Vanguard International Explorer Fund Annual Report October 31 ...

Vanguard International Explorer Fund Annual Report October 31 ...

Vanguard International Explorer Fund Annual Report October 31 ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

22<br />

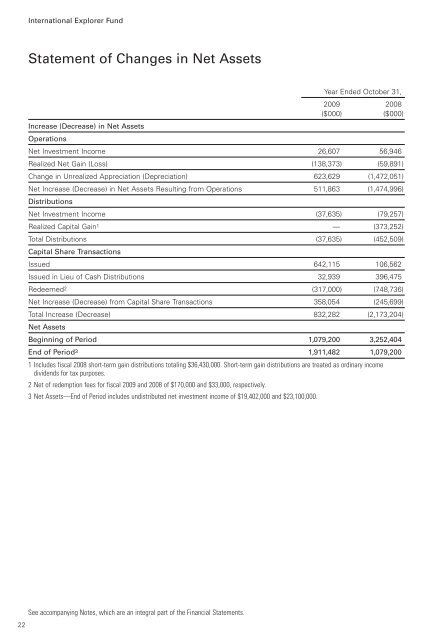

<strong>International</strong> <strong>Explorer</strong> <strong>Fund</strong><br />

Statement of Changes in Net Assets<br />

Increase (Decrease) in Net Assets<br />

Operations<br />

Year Ended <strong>October</strong> <strong>31</strong>,<br />

2009 2008<br />

($000) ($000)<br />

Net Investment Income 26,607 56,946<br />

Realized Net Gain (Loss) (138,373) (59,891)<br />

Change in Unrealized Appreciation (Depreciation) 623,629 (1,472,051)<br />

Net Increase (Decrease) in Net Assets Resulting from Operations 511,863 (1,474,996)<br />

Distributions<br />

Net Investment Income (37,635) (79,257)<br />

Realized Capital Gain 1 — (373,252)<br />

Total Distributions (37,635) (452,509)<br />

Capital Share Transactions<br />

Issued 642,115 106,562<br />

Issued in Lieu of Cash Distributions 32,939 396,475<br />

Redeemed 2 (<strong>31</strong>7,000) (748,736)<br />

Net Increase (Decrease) from Capital Share Transactions 358,054 (245,699)<br />

Total Increase (Decrease) 832,282 (2,173,204)<br />

Net Assets<br />

Beginning of Period 1,079,200 3,252,404<br />

End of Period3 1,911,482 1,079,200<br />

1 Includes fiscal 2008 short-term gain distributions totaling $36,430,000. Short-term gain distributions are treated as ordinary income<br />

dividends for tax purposes.<br />

2 Net of redemption fees for fiscal 2009 and 2008 of $170,000 and $33,000, respectively.<br />

3 Net Assets—End of Period includes undistributed net investment income of $19,402,000 and $23,100,000.<br />

See accompanying Notes, which are an integral part of the Financial Statements.