Auditing Asset Management Internal Audit - MIS Training

Auditing Asset Management Internal Audit - MIS Training

Auditing Asset Management Internal Audit - MIS Training

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

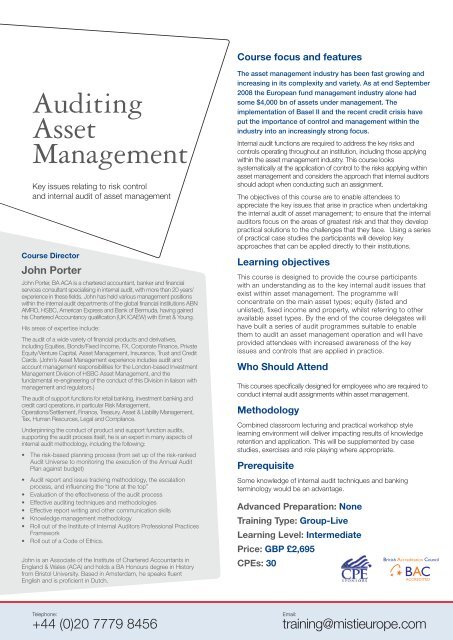

Course focus and features<strong><strong>Audit</strong>ing</strong><strong>Asset</strong><strong>Management</strong>Key issues relating to risk controland internal audit of asset managementCourse DirectorJohn PorterJohn Porter, BA ACA is a chartered accountant, banker and financialservices consultant specialising in internal audit, with more than 20 years’experience in these fields. John has held various management positionswithin the internal audit departments of the global financial institutions ABNAMRO, HSBC, American Express and Bank of Bermuda, having gainedhis Chartered Accountancy qualification (UK ICAEW) with Ernst & Young.His areas of expertise include:The audit of a wide variety of financial products and derivatives,including Equities, Bonds/Fixed Income, FX, Corporate Finance, PrivateEquity/Venture Capital, <strong>Asset</strong> <strong>Management</strong>, Insurance, Trust and CreditCards. (John’s <strong>Asset</strong> <strong>Management</strong> experience includes audit andaccount management responsibilities for the London-based Investment<strong>Management</strong> Division of HSBC <strong>Asset</strong> <strong>Management</strong>, and thefundamental re-engineering of the conduct of this Division in liaison withmanagement and regulators.)The audit of support functions for retail banking, investment banking andcredit card operations, in particular Risk <strong>Management</strong>,Operations/Settlement, Finance, Treasury, <strong>Asset</strong> & Liability <strong>Management</strong>,Tax, Human Resources, Legal and Compliance.Underpinning the conduct of product and support function audits,supporting the audit process itself, he is an expert in many aspects ofinternal audit methodology, including the following:• The risk-based planning process (from set up of the risk-ranked<strong>Audit</strong> Universe to monitoring the execution of the Annual <strong>Audit</strong>Plan against budget)• <strong>Audit</strong> report and issue tracking methodology, the escalationprocess, and influencing the “tone at the top”• Evaluation of the effectiveness of the audit process• Effective auditing techniques and methodologies• Effective report writing and other communication skills• Knowledge management methodology• Roll out of the Institute of <strong>Internal</strong> <strong>Audit</strong>ors Professional PracticesFramework• Roll out of a Code of Ethics.John is an Associate of the Institute of Chartered Accountants inEngland & Wales (ACA) and holds a BA Honours degree in Historyfrom Bristol University. Based in Amsterdam, he speaks fluentEnglish and is proficient in Dutch.The asset management industry has been fast growing andincreasing in its complexity and variety. As at end September2008 the European fund management industry alone hadsome $4,000 bn of assets under management. Theimplementation of Basel II and the recent credit crisis haveput the importance of control and management within theindustry into an increasingly strong focus.<strong>Internal</strong> audit functions are required to address the key risks andcontrols operating throughout an institution, including those applyingwithin the asset management industry. This course lookssystematically at the application of control to the risks applying withinasset management and considers the approach that internal auditorsshould adopt when conducting such an assignment.The objectives of this course are to enable attendees toappreciate the key issues that arise in practice when undertakingthe internal audit of asset management; to ensure that the internalauditors focus on the areas of greatest risk and that they developpractical solutions to the challenges that they face. Using a seriesof practical case studies the participants will develop keyapproaches that can be applied directly to their institutions.Learning objectivesThis course is designed to provide the course participantswith an understanding as to the key internal audit issues thatexist within asset management. The programme willconcentrate on the main asset types; equity (listed andunlisted), fixed income and property, whilst referring to otheravailable asset types. By the end of the course delegates willhave built a series of audit programmes suitable to enablethem to audit an asset management operation and will haveprovided attendees with increased awareness of the keyissues and controls that are applied in practice.Who Should AttendThis courses specifically designed for employees who are required toconduct internal audit assignments within asset management.MethodologyCombined classroom lecturing and practical workshop stylelearning environment will deliver impacting results of knowledgeretention and application. This will be supplemented by casestudies, exercises and role playing where appropriate.PrerequisiteSome knowledge of internal audit techniques and bankingterminology would be an advantage.Advanced Preparation: None<strong>Training</strong> Type: Group-LiveLearning Level: IntermediatePrice: GBP £2,695CPEs: 30Telephone:+44 (0)20 7779 8456Email:training@mistieurope.com