Full annual report - Zurich

Full annual report - Zurich

Full annual report - Zurich

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

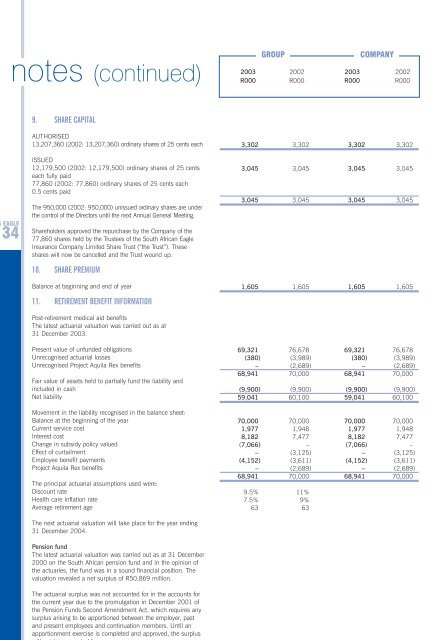

notes (continued)2003 2002 2003 2002R000 R000 R000 R000GROUPCOMPANY9. SHARE CAPITALSA EAGLE34AUTHORISED13,207,360 (2002: 13,207,360) ordinary shares of 25 cents eachISSUED12,179,500 (2002: 12,179,500) ordinary shares of 25 centseach fully paid77,860 (2002: 77,860) ordinary shares of 25 cents each0.5 cents paidThe 950,000 (2002: 950,000) unissued ordinary shares are underthe control of the Directors until the next Annual General Meeting.Shareholders approved the repurchase by the Company of the77,860 shares held by the Trustees of the South African EagleInsurance Company Limited Share Trust (“the Trust”). Theseshares will now be cancelled and the Trust wound up.10. SHARE PREMIUMBalance at beginning and end of year11. RETIREMENT BENEFIT INFORMATIONPost-retirement medical aid benefitsThe latest actuarial valuation was carried out as at31 December 2003.Present value of unfunded obligationsUnrecognised actuarial lossesUnrecognised Project Aquila Rex benefitsFair value of assets held to partially fund the liability andincluded in cashNet liabilityMovement in the liability recognised in the balance sheet:Balance at the beginning of the yearCurrent service costInterest costChange in subsidy policy valuedEffect of curtailmentEmployee benefit paymentsProject Aquila Rex benefitsThe principal actuarial assumptions used were:Discount rateHealth care inflation rateAverage retirement ageThe next actuarial valuation will take place for the year ending31 December 2004.Pension fundThe latest actuarial valuation was carried out as at 31 December2000 on the South African pension fund and in the opinion ofthe actuaries, the fund was in a sound financial position. Thevaluation revealed a net surplus of R50,869 million.The actuarial surplus was not accounted for in the accounts forthe current year due to the promulgation in December 2001 ofthe Pension Funds Second Amendment Act, which requires anysurplus arising to be apportioned between the employer, pastand present employees and continuation members. Until anapportionment exercise is completed and approved, the surpluswill not be accounted for.3,302 3,302 3,302 3,3023,045 3,045 3,045 3,0453,045 3,045 3,045 3,0451,605 1,605 1,605 1,60569,321 76,678 69,321 76,678(380) (3,989) (380) (3,989)– (2,689) – (2,689)68,941 70,000 68,941 70,000(9,900) (9,900) (9,900) (9,900)59,041 60,100 59,041 60,10070,000 70,000 70,000 70,0001,977 1,948 1,977 1,9488,182 7,477 8,182 7,477(7,066) – (7,066) –– (3,125) – (3,125)(4,152) (3,611) (4,152) (3,611)– (2,689) – (2,689)68,941 70,000 68,941 70,0009.5% 11%7.5% 9%63 63