2012 Annual Report - Arizona Community Foundation

2012 Annual Report - Arizona Community Foundation

2012 Annual Report - Arizona Community Foundation

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

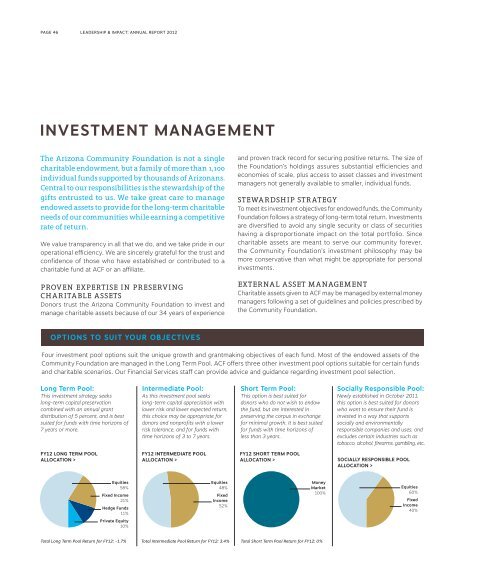

PAGE 46 LEADERSHIP & IMPACT: ANNUAL REPORT <strong>2012</strong>INVESTMENT MANAGEMENTThe <strong>Arizona</strong> <strong>Community</strong> <strong>Foundation</strong> is not a singlecharitable endowment, but a family of more than 1,100individual funds supported by thousands of <strong>Arizona</strong>ns.Central to our responsibilities is the stewardship of thegifts entrusted to us. We take great care to manageendowed assets to provide for the long-term charitableneeds of our communities while earning a competitiverate of return.We value transparency in all that we do, and we take pride in ouroperational efficiency. We are sincerely grateful for the trust andconfidence of those who have established or contributed to acharitable fund at ACF or an affiliate.PROVEN EXPERTISE IN PRESERVINGCHARITABLE ASSETSDonors trust the <strong>Arizona</strong> <strong>Community</strong> <strong>Foundation</strong> to invest andmanage charitable assets because of our 34 years of experienceand proven track record for securing positive returns. The size ofthe <strong>Foundation</strong>’s holdings assures substantial efficiencies andeconomies of scale, plus access to asset classes and investmentmanagers not generally available to smaller, individual funds.STEWARDSHIP STRATEGYTo meet its investment objectives for endowed funds, the <strong>Community</strong><strong>Foundation</strong> follows a strategy of long-term total return. Investmentsare diversified to avoid any single security or class of securitieshaving a disproportionate impact on the total portfolio. Sincecharitable assets are meant to serve our community forever,the <strong>Community</strong> <strong>Foundation</strong>’s investment philosophy may bemore conservative than what might be appropriate for personalinvestments.EXTERNAL ASSET MANAGEMENTCharitable assets given to ACF may be managed by external moneymanagers following a set of guidelines and policies prescribed bythe <strong>Community</strong> <strong>Foundation</strong>.OPTIONS TO SUIT YOUR OBJECTIVESFour investment pool options suit the unique growth and grantmaking objectives of each fund. Most of the endowed assets of the<strong>Community</strong> <strong>Foundation</strong> are managed in the Long Term Pool. ACF offers three other investment pool options suitable for certain fundsand charitable scenarios. Our Financial Services staff can provide advice and guidance regarding investment pool selection.Long Term Pool:This investment strategy seekslong-term capital preservationcombined with an annual grantdistribution of 5 percent, and is bestsuited for funds with time horizons of7 years or more.Intermediate Pool:As this investment pool seekslong-term capital appreciation withlower risk and lower expected return,this choice may be appropriate fordonors and nonprofits with a lowerrisk tolerance, and for funds withtime horizons of 3 to 7 years.Short Term Pool:This option is best suited fordonors who do not wish to endowthe fund, but are interested inpreserving the corpus in exchangefor minimal growth. It is best suitedfor funds with time horizons ofless than 3 years.Socially Responsible Pool:Newly established in October 2011,this option is best suited for donorswho want to ensure their fund isinvested in a way that supportssocially and environmentallyresponsible companies and uses, andexcludes certain industries such astobacco, alcohol, firearms, gambling, etc.FY12 LONG TERM POOLALLOCATION >FY12 INTERMEDIATE POOLALLOCATION >FY12 SHORT TERM POOLALLOCATION >SOCIALLY RESPONSIBLE POOLALLOCATION >Equities58%Fixed Income21%Hedge Funds11%Private Equity10%Equities48%FixedIncome52%MoneyMarket100%Equities60%FixedIncome40%Total Long Term Pool Return for FY12: -1.7% Total Intermediate Pool Return for FY12: 3.4% Total Short Term Pool Return for FY12: 0%