosBetty and Lawrence FaatzHua FanDarren FaulkWilliam and Susan FeraFord Black & Company, PCErin FrazierHeidi FreemanRonald and Christina FribergAnn GellerMary GilbertBrian GillSylvia GillpatrickRoger GrahamCharlotte and Brent GreenMike and Leslie HansonGabriel Harmon and JenniferH<strong>of</strong>fmanAllen and Linda HarperChristopher and Kathleen HarrisLucille HarwoodJulie Heidenreich and ScottRawitscherSylvia H<strong>of</strong>fmanRichard and Nancy HopperHarold and Jo Ann HubbardKai Wai HuiNini HungLeRoy HuusIntel FoundationInternational <strong>Business</strong> MachinesCorporationJ. Sam Wood Jr. TrustJoanne JensenJohn Hancock Financial ServicesFritz Duncan presents theOSCPA Educational FoundationJones & Roth scholarship.Meredith and Craig JohnsonRaymond and Marilyn JohnsonSheila JonesJohn Joyce and Janice AndersonJerome KatzkyRonald KellyMichael KontichRonald and Barbara KovarBrett and Jennifer KummNicole LaBuwiJeffrey LakeCynthia LashinskiKristin LauxMacy and Julie LawrenceDavid and Susan LindleyKeen Loh and Lucy ChuahWilliam and Sylvia LoveAnne and John MacdonaldLeana MadarangVincent MarellaJay and Laurie MaxwellDouglas and Shirlene MayDennis and Maureen McConaghyCharles and Karen McGeheeErin and Brice McKalipJames and Diane McKittrickBrandie Cook McNameeAnnamarie McNielLisha MenneChris and Nancy MiddletonRoger MillsKimberly MolbaekLinda Moreland-Hooker andSteven HookerEdwin Morgan Jr.Jody and Abigail MortimoreChristopher MurphyMyron E. Brown, CPA, PCLoretta NicholsonNikeRoger and Linda NoahPatrick O’BrienEmeka and Laura OfobikeOregon Community FoundationDennis and Michele OshitaJustin PackardAnthony ParkeBrandon ParkerYan Emma PengDonna PhilbrickMarta and Peter PowersEric and April PressRagan & Brown CPAs, PSRobert and Fran RaneyJared Holum presents theOSCPA Educational FoundationPerkins & Company scholarship.Linda and Steve ReichenbachKevin and Gina RichWilliam and Annadale RooperMichael and Laura RootsDouglas and Julie RuschMargaret and Scott SavoianTad and Jeri ScharpfJeffery and Anne SchillingJami SealShackelford Hanson, LLCAdriene SimpsonKraig and Erin SmithRichard and Nancy SottaDavid and Annette SparksRoger and Margot SquierKatherine StalsbergCaleb and Marijo StandaferJames and Cathy StarkMark and Linda SteinhauerPeter StephensKirk and Joanne StevensRhonda Stoltz and StephenMustoeStanley and Norma StoutMatthew StringerAllegra StuartRonald and Jamie SuttonTyler SweetIsho Tama-SweetEdward and Barbara ThomasPaul Tiger and Jaime VermeerMichael and Cecilia TomcalWilliam TonerE. William TrimbleJohn and Mischelle UhlmanUnited Way <strong>of</strong> Bergen CountyWalter VierraChristopher WadeHeather and Fredrik WallbergJing WanMable Westley WardJoseph and Jane WeintropPeter and Daphne WhitneyRyan and Nicole WilsonRobert and Janet WinchesterJoseph and Sheryl WonderlickJ. Sam Wood Jr.Carol Woodard-Kozimor andJeffrey KozimorYueling XieDale YeePing Eric YeungYoung Min YuDwight and Emilie Zulauf16

In MemoriamDon GrecoAccounting Circle Losesa Loyal DuckDon Greco, 77, <strong>of</strong> Portland, passedaway last January. Born in 1932in Eugene, he graduated from theUniversity <strong>of</strong> Oregon in 1953 with hisaccounting degree. After graduation,he served fourteen months in the U.S.Army and began working in Portlandwith Peat Marwick Mitchell & Co.(now KPMG) in 1955, the start <strong>of</strong> asuccessful career as an auditor, andretired as a partner at age fifty-six in1988. He married his wife, Colleen,in 1959, and enjoyed more than fiftyyears with her, raising four daughters.Don was a longtime supporter <strong>of</strong>the UO, particularly the accountingdepartment. He helped establish theCharles E. Johnson Memorial Awardfund and was one <strong>of</strong> the foundingmembers <strong>of</strong> the Accounting Circle.Don was also a very loyal Duck. He hada portion <strong>of</strong> his living room devoted tothe Ducks, which he proudly sharedwith anyone who visited his home.He was a passionate UO football fanand held season tickets for fifty years.His last football game was the 2009Civil War, a win that resulted in theDucks going to the Rose Bowl. Athis memorial service, his ticket fromthat game was in his hands—that’show much it meant to him. He was adelightful, giving, and humble man, aswell as a true friend <strong>of</strong> the Department<strong>of</strong> Accounting and the University <strong>of</strong>Oregon. We miss him dearly.What have youbeen up to?New developments in your lifeor career? Let us know! Send ane-mail or call!Margaret Zuber SavoianAdministrative ManagerDepartment <strong>of</strong> AccountingCharles H. <strong>Lundquist</strong><strong>College</strong> <strong>of</strong> <strong>Business</strong>1208 University <strong>of</strong> OregonEugene, Oregon 97403-1208541-346-1461541-346-3341 faxmsavoian@uoregon.edulcb.uoregon.edu/departments/actgDEPARTMENT OF ACCOUNTINGCalendar <strong>of</strong> Events 2010–11September 16September 17–18September 20–23October 7February 2TBDMay 19June 9June 11Accounting Faculty RetreatAccounting Circle Fall MeetingMaster <strong>of</strong> Accounting OrientationBeta Alpha Psi Meet the FirmsBeta Alpha Psi—Oregon Society <strong>of</strong> CertifiedPublic Accountants University NightAccounting Circle Advisory Board MeetingAccounting Recognition EveningMaster <strong>of</strong> Accounting GraduationUniversity <strong>of</strong> Oregon GraduationAn equal-opportunity, affirmative-action institution committed to cultural diversity and compliance with theAmericans with Disabilities Act. This publication will be provided in accessible formats upon request.© 2010 University <strong>of</strong> Oregon DES0910-104ak-A18065. Design: Lori HowardEight Ways YouCan Support theDepartment <strong>of</strong>Accounting1 Contribute to the accountingdepartment fund.2 Hire an intern.3 Sponsor a scholarship.4 Participate in career fairs,such as Meet the Firms andMeet the Students.5 Speak to a class or to BetaAlpha Psi, the UO chapter <strong>of</strong>the honorary organization foraccounting students.6 Teach a class.7 Endow the master <strong>of</strong>accounting program suite.8 Join the Accounting Circle.17

DEPARTMENT OF ACCOUNTING1208 University <strong>of</strong> OregonEugene OR 97403-1208Nonpr<strong>of</strong>itOrganizationU.S. PostagePAIDEugene ORPermit No. 63HELP SUPPORT US!Your gift will go a long way in supporting accounting educationGive OnlineVisit isupportuoregon.org.Type “accounting” in the searchbox and select “give now” under“<strong>Lundquist</strong> <strong>College</strong> <strong>of</strong> <strong>Business</strong>Accounting Department.”InformationIf you have questions about giving, contact Michele Henney or Wendy Jett.Send a CheckMail your check payableto “University <strong>of</strong> OregonFoundation–Accounting Fund” toMargaret SavoianDepartment <strong>of</strong> Accounting1208 University <strong>of</strong> OregonEugene OR 97403Michele HenneySenior Instructor <strong>of</strong> AccountingExternal Relations ManagerDepartment <strong>of</strong> Accounting541-346-3281mhenney@uoregon.eduWendy JettDirector <strong>of</strong> Development<strong>Lundquist</strong> <strong>College</strong> <strong>of</strong> <strong>Business</strong>541-346-1612wjett@uoregon.edu30%Postconsumer waste. Elemental chlorine-free paper from well-managed forests. 100 percent Green-e ® -certified renewableenergy used to manufacture paper. Opus 30 paper from Sappi Fine Paper North America. Milled in Cloquet, Minnesota.If you choose not to keep this brochure, please recycle it.