insider trading and market manipulation: detection - FINREP

insider trading and market manipulation: detection - FINREP

insider trading and market manipulation: detection - FINREP

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

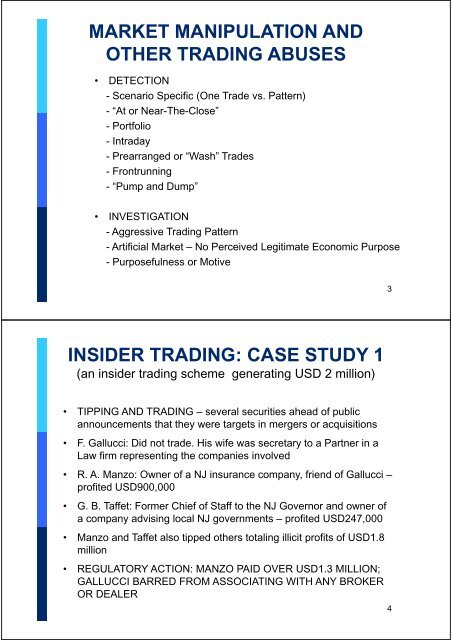

MARKET MANIPULATION ANDOTHER TRADING ABUSES• DETECTION- Scenario Specific (One Trade vs. Pattern)- “At or Near-The-Close”- Portfolio- Intraday- Prearranged or “Wash” Trades- Frontrunning- “Pump <strong>and</strong> Dump”• INVESTIGATION- Aggressive Trading Pattern- Artificial Market – No Perceived Legitimate Economic Purpose- Purposefulness or Motive3INSIDER TRADING: CASE STUDY 1(an <strong>insider</strong> <strong>trading</strong> scheme generating USD 2 million)• TIPPING AND TRADING – several securities ahead of publicannouncements that they were targets in mergers or acquisitions• F. Gallucci: Did not trade. His wife was secretary to a Partner in aLaw firm representing the companies involved• R. A. Manzo: Owner of a NJ insurance company, friend of Gallucci –profited USD900,000• G. B. Taffet: Former Chief of Staff to the NJ Governor <strong>and</strong> owner ofa company advising local NJ governments – profited USD247,000• Manzo <strong>and</strong> Taffet also tipped others totaling illicit profits of USD1.8million• REGULATORY ACTION: MANZO PAID OVER USD1.3 MILLION;GALLUCCI BARRED FROM ASSOCIATING WITH ANY BROKEROR DEALER4