Personal Risk Profile Questionnaire

Personal Risk Profile Questionnaire

Personal Risk Profile Questionnaire

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

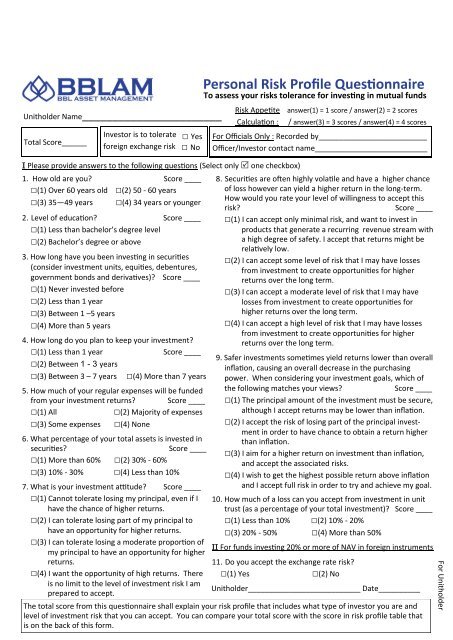

For UnitholderUnitholder Name_______________________Total Score______Investor is to tolerateforeign exchange risk□ Yes□ NoI Please provide answers to the following questions (Select only one checkbox)1. How old are you? Score ____□(1) Over 60 years old □(2) 50 - 60 years□(3) 35—49 years□(4) 34 years or younger2. Level of education? Score ____□(1) Less than bachelor’s degree level□(2) Bachelor’s degree or above3. How long have you been investing in securities(consider investment units, equities, debentures,government bonds and derivatives)? Score ____□(1) Never invested before□(2) Less than 1 year□(3) Between 1 –5 years□(4) More than 5 years4. How long do you plan to keep your investment?□(1) Less than 1 yearScore ____□(2) Between 1 - 3 years□(3) Between 3 – 7 years□(4) More than 7 years5. How much of your regular expenses will be fundedfrom your investment returns? Score ____□(1) All□(2) Majority of expenses□(3) Some expenses□(4) None6. What percentage of your total assets is invested insecurities?Score ____□(1) More than 60% □(2) 30% - 60%□(3) 10% - 30% □(4) Less than 10%7. What is your investment attitude? Score ____□(1) Cannot tolerate losing my principal, even if Ihave the chance of higher returns.□(2) I can tolerate losing part of my principal tohave an opportunity for higher returns.□(3) I can tolerate losing a moderate proportion ofmy principal to have an opportunity for higherreturns.□(4) I want the opportunity of high returns. Thereis no limit to the level of investment risk I amprepared to accept.<strong>Personal</strong> <strong>Risk</strong> <strong>Profile</strong> <strong>Questionnaire</strong>To assess your risks tolerance for investing in mutual funds<strong>Risk</strong> Appetite answer(1) = 1 score / answer(2) = 2 scoresCalculation : / answer(3) = 3 scores / answer(4) = 4 scoresFor Officials Only : Recorded by__________________________Officer/Investor contact name___________________________8. Securities are often highly volatile and have a higher chanceof loss however can yield a higher return in the long-term.How would you rate your level of willingness to accept thisrisk?Score ____□(1) I can accept only minimal risk, and want to invest inproducts that generate a recurring revenue stream witha high degree of safety. I accept that returns might berelatively low.□(2) I can accept some level of risk that I may have lossesfrom investment to create opportunities for higherreturns over the long term.□(3) I can accept a moderate level of risk that I may havelosses from investment to create opportunities forhigher returns over the long term.□(4) I can accept a high level of risk that I may have lossesfrom investment to create opportunities for higherreturns over the long term.9. Safer investments sometimes yield returns lower than overallinflation, causing an overall decrease in the purchasingpower. When considering your investment goals, which ofthe following matches your views?Score ____□(1) The principal amount of the investment must be secure,although I accept returns may be lower than inflation.□(2) I accept the risk of losing part of the principal investmentin order to have chance to obtain a return higherthan inflation.□(3) I aim for a higher return on investment than inflation,and accept the associated risks.□(4) I wish to get the highest possible return above inflationand I accept full risk in order to try and achieve my goal.10. How much of a loss can you accept from investment in unittrust (as a percentage of your total investment)? Score ____□(1) Less than 10% □(2) 10% - 20%□(3) 20% - 50% □(4) More than 50%II For funds investing 20% or more of NAV in foreign instruments11. Do you accept the exchange rate risk?□(1) Yes□(2) NoUnitholder___________________________ Date__________The total score from this questionnaire shall explain your risk profile that includes what type of investor you are andlevel of investment risk that you can accept. You can compare your total score with the score in risk profile table thatis on the back of this form.