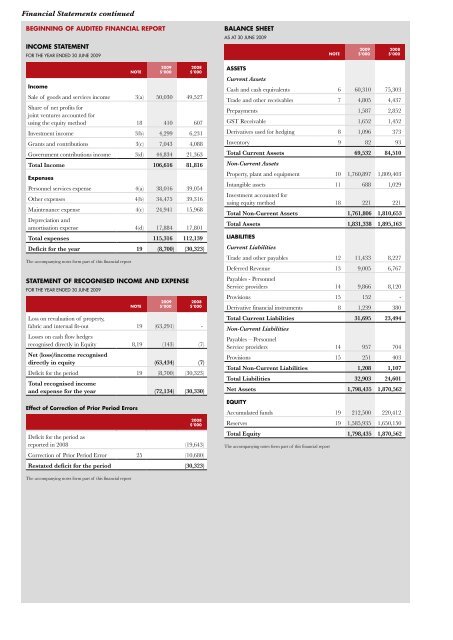

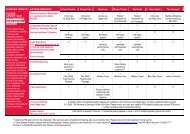

Financial Statements continuedBEGINNING OF AUDITED FINANCIAL REPORTBALANCE SHEETAS AT 30 JUNE 20<strong>09</strong>INCOME STATEMENTFOR THE YEAR ENDED 30 JUNE 20<strong>09</strong>NOTE20<strong>09</strong>$’000<strong>2008</strong>$’000IncomeSale of goods and services income 3(a) 50,030 49,527Share of net profits forjoint ventures accounted forusing the equity method 18 410 607Investment income 3(b) 4,299 6,231Grants and contributions 3(c) 7,043 4,088Government contributions income 3(d) 44,834 21,363Total Income 106,616 81,816ExpensesPersonnel services expense 4(a) 38,016 39,054Other expenses 4(b) 34,475 39,316Maintenance expense 4(c) 24,941 15,968Depreciation andamortisation expense 4(d) 17,884 17,801Total expenses 115,316 112,139Deficit for the year 19 (8,700) (30,323)The accompanying notes form part of this financial reportNOTE20<strong>09</strong>$’000STATEMENT OF RECOGNISED INCOME AND EXPENSEFOR THE YEAR ENDED 30 JUNE 20<strong>09</strong>NOTE<strong>2008</strong>$’000Loss on revaluation of property,fabric and internal fit-out 19 (63,291) -Losses on cash flow hedges recognised directly in Equity 8,19 (143) (7)Net (loss)/income recogniseddirectly in equity (63,434) (7)Deficit for the period 19 (8,700) (30,323)Total recognised incomeand expense for the year (72,134) (30,330)Effect of Correction of Prior Period Errors20<strong>09</strong>$’000<strong>2008</strong>$’000<strong>2008</strong>$’000Deficit for the period asreported in <strong>2008</strong> (19,643)Correction of Prior Period Error 25 (10,680)Restated deficit for the period (30,323)ASSETSCurrent AssetsCash and cash equivalents 6 60,310 75,303Trade and other receivables 7 4,805 4,437Prepayments 1,587 2,852GST Receivable 1,652 1,452Derivatives used for hedging 8 1,<strong>09</strong>6 373Inventory 9 82 93Total Current Assets 69,532 84,510Non-Current AssetsProperty, plant and equipment 10 1,760,897 1,8<strong>09</strong>,403Intangible assets 11 688 1,029Investment accounted forusing equity method 18 221 221Total Non-Current Assets 1,761,806 1,810,653Total Assets 1,831,338 1,895,163LIABILITIESCurrent LiabilitiesTrade and other payables 12 11,433 8,227Deferred Revenue 13 9,005 6,767Payables - PersonnelService providers 14 9,866 8,120Provisions 15 152 -Derivative financial instruments 8 1,239 380Total Current Liabilities 31,695 23,494Non-Current LiabilitiesPayables – PersonnelService providers 14 957 704Provisions 15 251 403Total Non-Current Liabilities 1,208 1,107Total Liabilities 32,903 24,601Net Assets 1,798,435 1,870,562EQUITYAccumulated funds 19 212,500 220,412Reserves 19 1,585,935 1,650,150Total Equity 1,798,435 1,870,562The accompanying notes form part of this financial reportThe accompanying notes form part of this financial report

CASH FLOW STATEMENTFOR THE YEAR ENDED 30 JUNE 20<strong>09</strong>NOTE20<strong>09</strong>$’000<strong>2008</strong>$’000Cash flows fromoperating activitiesReceiptsReceipts from operations 59,003 67,374Interest received 3,879 6,235Cash flows from Government 44,834 21,363Total Receipts 107,716 94,972PaymentsPayments to suppliers andpersonnel service providers (90,498) (97,494)Total payments (90,498) (97,494)Net Cash inflows/(outflows)from operating activities 24 17,218 (2,522)Cash flows frominvesting activitiesPayments for property, plantand equipment (32,211) (27,120)Net Cash outflows frominvesting activities (32,211) (27,120)Net decrease in cashand cash equivalents (14,993) (29,642)Cash and cash equivalents at thebeginning of the financial year 75,303 104,945Cash and cash equivalents atthe end of the financial year 6 60,310 75,303The accompanying notes form part of this financial reportSYDNEY OPERA HOUSE TRUST NOTES TOAND FORMING PART OF THE FINANCIAL REPORTFOR THE YEAR ENDED 30 JUNE 20<strong>09</strong>1.Summary of SignificantAccounting Policies(a) <strong>Report</strong>ing EntityThe <strong>Sydney</strong> <strong>Opera</strong> <strong>House</strong> Trust is constituted as a body corporate by the<strong>Sydney</strong> <strong>Opera</strong> <strong>House</strong> Trust Act, 1961. It is designated as a transitionalentity by the NSW Treasury and required to use the not for profitaccounting standards.This financial report for the year ended 30 June 20<strong>09</strong> has been authorisedfor issue by the <strong>Sydney</strong> <strong>Opera</strong> <strong>House</strong> Trust on 22 September 20<strong>09</strong>.(b) Basis of PreparationThe financial report is a general purpose financial report which hasbeen prepared on an accruals basis and in accordance with applicableAustralian Accounting Standards (which include Australian AccountingInterpretations), the requirements of the Public Finance and Audit Act,1983, and the Public Finance and Audit (General) Regulation, 2005, andTreasurer’s Directions.Property, plant and equipment, collection assets and financial assets at ‘fairvalue through profit or loss’ are measured at fair value. Other financialreport items are prepared on an accrual basis and based on historical costs.The methods used for measuring fair value are discussed further below.The Trust has kept proper accounts and records in relation to all of itsoperations in accordance with Section 41(1) of the Public Finance andAudit Act.Judgements, key assumptions and estimations management has made aredisclosed in the relevant notes to the financial statements.Figures shown in the financial report have been rounded to the nearest$1,000 and expressed in Australian currency.(c) Statement of ComplianceThe financial statements and notes comply with Australian AccountingStandards which include Australian Accounting Interpretations.(d) InsuranceThe Trust’s insurance activities are conducted through the NSW TreasuryManaged Fund Scheme of self insurance for Government agencies. Theexpense (premium) is determined by the Fund Manager based on pastclaim experience.(e) Accounting for Goods & Services Tax (GST)Revenues, expenses and assets are recognised net of the amount of GST,except:• the amount of GST incurred by the Trust as a purchaser that is notrecoverable from the Australian Taxation Office is recognised as partof the cost of acquisition of an asset or as part of an item of expense;and• receivables and payables are stated with the amount of GST included.Cash flows are included in the cash flow statement on a gross basis.However, the GST components of cash flows arising from investing andfinancing activities which is recoverable from, or payable to, the AustralianTaxation Office are classified as operating cash flows.(f) Income RecognitionIncome is measured at the fair value of the consideration or contributionreceived or receivable. Additional comments regarding the accountingpolicies for the recognition of income are discussed below.(i) Government ContributionsGovernment contributions (including grants and donations) are recognisedas revenue when the Trust obtains control over the assets. Control overGovernment contributions is obtained upon the receipt of cash.(ii) Sale of GoodsRevenue from the sale of goods is recognised as income when the Trusttransfers the significant risks and rewards of ownership of the assets.SYDNEY OPERA HOUSE41 ANNUAL REPORT <strong>2008</strong>/<strong>09</strong>