Life Insurance Securitization - The Actuaries' Club of the Southwest

Life Insurance Securitization - The Actuaries' Club of the Southwest

Life Insurance Securitization - The Actuaries' Club of the Southwest

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

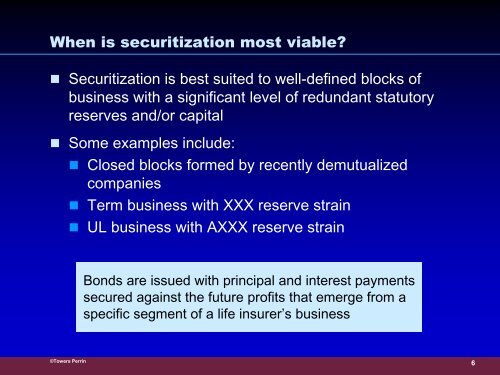

When is securitization most viable?• <strong>Securitization</strong> is best suited to well-defined blocks <strong>of</strong>business with a significant level <strong>of</strong> redundant statutoryreserves and/or capital• Some examples include:• Closed blocks formed by recently demutualizedcompanies• Term business with XXX reserve strain• UL business with AXXX reserve strainBonds are issued with principal and interest paymentssecured against <strong>the</strong> future pr<strong>of</strong>its that emerge from aspecific segment <strong>of</strong> a life insurer’s business©Towers Perrin6