Global Syndicated Loan - Bloomberg

Global Syndicated Loan - Bloomberg

Global Syndicated Loan - Bloomberg

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

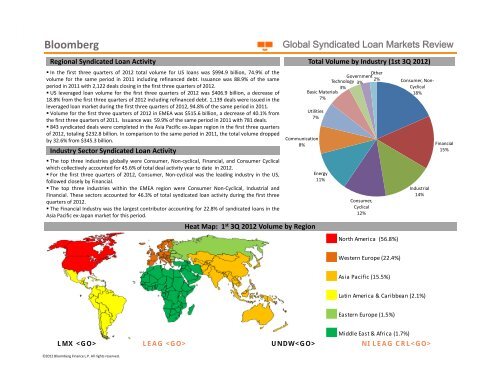

<strong>Bloomberg</strong><strong>Global</strong> <strong>Syndicated</strong> <strong>Loan</strong> Markets ReviewRegional <strong>Syndicated</strong> <strong>Loan</strong> Activity• In the first three quarters of 2012 total volume for US loans was $994.9 billion, 74.9% of thevolume for the same period in 2011 including refinanced debt. Issuance was 88.9% of the sameperiod in 2011 with 2,122 deals closing in the first three quarters of 2012.• US leveraged loan volume for the first three quarters of 2012 was $406.9 billion, a decrease of18.8% from the first three quarters of 2012 including refinanced debt. 1,139 deals were issued in theleveraged loan market during the first three quarters of 2012, 94.8% of the same period in 2011.• Volume for the first three quarters of 2012 in EMEA was $515.6 billion, a decrease of 40.1% fromthe first three quarters of 2011. Issuance was 59.9% of the same period in 2011 with 781 deals.• 843 syndicated deals were completed in the Asia Pacific ex‐Japan region in the first three quartersof 2012, totaling $232.8 billion. In comparison to the same period in 2011, the total volume droppedby 32.6% from $345.3 billion.Industry Sector <strong>Syndicated</strong> <strong>Loan</strong> Activity• The top three industries globally were Consumer, Non‐cyclical, Financial, and Consumer Cyclicalwhich collectively accounted for 45.6% of total deal activity year to date in 2012.• For the first three quarters of 2012, Consumer, Non‐cyclical was the leading industry in the US,followed closely by Financial.• The top three industries within the EMEA region were Consumer Non‐Cyclical, Industrial andFinancial. These sectors accounted for 46.3% of total syndicated loan activity during the first threequarters of 2012.• The Financial Industry was the largest contributor accounting for 22.8% of syndicated loans in theAsia Pacific ex‐Japan market for this period.Utilities7%Communication8%Heat Map: 1 st 3Q 2012 Volume by RegionTotal Volume by Industry (1st 3Q 2012)OtherGovernmentTechnology2%3%3%Basic Materials7%Energy11%Consumer,Cyclical12%North America (56.8%)Consumer, Non‐Cyclical18%Industrial14%Financial15%Western Europe (22.4%)Asia Pacific (15.5%)Latin America & Caribbean (2.1%)Eastern Europe (1.5%)LMX LEAG UNDW NI LEAG CRL©2012 <strong>Bloomberg</strong> Finance L.P. All rights reserved.Middle East & Africa (1.7%)