FINANCIAL STATEMENTS - Mewah Group

FINANCIAL STATEMENTS - Mewah Group

FINANCIAL STATEMENTS - Mewah Group

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

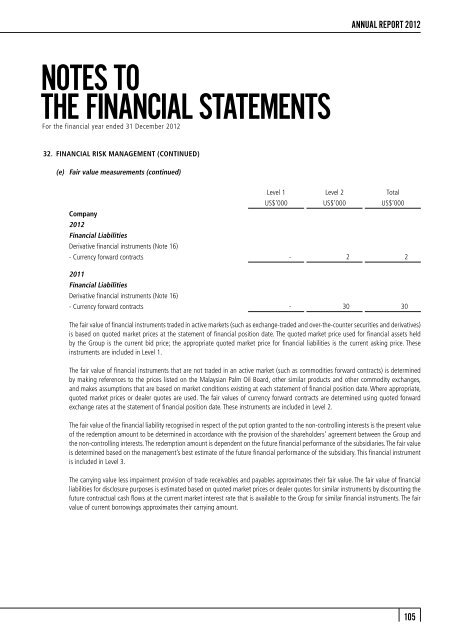

ANNUAL REPORT 2012NOTES TOTHE <strong>FINANCIAL</strong> <strong>STATEMENTS</strong>For the financial year ended 31 December 201232. <strong>FINANCIAL</strong> RISK MANAGEMENT (CONTINUED)(e) Fair value measurements (continued)Company2012Financial LiabilitiesDerivative financial instruments (Note 16)Level 1 Level 2 TotalUS$’000 US$’000 US$’000- Currency forward contracts - 2 22011Financial LiabilitiesDerivative financial instruments (Note 16)- Currency forward contracts - 30 30The fair value of financial instruments traded in active markets (such as exchange-traded and over-the-counter securities and derivatives)is based on quoted market prices at the statement of financial position date. The quoted market price used for financial assets heldby the <strong>Group</strong> is the current bid price; the appropriate quoted market price for financial liabilities is the current asking price. Theseinstruments are included in Level 1.The fair value of financial instruments that are not traded in an active market (such as commodities forward contracts) is determinedby making references to the prices listed on the Malaysian Palm Oil Board, other similar products and other commodity exchanges,and makes assumptions that are based on market conditions existing at each statement of financial position date. Where appropriate,quoted market prices or dealer quotes are used. The fair values of currency forward contracts are determined using quoted forwardexchange rates at the statement of financial position date. These instruments are included in Level 2.The fair value of the financial liability recognised in respect of the put option granted to the non-controlling interests is the present valueof the redemption amount to be determined in accordance with the provision of the shareholders’ agreement between the <strong>Group</strong> andthe non-controlling interests. The redemption amount is dependent on the future financial performance of the subsidiaries. The fair valueis determined based on the management’s best estimate of the future financial performance of the subsidiary. This financial instrumentis included in Level 3.The carrying value less impairment provision of trade receivables and payables approximates their fair value. The fair value of financialliabilities for disclosure purposes is estimated based on quoted market prices or dealer quotes for similar instruments by discounting thefuture contractual cash flows at the current market interest rate that is available to the <strong>Group</strong> for similar financial instruments. The fairvalue of current borrowings approximates their carrying amount.105