Interim - Chime Communications PLC

Interim - Chime Communications PLC

Interim - Chime Communications PLC

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

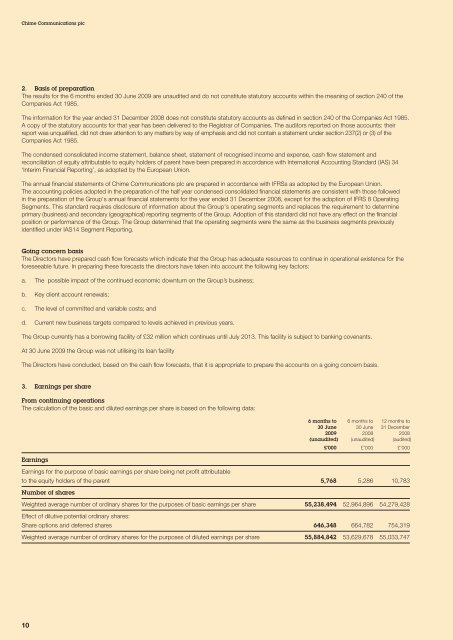

<strong>Chime</strong> <strong>Communications</strong> plc2. Basis of preparationThe results for the 6 months ended 30 June 2009 are unaudited and do not constitute statutory accounts within the meaning of section 240 of theCompanies Act 1985.The information for the year ended 31 December 2008 does not constitute statutory accounts as defined in section 240 of the Companies Act 1985.A copy of the statutory accounts for that year has been delivered to the Registrar of Companies. The auditors reported on those accounts: theirreport was unqualified, did not draw attention to any matters by way of emphasis and did not contain a statement under section 237(2) or (3) of theCompanies Act 1985.The condensed consolidated income statement, balance sheet, statement of recognised income and expense, cash flow statement andreconciliation of equity attributable to equity holders of parent have been prepared in accordance with International Accounting Standard (IAS) 34‘<strong>Interim</strong> Financial Reporting’, as adopted by the European Union.The annual financial statements of <strong>Chime</strong> <strong>Communications</strong> plc are prepared in accordance with IFRSs as adopted by the European Union.The accounting policies adopted in the preparation of the half year condensed consolidated financial statements are consistent with those followedin the preparation of the Group's annual financial statements for the year ended 31 December 2008, except for the adoption of IFRS 8 OperatingSegments. This standard requires disclosure of information about the Group's operating segments and replaces the requirement to determineprimary (business) and secondary (geographical) reporting segments of the Group. Adoption of this standard did not have any effect on the financialposition or performance of the Group. The Group determined that the operating segments were the same as the business segments previouslyidentified under IAS14 Segment Reporting.Going concern basisThe Directors have prepared cash flow forecasts which indicate that the Group has adequate resources to continue in operational existence for theforeseeable future. In preparing these forecasts the directors have taken into account the following key factors:a. The possible impact of the continued economic downturn on the Group’s business;b. Key client account renewals;c. The level of committed and variable costs; andd. Current new business targets compared to levels achieved in previous years.The Group currently has a borrowing facility of £32 million which continues until July 2013. This facility is subject to banking covenants.At 30 June 2009 the Group was not utilising its loan facilityThe Directors have concluded, based on the cash flow forecasts, that it is appropriate to prepare the accounts on a going concern basis.3. Earnings per shareFrom continuing operationsThe calculation of the basic and diluted earnings per share is based on the following data:6 months to 6 months to 12 months to30 June 30 June 31 December2009 2008 2008(unaudited) (unaudited) (audited)£’000 £’000 £’000EarningsEarnings for the purpose of basic earnings per share being net profit attributableto the equity holders of the parent 5,768 5,286 10,783Number of sharesWeighted average number of ordinary shares for the purposes of basic earnings per share 55,238,494 52,964,896 54,279,428Effect of dilutive potential ordinary shares:Share options and deferred shares 646,348 664,782 754,319Weighted average number of ordinary shares for the purposes of diluted earnings per share 55,884,842 53,629,678 55,033,74710