Brazil-China Soybean Trade - The Nature Conservancy

Brazil-China Soybean Trade - The Nature Conservancy

Brazil-China Soybean Trade - The Nature Conservancy

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

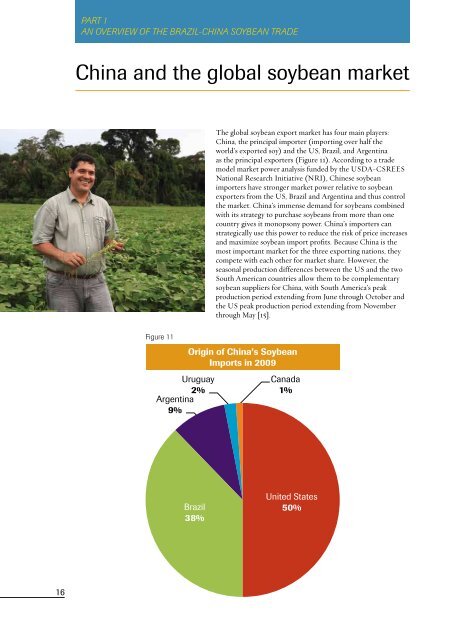

PART 1AN OVERVIEW OF THE BRAZIL-CHINA SOYBEAN TRADEPART 1AN OVERVIEW OF THE BRAZIL-CHINA SOYBEAN TRADE<strong>China</strong> and the global soybean marketFigure 11Uruguay2%Argentina9%<strong>The</strong> global soybean export market has four main players:<strong>China</strong>, the principal importer (importing over half theworld’s exported soy) and the US, <strong>Brazil</strong>, and Argentinaas the principal exporters (Figure 11). According to a trademodel market power analysis funded by the USDA-CSREESNational Research Initiative (NRI), Chinese soybeanimporters have stronger market power relative to soybeanexporters from the US, <strong>Brazil</strong> and Argentina and thus controlthe market. <strong>China</strong>’s immense demand for soybeans combinedwith its strategy to purchase soybeans from more than onecountry gives it monopsony power. <strong>China</strong>’s importers canstrategically use this power to reduce the risk of price increasesand maximize soybean import profits. Because <strong>China</strong> is themost important market for the three exporting nations, theycompete with each other for market share. However, theseasonal production differences between the US and the twoSouth American countries allow them to be complementarysoybean suppliers for <strong>China</strong>, with South America’s peakproduction period extending from June through October andthe US peak production period extending from Novemberthrough May [15].Origin of <strong>China</strong>’s <strong>Soybean</strong>Imports in 2009<strong>Brazil</strong>38%Canada1%United States50%BAIXA RESOLUÇÃOTAMANHO FINAL:9,5cm x 14cm(300dpi)In this market <strong>Brazil</strong> has competitive advantages anddisadvantages. One of the disadvantages is that the US hasa far superior system for transporting soybeans to globalmarkets, particularly in comparison to the Center-West of<strong>Brazil</strong>, including Mato Grosso, where the greatest percentageof the country’s soybeans are currently produced (see table 2).Most of the soybeans produced in the interior of <strong>Brazil</strong> aretransported south by truck along more than a thousand milesof under-maintained highways. Once the soybeans arrive atthe ports, offloaded from trucks in queues that can stretchto thirty kilometers, congestion is such that ships can wait atanchor for up to a month before a dock is available to loadthe soybeans. Under these conditions, transporting soybeansfrom Mato Grosso to <strong>Brazil</strong>ian ports costs more than fourtimes what American soybean farmers spend to transporttheir soybeans from the mid-western states to ports in NewOrleans and the Pacific Northwest. Cheaper labor and otherinputs in <strong>Brazil</strong> do not offset the higher transportation costs,and <strong>Brazil</strong>ian producers see lower soybean profits comparedto their American counterparts. [10] Another competitivedisadvantage <strong>Brazil</strong> faces is that the country’s environmentalrestrictions on soybean growers are greater in <strong>Brazil</strong> thanin Argentina and the US. For example, <strong>Brazil</strong>’s Forest coderequires that landowners preserve natural vegetation between30-50 meters of riparian zone, depending on the regionin <strong>Brazil</strong>, while the US and Argentina do not have theserequirements [7].However, <strong>Brazil</strong> holds a major strategic advantage in its vastcapacity to expand area planted to soybeans. US croplanddevoted to soybeans has declined as land use has shifted tocorn for ethanol production, with very limited new arableland available for expansion. Another advantage that <strong>Brazil</strong>holds over the US is the composition of its soybeans. <strong>Brazil</strong>iansoybeans yield about 4.5% more oil and contain 4.5% moreprotein than US soybeans. <strong>Brazil</strong>ian meal is guaranteed tocontain 47-48% protein, while US meal is sold as 44%. Whilegenetically modified soybean strains have been introduced to<strong>Brazil</strong>, the predominance of non-genetically modified soybeanshas made <strong>Brazil</strong>ian exports more attractive to European andAsian consumers. [16]Despite the competitive challenges <strong>Brazil</strong> faces in the Chinesemarket, all projections indicate that the bilateral trade ofsoybeans will continue to grow in coming years. With <strong>Brazil</strong>’svast supply of arable land and <strong>China</strong>’s ever-growing soydemands, the two countries are likely to make history with thevolume and value of trade in this commodity. Part 2 of thisreport projects out what this trade will look like to 2020 undervarious scenarios.16 17