Sudden Allure - Digital Transactions

Sudden Allure - Digital Transactions

Sudden Allure - Digital Transactions

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

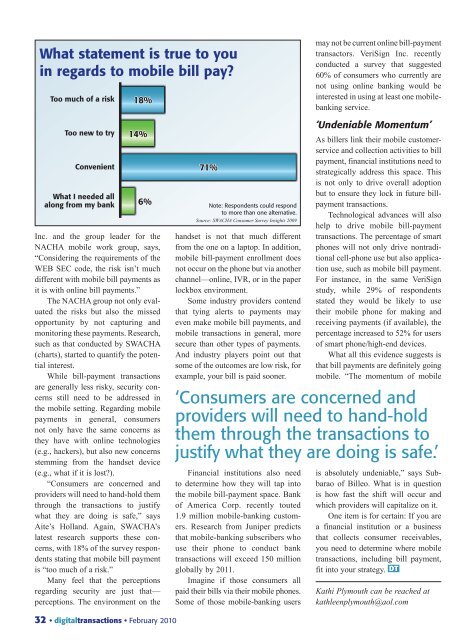

What statement is true to youin regards to mobile bill pay?Too much of a riskToo new to tryConvenientWhat I needed allalong from my bank18%14%6%Inc. and the group leader for theNACHA mobile work group, says,“Considering the requirements of theWEB SEC code, the risk isn’t muchdifferent with mobile bill payments asit is with online bill payments.”The NACHA group not only evaluatedthe risks but also the missedopportunity by not capturing andmonitoring these payments. Research,such as that conducted by SWACHA(charts), started to quantify the potentialinterest.While bill-payment transactionsare generally less risky, security concernsstill need to be addressed inthe mobile setting. Regarding mobilepayments in general, consumersnot only have the same concerns asthey have with online technologies(e.g., hackers), but also new concernsstemming from the handset device(e.g., what if it is lost?).“Consumers are concerned andproviders will need to hand-hold themthrough the transactions to justifywhat they are doing is safe,” saysAite’s Holland. Again, SWACHA’slatest research supports these concerns,with 18% of the survey respondentsstating that mobile bill paymentis “too much of a risk.”Many feel that the perceptionsregarding security are just that—perceptions. The environment on the32 digitalFebruary 201071%Note: Respondents could respondto more than one alternative.Source: SWACHA Consumer Survey Insights 2009handset is not that much differentfrom the one on a laptop. In addition,mobile bill-payment enrollment doesnot occur on the phone but via anotherchannel—online, IVR, or in the paperlockbox environment.Some industry providers contendthat tying alerts to payments mayeven make mobile bill payments, andmobile transactions in general, moresecure than other types of payments.And industry players point out thatsome of the outcomes are low risk, forexample, your bill is paid sooner.Financial institutions also needto determine how they will tap intothe mobile bill-payment space. Bankof America Corp. recently touted1.9 million mobile-banking customers.Research from Juniper predictsthat mobile-banking subscribers whouse their phone to conduct banktransactions will exceed 150 millionglobally by 2011.Imagine if those consumers allpaid their bills via their mobile phones.Some of those mobile-banking usersmay not be current online bill-paymenttransactors. VeriSign Inc. recentlyconducted a survey that suggested60% of consumers who currently arenot using online banking would beinterested in using at least one mobilebankingservice.‘Undeniable Momentum’As billers link their mobile customerserviceand collection activities to billpayment, financial institutions need tostrategically address this space. Thisis not only to drive overall adoptionbut to ensure they lock in future billpaymenttransactions.Technological advances will alsohelp to drive mobile bill-paymenttransactions. The percentage of smartphones will not only drive nontraditionalcell-phone use but also applicationuse, such as mobile bill payment.For instance, in the same VeriSignstudy, while 29% of respondentsstated they would be likely to usetheir mobile phone for making andreceiving payments (if available), thepercentage increased to 52% for usersof smart phone/high-end devices.What all this evidence suggests isthat bill payments are definitely goingmobile. “The momentum of mobile‘Consumers are concerned andproviders will need to hand-holdthem through the transactions tojustify what they are doing is safe.’is absolutely undeniable,” says Subbaraoof Billeo. What is in questionis how fast the shift will occur andwhich providers will capitalize on it.One item is for certain: If you area financial institution or a businessthat collects consumer receivables,you need to determine where mobiletransactions, including bill payment,fit into your strategy. DTKathi Plymouth can be reached atkathleenplymouth@aol.com