A tax credit guide for self-employed parents - Contact a Family

A tax credit guide for self-employed parents - Contact a Family

A tax credit guide for self-employed parents - Contact a Family

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

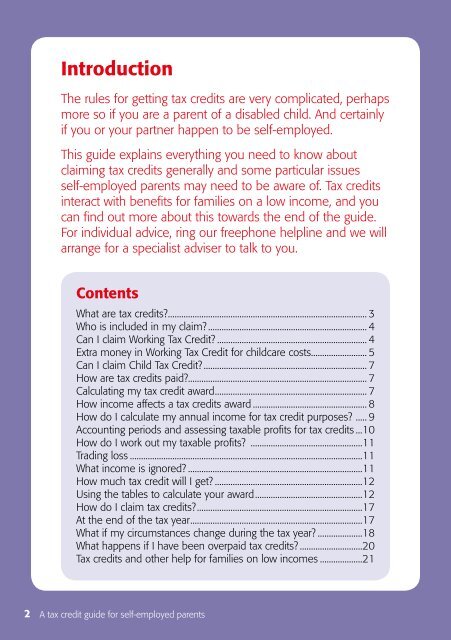

IntroductionThe rules <strong>for</strong> getting <strong>tax</strong> <strong>credit</strong>s are very complicated, perhapsmore so if you are a parent of a disabled child. And certainlyif you or your partner happen to be <strong>self</strong>-<strong>employed</strong>.This <strong>guide</strong> explains everything you need to know aboutclaiming <strong>tax</strong> <strong>credit</strong>s generally and some particular issues<strong>self</strong>-<strong>employed</strong> <strong>parents</strong> may need to be aware of. Tax <strong>credit</strong>sinteract with benefits <strong>for</strong> families on a low income, and youcan find out more about this towards the end of the <strong>guide</strong>.For individual advice, ring our freephone helpline and we willarrange <strong>for</strong> a specialist adviser to talk to you.ContentsWhat are <strong>tax</strong> <strong>credit</strong>s?.......................................................................................... 3Who is included in my claim?........................................................................ 4Can I claim Working Tax Credit?.................................................................... 4Extra money in Working Tax Credit <strong>for</strong> childcare costs......................... 5Can I claim Child Tax Credit?.......................................................................... 7How are <strong>tax</strong> <strong>credit</strong>s paid?................................................................................. 7Calculating my <strong>tax</strong> <strong>credit</strong> award..................................................................... 7How income affects a <strong>tax</strong> <strong>credit</strong>s award.................................................... 8How do I calculate my annual income <strong>for</strong> <strong>tax</strong> <strong>credit</strong> purposes? ...... 9Accounting periods and assessing <strong>tax</strong>able profits <strong>for</strong> <strong>tax</strong> <strong>credit</strong>s....10How do I work out my <strong>tax</strong>able profits? ...................................................11Trading loss.........................................................................................................11What income is ignored?...............................................................................11How much <strong>tax</strong> <strong>credit</strong> will I get?...................................................................12Using the tables to calculate your award.................................................12How do I claim <strong>tax</strong> <strong>credit</strong>s?...........................................................................17At the end of the <strong>tax</strong> year..............................................................................17What if my circumstances change during the <strong>tax</strong> year?.....................18What happens if I have been overpaid <strong>tax</strong> <strong>credit</strong>s?.............................20Tax <strong>credit</strong>s and other help <strong>for</strong> families on low incomes....................212A <strong>tax</strong> <strong>credit</strong> <strong>guide</strong> <strong>for</strong> <strong>self</strong>-<strong>employed</strong> <strong>parents</strong>