Risk Measurement Guidelines - EVCA

Risk Measurement Guidelines - EVCA

Risk Measurement Guidelines - EVCA

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

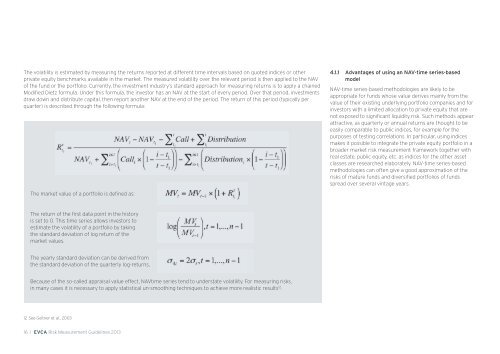

The volatility is estimated by measuring the returns reported at different time intervals based on quoted indices or otherprivate equity benchmarks available in the market. The measured volatility over the relevant period is then applied to the NAVof the fund or the portfolio. Currently, the investment industry’s standard approach for measuring returns is to apply a chainedModified Dietz formula. Under this formula, the investor has an NAV at the start of every period. Over that period, investmentsdraw down and distribute capital, then report another NAV at the end of the period. The return of this period (typically perquarter) is described through the following formula:The market value of a portfolio is defined as:4.1.1 Advantages of using an NAV-time series-basedmodelNAV-time series-based methodologies are likely to beappropriate for funds whose value derives mainly from thevalue of their existing underlying portfolio companies and forinvestors with a limited allocation to private equity that arenot exposed to significant liquidity risk. Such methods appearattractive, as quarterly or annual returns are thought to beeasily comparable to public indices, for example for thepurposes of testing correlations. In particular, using indicesmakes it possible to integrate the private equity portfolio in abroader market risk measurement framework together withreal estate, public equity, etc. as indices for the other assetclasses are researched elaborately. NAV-time series-basedmethodologies can often give a good approximation of therisks of mature funds and diversified portfolios of fundsspread over several vintage years.The return of the first data point in the historyis set to 0. This time series allows investors toestimate the volatility of a portfolio by takingthe standard deviation of log return of themarket values.The yearly standard deviation can be derived fromthe standard deviation of the quarterly log-returns,Because of the so-called appraisal value effect, NAVtime series tend to understate volatility. For measuring risks,in many cases it is necessary to apply statistical un-smoothing techniques to achieve more realistic results 12 .12 See Geltner et al., 200316 I <strong>EVCA</strong> <strong>Risk</strong> <strong>Measurement</strong> <strong>Guidelines</strong> 2013