The diamond in ancient India - Diamantschleiferei Michael Bonke

The diamond in ancient India - Diamantschleiferei Michael Bonke

The diamond in ancient India - Diamantschleiferei Michael Bonke

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

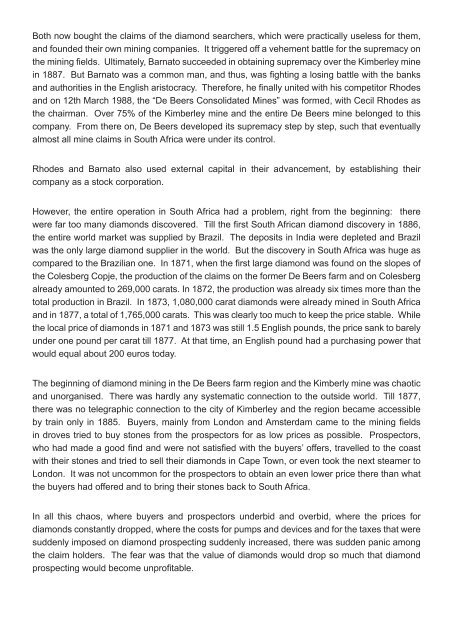

Both now bought the claims of the <strong>diamond</strong> searchers, which were practically useless for them,and founded their own m<strong>in</strong><strong>in</strong>g companies. It triggered off a vehement battle for the supremacy onthe m<strong>in</strong><strong>in</strong>g fields. Ultimately, Barnato succeeded <strong>in</strong> obta<strong>in</strong><strong>in</strong>g supremacy over the Kimberley m<strong>in</strong>e<strong>in</strong> 1887. But Barnato was a common man, and thus, was fight<strong>in</strong>g a los<strong>in</strong>g battle with the banksand authorities <strong>in</strong> the English aristocracy. <strong>The</strong>refore, he f<strong>in</strong>ally united with his competitor Rhodesand on 12th March 1988, the “De Beers Consolidated M<strong>in</strong>es” was formed, with Cecil Rhodes asthe chairman. Over 75% of the Kimberley m<strong>in</strong>e and the entire De Beers m<strong>in</strong>e belonged to thiscompany. From there on, De Beers developed its supremacy step by step, such that eventuallyalmost all m<strong>in</strong>e claims <strong>in</strong> South Africa were under its control.Rhodes and Barnato also used external capital <strong>in</strong> their advancement, by establish<strong>in</strong>g theircompany as a stock corporation.However, the entire operation <strong>in</strong> South Africa had a problem, right from the beg<strong>in</strong>n<strong>in</strong>g: therewere far too many <strong>diamond</strong>s discovered. Till the first South African <strong>diamond</strong> discovery <strong>in</strong> 1886,the entire world market was supplied by Brazil. <strong>The</strong> deposits <strong>in</strong> <strong>India</strong> were depleted and Brazilwas the only large <strong>diamond</strong> supplier <strong>in</strong> the world. But the discovery <strong>in</strong> South Africa was huge ascompared to the Brazilian one. In 1871, when the first large <strong>diamond</strong> was found on the slopes ofthe Colesberg Copje, the production of the claims on the former De Beers farm and on Colesbergalready amounted to 269,000 carats. In 1872, the production was already six times more than thetotal production <strong>in</strong> Brazil. In 1873, 1,080,000 carat <strong>diamond</strong>s were already m<strong>in</strong>ed <strong>in</strong> South Africaand <strong>in</strong> 1877, a total of 1,765,000 carats. This was clearly too much to keep the price stable. Whilethe local price of <strong>diamond</strong>s <strong>in</strong> 1871 and 1873 was still 1.5 English pounds, the price sank to barelyunder one pound per carat till 1877. At that time, an English pound had a purchas<strong>in</strong>g power thatwould equal about 200 euros today.<strong>The</strong> beg<strong>in</strong>n<strong>in</strong>g of <strong>diamond</strong> m<strong>in</strong><strong>in</strong>g <strong>in</strong> the De Beers farm region and the Kimberly m<strong>in</strong>e was chaoticand unorganised. <strong>The</strong>re was hardly any systematic connection to the outside world. Till 1877,there was no telegraphic connection to the city of Kimberley and the region became accessibleby tra<strong>in</strong> only <strong>in</strong> 1885. Buyers, ma<strong>in</strong>ly from London and Amsterdam came to the m<strong>in</strong><strong>in</strong>g fields<strong>in</strong> droves tried to buy stones from the prospectors for as low prices as possible. Prospectors,who had made a good f<strong>in</strong>d and were not satisfied with the buyers’ offers, travelled to the coastwith their stones and tried to sell their <strong>diamond</strong>s <strong>in</strong> Cape Town, or even took the next steamer toLondon. It was not uncommon for the prospectors to obta<strong>in</strong> an even lower price there than whatthe buyers had offered and to br<strong>in</strong>g their stones back to South Africa.In all this chaos, where buyers and prospectors underbid and overbid, where the prices for<strong>diamond</strong>s constantly dropped, where the costs for pumps and devices and for the taxes that weresuddenly imposed on <strong>diamond</strong> prospect<strong>in</strong>g suddenly <strong>in</strong>creased, there was sudden panic amongthe claim holders. <strong>The</strong> fear was that the value of <strong>diamond</strong>s would drop so much that <strong>diamond</strong>prospect<strong>in</strong>g would become unprofitable.