Product Brochures - Federal Home Loan Bank of Des Moines

Product Brochures - Federal Home Loan Bank of Des Moines

Product Brochures - Federal Home Loan Bank of Des Moines

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

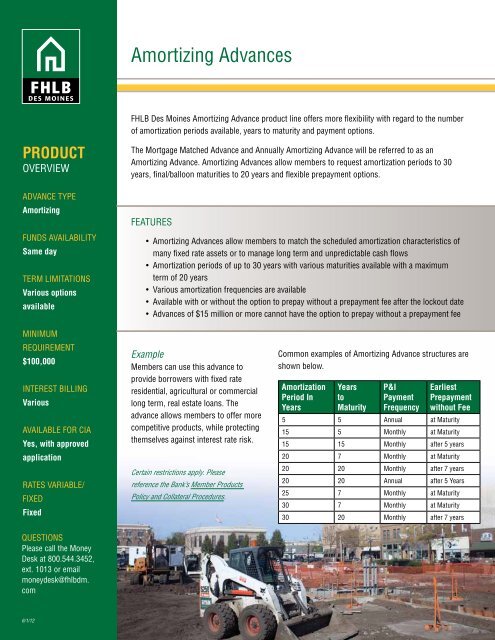

Amortizing AdvancesFHLB <strong>Des</strong> <strong>Moines</strong> Amortizing Advance product line <strong>of</strong>fers more flexibility with regard to the number<strong>of</strong> amortization periods available, years to maturity and payment options.PRODUCTOverviewAdvance TypeAmortizingFunds AvailabilitySame dayTerm LimitationsVarious optionsavailableThe Mortgage Matched Advance and Annually Amortizing Advance will be referred to as anAmortizing Advance. Amortizing Advances allow members to request amortization periods to 30years, final/balloon maturities to 20 years and flexible prepayment options.FEATURES• Amortizing Advances allow members to match the scheduled amortization characteristics <strong>of</strong>many fixed rate assets or to manage long term and unpredictable cash flows• Amortization periods <strong>of</strong> up to 30 years with various maturities available with a maximumterm <strong>of</strong> 20 years• Various amortization frequencies are available• Available with or without the option to prepay without a prepayment fee after the lockout date• Advances <strong>of</strong> $15 million or more cannot have the option to prepay without a prepayment feeMinimumRequirement$100,000Interest BillingVariousAvailable for CIAYes, with approvedapplicationRates Variable/FixedFixedQuestionsPlease call the Money<strong>Des</strong>k at 800.544.3452,ext. 1013 or emailmoneydesk@fhlbdm.comExampleMembers can use this advance toprovide borrowers with fixed rateresidential, agricultural or commerciallong term, real estate loans. Theadvance allows members to <strong>of</strong>fer morecompetitive products, while protectingthemselves against interest rate risk.Certain restrictions apply. Pleasereference the <strong>Bank</strong>’s Member <strong>Product</strong>sPolicy and Collateral Procedures.Common examples <strong>of</strong> Amortizing Advance structures areshown below.AmortizationPeriod InYearsYearstoMaturityP&IPaymentFrequencyEarliestPrepaymentwithout Fee5 5 Annual at Maturity15 5 Monthly at Maturity15 15 Monthly after 5 years20 7 Monthly at Maturity20 20 Monthly after 7 years20 20 Annual after 5 Years25 7 Monthly at Maturity30 7 Monthly at Maturity30 20 Monthly after 7 years6/1/12