Collateral Management - Securities Lending Times

Collateral Management - Securities Lending Times

Collateral Management - Securities Lending Times

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

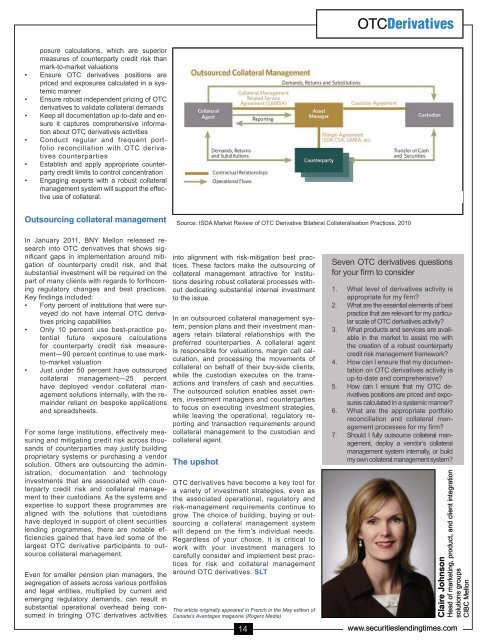

OTCDerivativesposure calculations, which are superiormeasures of counterparty credit risk thanmark-to-market valuations• Ensure OTC derivatives positions arepriced and exposures calculated in a systemicmanner• Ensure robust independent pricing of OTCderivatives to validate collateral demands• Keep all documentation up-to-date and ensureit captures comprehensive informationabout OTC derivatives activities• Conduct regular and frequent portfolioreconciliation with OTC derivativescounterparties• Establish and apply appropriate counterpartycredit limits to control concentration• Engaging experts with a robust collateralmanagement system will support the effectiveuse of collateral.Outsourcing collateral managementSource: ISDA Market Review of OTC Derivative Bilateral <strong>Collateral</strong>isation Practices, 2010In January 2011, BNY Mellon released researchinto OTC derivatives that shows significantgaps in implementation around mitigationof counterparty credit risk, and thatsubstantial investment will be required on thepart of many clients with regards to forthcomingregulatory changes and best practices.Key findings included:• Forty percent of institutions that were surveyeddo not have internal OTC derivativespricing capabilities• Only 10 percent use best-practice potentialfuture exposure calculationsfor counterparty credit risk measurement—90percent continue to use markto-marketvaluation• Just under 50 percent have outsourcedcollateral management—25 percenthave deployed vendor collateral managementsolutions internally, with the remainderreliant on bespoke applicationsand spreadsheets.For some large institutions, effectively measuringand mitigating credit risk across thousandsof counterparties may justify buildingproprietary systems or purchasing a vendorsolution. Others are outsourcing the administration,documentation and technologyinvestments that are associated with counterpartycredit risk and collateral managementto their custodians. As the systems andexpertise to support these programmes arealigned with the solutions that custodianshave deployed in support of client securitieslending programmes, there are notable efficienciesgained that have led some of thelargest OTC derivative participants to outsourcecollateral management.Even for smaller pension plan managers, thesegregation of assets across various portfoliosand legal entities, multiplied by current andemerging regulatory demands, can result insubstantial operational overhead being consumedin bringing OTC derivatives activitiesinto alignment with risk-mitigation best practices.These factors make the outsourcing ofcollateral management attractive for institutionsdesiring robust collateral processes withoutdedicating substantial internal investmentto the issue.In an outsourced collateral management system,pension plans and their investment managersretain bilateral relationships with thepreferred counterparties. A collateral agentis responsible for valuations, margin call calculation,and processing the movements ofcollateral on behalf of their buy-side clients,while the custodian executes on the transactionsand transfers of cash and securities.The outsourced solution enables asset owners,investment managers and counterpartiesto focus on executing investment strategies,while leaving the operational, regulatory reportingand transaction requirements aroundcollateral management to the custodian andcollateral agent.The upshotOTC derivatives have become a key tool fora variety of investment strategies, even asthe associated operational, regulatory andrisk-management requirements continue togrow. The choice of building, buying or outsourcinga collateral management systemwill depend on the firm’s individual needs.Regardless of your choice, it is critical towork with your investment managers tocarefully consider and implement best practicesfor risk and collateral managementaround OTC derivatives. SLTThis article originally appeared in French in the May edition ofCanada’s Avantages magazine (Rogers Media)14Seven OTC derivatives questionsfor your firm to consider1. What level of derivatives activity isappropriate for my firm?2. What are the essential elements of bestpractice that are relevant for my particularscale of OTC derivatives activity?3. What products and services are availablein the market to assist me withthe creation of a robust counterpartycredit risk management framework?4. How can I ensure that my documentationon OTC derivatives activity isup-to-date and comprehensive?5. How can I ensure that my OTC derivativespositions are priced and exposurescalculated in a systemic manner?6. What are the appropriate portfolioreconciliation and collateral managementprocesses for my firm?7. Should I fully outsource collateral management,deploy a vendor’s collateralmanagement system internally, or buildmy own collateral management system?Claire JohnsonHead of marketing, product, and client integrationsolutions groupsCIBC Mellonwww.securitieslendingtimes.com