ANNUAL REPORT & ACCOUNTS - Coventry Building Society

ANNUAL REPORT & ACCOUNTS - Coventry Building Society

ANNUAL REPORT & ACCOUNTS - Coventry Building Society

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

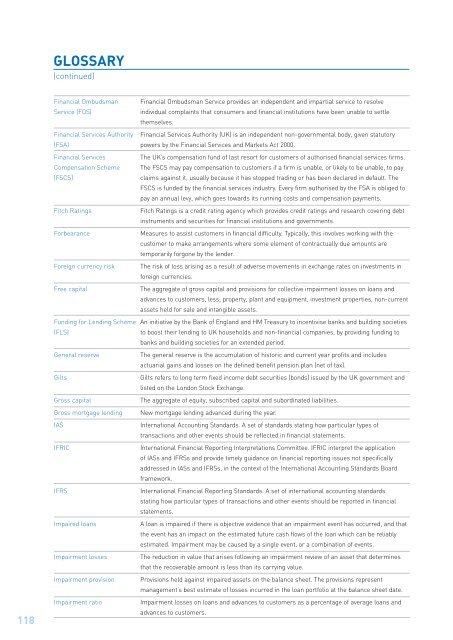

GLOSSARY(continued)118Financial OmbudsmanService (FOS)Financial Services Authority(FSA)Financial ServicesCompensation Scheme(FSCS)Fitch RatingsForbearanceForeign currency riskFree capitalFunding for Lending Scheme(FLS)General reserveGiltsGross capitalGross mortgage lendingIASIFRICIFRSImpaired loansImpairment lossesImpairment provisionImpairment ratioFinancial Ombudsman Service provides an independent and impartial service to resolveindividual complaints that consumers and financial institutions have been unable to settlethemselves.Financial Services Authority (UK) is an independent non-governmental body, given statutorypowers by the Financial Services and Markets Act 2000.The UK’s compensation fund of last resort for customers of authorised financial services firms.The FSCS may pay compensation to customers if a firm is unable, or likely to be unable, to payclaims against it, usually because it has stopped trading or has been declared in default. TheFSCS is funded by the financial services industry. Every firm authorised by the FSA is obliged topay an annual levy, which goes towards its running costs and compensation payments.Fitch Ratings is a credit rating agency which provides credit ratings and research covering debtinstruments and securities for financial institutions and governments.Measures to assist customers in financial difficulty. Typically, this involves working with thecustomer to make arrangements where some element of contractually due amounts aretemporarily forgone by the lender.The risk of loss arising as a result of adverse movements in exchange rates on investments inforeign currencies.The aggregate of gross capital and provisions for collective impairment losses on loans andadvances to customers, less; property, plant and equipment, investment properties, non-currentassets held for sale and intangible assets.An initiative by the Bank of England and HM Treasury to incentivise banks and building societiesto boost their lending to UK households and non-financial companies, by providing funding tobanks and building societies for an extended period.The general reserve is the accumulation of historic and current year profits and includesactuarial gains and losses on the defined benefit pension plan (net of tax).Gilts refers to long term fixed income debt securities (bonds) issued by the UK government andlisted on the London Stock Exchange.The aggregate of equity, subscribed capital and subordinated liabilities.New mortgage lending advanced during the year.International Accounting Standards. A set of standards stating how particular types oftransactions and other events should be reflected in financial statements.International Financial Reporting Interpretations Committee. IFRIC interpret the applicationof IASs and IFRSs and provide timely guidance on financial reporting issues not specificallyaddressed in IASs and IFRSs, in the context of the International Accounting Standards Boardframework.International Financial Reporting Standards. A set of international accounting standardsstating how particular types of transactions and other events should be reported in financialstatements.A loan is impaired if there is objective evidence that an impairment event has occurred, and thatthe event has an impact on the estimated future cash flows of the loan which can be reliablyestimated. Impairment may be caused by a single event, or a combination of events.The reduction in value that arises following an impairment review of an asset that determinesthat the recoverable amount is less than its carrying value.Provisions held against impaired assets on the balance sheet. The provisions representmanagement’s best estimate of losses incurred in the loan portfolio at the balance sheet date.Impairment losses on loans and advances to customers as a percentage of average loans andadvances to customers.