Annual Report 2007-08 - Kingfisher Airlines

Annual Report 2007-08 - Kingfisher Airlines

Annual Report 2007-08 - Kingfisher Airlines

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

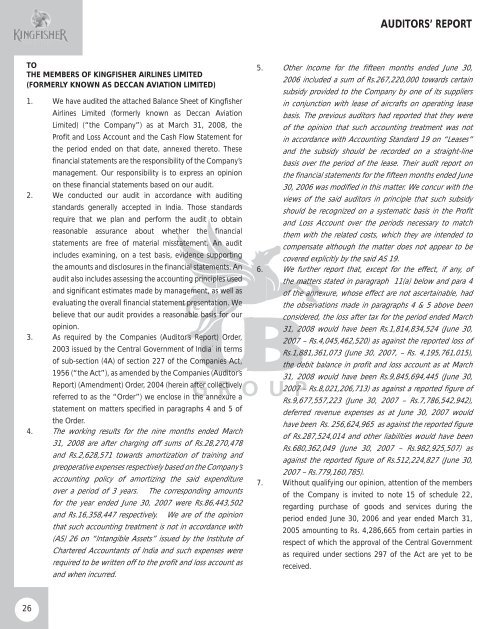

AUDITORS’ REPORTTOTHE MEMBERS OF KINGFISHER AIRLINES LIMITED(FORMERLY KNOWN AS DECCAN AVIATION LIMITED)1. We have audited the attached Balance Sheet of <strong>Kingfisher</strong><strong>Airlines</strong> Limited (formerly known as Deccan AviationLimited) (“the Company”) as at March 31, 20<strong>08</strong>, theProfit and Loss Account and the Cash Flow Statement forthe period ended on that date, annexed thereto. Thesefinancial statements are the responsibility of the Company’smanagement. Our responsibility is to express an opinionon these financial statements based on our audit.2. We conducted our audit in accordance with auditingstandards generally accepted in India. Those standardsrequire that we plan and perform the audit to obtainreasonable assurance about whether the financialstatements are free of material misstatement. An auditincludes examining, on a test basis, evidence supportingthe amounts and disclosures in the financial statements. Anaudit also includes assessing the accounting principles usedand significant estimates made by management, as well asevaluating the overall financial statement presentation. Webelieve that our audit provides a reasonable basis for ouropinion.3. As required by the Companies (Auditor’s <strong>Report</strong>) Order,2003 issued by the Central Government of India` in termsof sub-section (4A) of section 227 of the Companies Act,1956 (“the Act”), as amended by the Companies (Auditor’s<strong>Report</strong>) (Amendment) Order, 2004 (herein after collectivelyreferred to as the “Order”) we enclose in the annexure astatement on matters specified in paragraphs 4 and 5 ofthe Order.4. The working results for the nine months ended March31, 20<strong>08</strong> are after charging off sums of Rs.28,270,478and Rs.2,628,571 towards amortization of training andpreoperative expenses respectively based on the Company’saccounting policy of amortizing the said expenditureover a period of 3 years.The corresponding amountsfor the year ended June 30, <strong>2007</strong> were Rs.86,443,502and Rs.16,358,447 respectively.We are of the opinionthat such accounting treatment is not in accordance with(AS) 26 on “Intangible Assets” issued by the Institute ofChartered Accountants of India and such expenses wererequired to be written off to the profit and loss account asand when incurred.5. Other Income for the fifteen months ended June 30,2006 included a sum of Rs.267,220,000 towards certainsubsidy provided to the Company by one of its suppliersin conjunction with lease of aircrafts on operating leasebasis. The previous auditors had reported that they wereof the opinion that such accounting treatment was notin accordance with Accounting Standard 19 on “Leases”and the subsidy should be recorded on a straight-linebasis over the period of the lease. Their audit report onthe financial statements for the fifteen months ended June30, 2006 was modified in this matter. We concur with theviews of the said auditors in principle that such subsidyshould be recognized on a systematic basis in the Profitand Loss Account over the periods necessary to matchthem with the related costs, which they are intended tocompensate although the matter does not appear to becovered explicitly by the said AS 19.6. We further report that, except for the effect, if any, ofthe matters stated in paragraph 11(a) below and para 4of the annexure, whose effect are not ascertainable, hadthe observations made in paragraphs 4 & 5 above beenconsidered, the loss after tax for the period ended March31, 20<strong>08</strong> would have been Rs.1,814,834,524 (June 30,<strong>2007</strong> – Rs.4,045,462,520) as against the reported loss ofRs.1,881,361,073 (June 30, <strong>2007</strong>, – Rs. 4,195,761,015),the debit balance in profit and loss account as at March31, 20<strong>08</strong> would have been Rs.9,845,694,445 (June 30,<strong>2007</strong> – Rs.8,021,206,713) as against a reported figure ofRs.9,677,557,223 (June 30, <strong>2007</strong> – Rs.7,786,542,942),deferred revenue expenses as at June 30, <strong>2007</strong> wouldhave been Rs. 256,624,965 as against the reported figureof Rs.287,524,014 and other liabilities would have beenRs.680,362,049 (June 30, <strong>2007</strong> – Rs.982,925,507) asagainst the reported figure of Rs.512,224,827 (June 30,<strong>2007</strong> – Rs.779,160,785).7. Without qualifying our opinion, attention of the membersof the Company is invited to note 15 of schedule 22,regarding purchase of goods and services during theperiod ended June 30, 2006 and year ended March 31,2005 amounting to Rs. 4,286,665 from certain parties inrespect of which the approval of the Central Governmentas required under sections 297 of the Act are yet to bereceived.26