All That Glitters

All That Glitters

All That Glitters

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

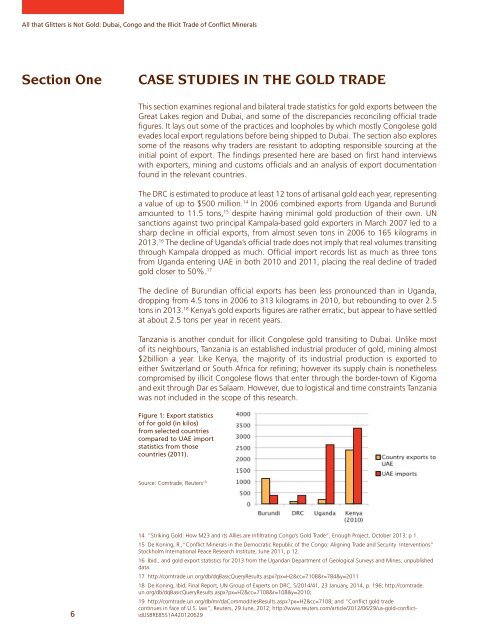

<strong>All</strong> that <strong>Glitters</strong> is Not Gold: Dubai, Congo and the Illicit Trade of Conflict MineralsSection OneCase Studies in the Gold TradeThis section examines regional and bilateral trade statistics for gold exports between theGreat Lakes region and Dubai, and some of the discrepancies reconciling official tradefigures. It lays out some of the practices and loopholes by which mostly Congolese goldevades local export regulations before being shipped to Dubai. The section also exploressome of the reasons why traders are resistant to adopting responsible sourcing at theinitial point of export. The findings presented here are based on first hand interviewswith exporters, mining and customs officials and an analysis of export documentationfound in the relevant countries.The DRC is estimated to produce at least 12 tons of artisanal gold each year, representinga value of up to $500 million. 14 In 2006 combined exports from Uganda and Burundiamounted to 11.5 tons, 15 despite having minimal gold production of their own. UNsanctions against two principal Kampala-based gold exporters in March 2007 led to asharp decline in official exports, from almost seven tons in 2006 to 165 kilograms in2013. 16 The decline of Uganda’s official trade does not imply that real volumes transitingthrough Kampala dropped as much. Official import records list as much as three tonsfrom Uganda entering UAE in both 2010 and 2011, placing the real decline of tradedgold closer to 50%. 17The decline of Burundian official exports has been less pronounced than in Uganda,dropping from 4.5 tons in 2006 to 313 kilograms in 2010, but rebounding to over 2.5tons in 2013. 18 Kenya’s gold exports figures are rather erratic, but appear to have settledat about 2.5 tons per year in recent years.Tanzania is another conduit for illicit Congolese gold transiting to Dubai. Unlike mostof its neighbours, Tanzania is an established industrial producer of gold, mining almost$2billion a year. Like Kenya, the majority of its industrial production is exported toeither Switzerland or South Africa for refining; however its supply chain is nonethelesscompromised by illicit Congolese flows that enter through the border-town of Kigomaand exit through Dar es Salaam. However, due to logistical and time constraints Tanzaniawas not included in the scope of this research.Figure 1: Export statisticsof for gold (in kilos)from selected countriescompared to UAE importstatistics from thosecountries (2011).Source: Comtrade, Reuters 19614 “Striking Gold: How M23 and its <strong>All</strong>ies are Infiltrating Congo’s Gold Trade”, Enough Project, October 2013; p 1.15 De Koning, R.,“Conflict Minerals in the Democratic Republic of the Congo: Aligning Trade and Security Interventions”Stockholm International Peace Research Institute, June 2011, p 12.16 Ibid., and gold export statistics for 2013 from the Ugandan Department of Geological Surveys and Mines, unpublisheddata.17 http://comtrade.un.org/db/dqBasicQueryResults.aspx?px=H2&cc=7108&r=784&y=201118 De Koning, Ibid; Final Report, UN Group of Experts on DRC, S/2014/41, 23 January, 2014, p. 196; http://comtrade.un.org/db/dqBasicQueryResults.aspx?px=H2&cc=7108&r=108&y=2010;19 http://comtrade.un.org/db/mr/daCommoditiesResults.aspx?px=H2&cc=7108; and “Conflict gold tradecontinues in face of U.S. law”, Reuters, 29 June, 2012; http://www.reuters.com/article/2012/06/29/us-gold-conflictidUSBRE85S1A420120629