Aberdeen Income and Growth VCT PLC - Aberdeen Asset ...

Aberdeen Income and Growth VCT PLC - Aberdeen Asset ...

Aberdeen Income and Growth VCT PLC - Aberdeen Asset ...

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

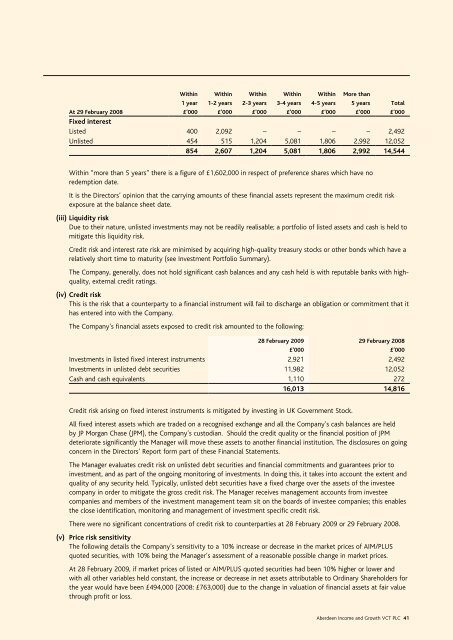

Within Within Within Within Within More than1 year 1-2 years 2-3 years 3-4 years 4-5 years 5 years TotalAt 29 February 2008 £’000 £’000 £’000 £’000 £’000 £’000 £’000Fixed interestListed 400 2,092 – – – – 2,492Unlisted 454 515 1,204 5,081 1,806 2,992 12,052854 2,607 1,204 5,081 1,806 2,992 14,544Within “more than 5 years” there is a figure of £1,602,000 in respect of preference shares which have noredemption date.It is the Directors’ opinion that the carrying amounts of these financial assets represent the maximum credit riskexposure at the balance sheet date.(iii) Liquidity riskDue to their nature, unlisted investments may not be readily realisable; a portfolio of listed assets <strong>and</strong> cash is held tomitigate this liquidity risk.Credit risk <strong>and</strong> interest rate risk are minimised by acquiring high-quality treasury stocks or other bonds which have arelatively short time to maturity (see Investment Portfolio Summary).The Company, generally, does not hold significant cash balances <strong>and</strong> any cash held is with reputable banks with highquality,external credit ratings.(iv) Credit riskThis is the risk that a counterparty to a financial instrument will fail to discharge an obligation or commitment that ithas entered into with the Company.The Company’s financial assets exposed to credit risk amounted to the following:28 February 2009 29 February 2008£’000 £’000Investments in listed fixed interest instruments 2,921 2,492Investments in unlisted debt securities 11,982 12,052Cash <strong>and</strong> cash equivalents 1,110 27216,013 14,816Credit risk arising on fixed interest instruments is mitigated by investing in UK Government Stock.All fixed interest assets which are traded on a recognised exchange <strong>and</strong> all the Company’s cash balances are heldby JP Morgan Chase (JPM), the Company’s custodian. Should the credit quality or the financial position of JPMdeteriorate significantly the Manager will move these assets to another financial institution. The disclosures on goingconcern in the Directors’ Report form part of these Financial Statements.The Manager evaluates credit risk on unlisted debt securities <strong>and</strong> financial commitments <strong>and</strong> guarantees prior toinvestment, <strong>and</strong> as part of the ongoing monitoring of investments. In doing this, it takes into account the extent <strong>and</strong>quality of any security held. Typically, unlisted debt securities have a fixed charge over the assets of the investeecompany in order to mitigate the gross credit risk. The Manager receives management accounts from investeecompanies <strong>and</strong> members of the investment management team sit on the boards of investee companies; this enablesthe close identification, monitoring <strong>and</strong> management of investment specific credit risk.There were no significant concentrations of credit risk to counterparties at 28 February 2009 or 29 February 2008.(v) Price risk sensitivityThe following details the Company’s sensitivity to a 10% increase or decrease in the market prices of AIM/PLUSquoted securities, with 10% being the Manager’s assessment of a reasonable possible change in market prices.At 28 February 2009, if market prices of listed or AIM/PLUS quoted securities had been 10% higher or lower <strong>and</strong>with all other variables held constant, the increase or decrease in net assets attributable to Ordinary Shareholders forthe year would have been £494,000 (2008: £763,000) due to the change in valuation of financial assets at fair valuethrough profit or loss.<strong>Aberdeen</strong> <strong>Income</strong> <strong>and</strong> <strong>Growth</strong> <strong>VCT</strong> <strong>PLC</strong> 41