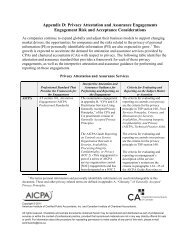

<strong>Financial</strong> <strong>Reporting</strong> <strong>by</strong> <strong>Investment</strong> <strong>Funds</strong>Since then, much has changed and continues tochange in the investment funds industry. For example,in Canada, the industry has been dealing with newaccounting standards for financial instruments. In addition,significant new Canadian regulatory requirementshave been added in the last few years. Internationally,the industry has been challenged <strong>by</strong> the requirements ofadopting IFRS, now or in the near future. A chronologyof events affecting the investment funds industry from1997 to 2008 is set out in Exhibit 1.1.Exhibit 1.1Chronology of EventsDateMay 1997May 1, 1998February 1, 2000March 3, 2000June 2003October 1, 2003January 2004EventCICA Research Report “<strong>Financial</strong> <strong>Reporting</strong> <strong>by</strong> <strong>Investment</strong> <strong>Funds</strong>” published.NI 81-105, Mutual Fund Sales Practices, came into force.NI 81-101, Mutual Fund Prospectus Disclosure, came into force. NI 81-102, Mutual <strong>Funds</strong>, came into force.EIC-107, Application of CICA 3465 to Mutual Fund Trusts, Real Estate <strong>Investment</strong> Trusts, Royalty Trusts and IncomeTrusts, issued.AcG-15, Consolidation of Variable Interest Entities, issued. Effective for annual and interim periods beginning on orafter November 1, 2004.Section 1100, Generally Accepted Accounting Principle, became effective. Limited the use of “industry” GAAP.AcG-18, <strong>Investment</strong> Companies, issued. Effective for financial years beginning on or after July 1, 2004 (exceptparagraph 12 effective on or after July 1, 2005).April 2005 Section 3855, <strong>Financial</strong> Instruments – Recognition and Measurement, and Section 3861, <strong>Financial</strong> Instruments –Disclosure and Presentation, published April 2005. Effective for financial periods beginning on or after October 1,2006. The basis of calculating NAV for financial statements was changed to “bid” from “closing market”.June 1, 2005September 2006October 1, 2006December 2006January 2007June 2007October 1, 2007March 2008May 30, 2008September 8, 2008NI 81-106, <strong>Investment</strong> Fund Continuous Disclosure, came into force. This requires the use of Canadian GAAP forstriking the NAV.CSA granted relief regarding the calculation of NAV for purposes other than financial statements, effectivelyallowing the continued use of “closing market” for non-financial statement purposes (not “bid” as required<strong>by</strong> Section 3855). The exemption was granted for the period to September 2007 (subsequently extended toSeptember 2008).Sections 3855 and 3861 effective for financial periods beginning on or after this date.Section 3862, <strong>Financial</strong> Instruments – Disclosures, and Section 3863, <strong>Financial</strong> Instruments – Presentation werepublished in December 2006 effective for financial periods beginning on or after October 1, 2007. The effect is tochange the nature and level of disclosure.Amendments to AcG-15 and AcG-18 issued, effective for annual and interim periods ending on or after September30, 2007. The effect is to permit under Canadian GAAP the exemption afforded US investment funds re VIEs reconsolidation.CSA released proposals for revisions to NI 81-106 to require the calculation of NAV using the fair value (as definedin NI 81-106) of the investment fund’s assets and liabilities.Sections 3862 and 3863 effective for financial periods beginning on or after this date.AcSB announced its decision adopt IFRS, effective for interim and annual financial statements for financialperiods beginning on or after January 1, 2011. IFRS, without modification, will replace Canadian GAAP for publiclyaccountable enterprises.OSC Staff Notice 81-709 “Report on Staff’s Continuous Disclosure Review of <strong>Investment</strong> <strong>Funds</strong> (2008), published.Revised NI 81-106 (as published on June 20, 2008) came into force.2

IntroductionThe Study Group’s mandate was to address accountingand financial reporting matters for Canadian investmentfunds, including current requirements and practices,and the consequences of the transition from CanadianGAAP to IFRS. To identify the pertinent issues toaddress, the Study Group:•y reviewed investment fund financial statements inCanada and internationally;•y held discussions with the industry, regulators,accounting standard setters and auditors;•y surveyed informed participants in the investmentfunds industry in Canada (the industry, regulators,auditors);• y reviewed the CICA Handbook-Accounting (includingSections, Guidelines and EICs) to identifymaterial relevant to investment funds;•y•y•yreviewed material prepared <strong>by</strong> the CanadianAccounting Standards Board and its staff on thetransition to IFRS (including a detailed comparisonof the CICA Handbook-Accounting and IFRS);reviewed securities regulations relevant to investmentfunds (with particular emphasis on revisedNI 81-106 which came into force on September 8,2008); andreviewed material published <strong>by</strong> a variety of organizations(for example, industry associations,accounting firms and the American Institute ofCertified Public Accountants).Exhibit 1.2 lists the key issues identified as a result ofthis process.Exhibit 1.2Key Issues on <strong>Financial</strong> <strong>Reporting</strong> and Continuous Disclosure1. Consolidation <strong>by</strong> <strong>Investment</strong> Fund CompaniesIssue: How should accounting principles for consolidation be meaningfully applied to investment fund companies (for example: fund offunds; segregated funds; related funds and implicit interests)?References: CICA Handbook – Accounting Section 1590, Subsidiaries; Section 1600, Consolidated <strong>Financial</strong> Statements; Section 3840,Related Party Transactions; AcG-15, Consolidation of Variable Interest Entities; EIC 157, Implicit Variable Interests Under AcG-15.2. <strong>Financial</strong> Instruments – Measurement, Recognition and DisclosureIssue: How should accounting principles for financial instruments be meaningfully applied to investment fund companies (for example,bid, ask, closing price; held-for-trading versus available-for-sale; transaction costs, risk disclosures; use of amortized cost for moneymarket funds)?References: CICA Handbook – Accounting Section 3855, <strong>Financial</strong> Instruments — Recognition and Measurement; Section 3861, <strong>Financial</strong>Instruments — Disclosure and Presentation; National Instrument 81-106, <strong>Investment</strong> Fund Continuous Disclosure.3. Income TaxesIssue: How should investment fund companies deal with the differences between generally accepted accounting principles (GAAP) andincome tax accounting treatment (for example, fund mergers — S.1581); corporate actions; mutual fund corporations — S.3465)?References: CICA Handbook – Accounting Section 1581, Business Combinations; Section 3465, Income Taxes.4. MRFP and Continuous DisclosureIssue: How should investment fund companies prepare financial statements in accordance with generally accepted accounting principles(GAAP) and, at the same time, take into consideration MRFP and continuous disclosure requirements (for example, management feebreakdown; reconciliation with GAAP; compensation and expense of independent review committee; itemized financial disclosure such assoft dollar costs)?References: National Instrument 81-106, <strong>Investment</strong> Fund Continuous Disclosure, Part 4, Management Reports of Fund Performance(MRFP).5. Earnings per ShareIssue: How should accounting principles for earnings per share be meaningfully applied to investment fund companies (for example,increase/decrease in net asset value per unit/share; calculation and disclosure in financial statements and management report on fundperformance)?References: CICA Handbook – Accounting Section 1100, Generally Accepted Accounting Principles; Section 3500, Earnings Per Share;National Instrument 81-106, <strong>Investment</strong> Fund Continuous Disclosure.3

- Page 3 and 4: CICA Research ReportFINANCIAL REPOR

- Page 6 and 7: Notice to ReaderThe Knowledge Devel

- Page 8 and 9: Financial Reporting by Investment F

- Page 10: PageChapter 3FINANCIAL STATEMENT DI

- Page 13 and 14: EXECUTIVE OVERVIEWThe objective of

- Page 15: Chapter 1INTRODUCTIONOUTLINE OF THE

- Page 19 and 20: Introductionfor alternative present

- Page 25 and 26: Financial Statements of Investment

- Page 28 and 29: Financial Reporting by Investment F

- Page 30: Financial Reporting by Investment F

- Page 33 and 34: Financial Statements of Investment

- Page 36 and 37: Financial Reporting by Investment F

- Page 39: Financial Statement Disclosures and

- Page 42 and 43: Financial Reporting by Investment F

- Page 44 and 45: Financial Reporting by Investment F

- Page 46 and 47: Financial Reporting by Investment F

- Page 48 and 49: Financial Reporting by Investment F

- Page 50 and 51: Financial Reporting by Investment F

- Page 52 and 53: Financial Reporting by Investment F

- Page 54 and 55: Financial Reporting by Investment F

- Page 56 and 57: Financial Reporting by Investment F

- Page 58 and 59: Financial Reporting by Investment F

- Page 60 and 61: Financial Reporting by Investment F

- Page 62 and 63: Financial Reporting by Investment F

- Page 64 and 65: Financial Reporting by Investment F

- Page 66 and 67:

Financial Reporting by Investment F

- Page 68 and 69:

Financial Reporting by Investment F

- Page 70 and 71:

Financial Reporting by Investment F

- Page 72 and 73:

Financial Reporting by Investment F

- Page 74 and 75:

Financial Reporting by Investment F

- Page 77 and 78:

Chapter 5MANAGEMENT REPORT ANDAUDIT

- Page 79 and 80:

Management Report and Auditor’s R

- Page 81 and 82:

Management Report and Auditor’s R

- Page 83 and 84:

Chapter 6MANAGEMENT REPORT OFFUND P

- Page 85 and 86:

Management Report of Fund Performan

- Page 87 and 88:

Management Report of Fund Performan

- Page 89 and 90:

Management Report of Fund Performan

- Page 91 and 92:

Chapter 7SPECIAL TYPES OFINVESTMENT

- Page 93 and 94:

Special Types of Investment Fundsof

- Page 95 and 96:

Special Types of Investment Fundswi

- Page 97 and 98:

Special Types of Investment Fundsan

- Page 99 and 100:

Special Types of Investment FundsEx

- Page 101 and 102:

Chapter 8TRANSITION TO INTERNATIONA

- Page 103 and 104:

Transition to International Financi

- Page 105 and 106:

Transition to International Financi

- Page 107 and 108:

Transition to International Financi

- Page 109:

Transition to International Financi

- Page 112 and 113:

Financial Reporting by Investment F

- Page 114 and 115:

Financial Reporting by Investment F

- Page 116 and 117:

Financial Reporting by Investment F

- Page 118 and 119:

Financial Reporting by Investment F

- Page 120 and 121:

Financial Reporting by Investment F

- Page 122 and 123:

Financial Reporting by Investment F

- Page 124 and 125:

Financial Reporting by Investment F

- Page 126 and 127:

Financial Reporting by Investment F

- Page 128 and 129:

Financial Reporting by Investment F

- Page 131 and 132:

Appendix CACCOUNTING FOR SPECIFIC T

- Page 133 and 134:

Security ortransactionGeneral descr

- Page 135 and 136:

Security ortransactionGeneral descr

- Page 137 and 138:

Security ortransactionGeneral descr

- Page 139:

Security ortransactionGeneral descr

- Page 142 and 143:

128Canadian AccountingStandards(CIC

- Page 144 and 145:

130Canadian AccountingStandards(CIC

- Page 146 and 147:

132Canadian AccountingStandards(CIC

- Page 148:

134Canadian AccountingStandards(CIC

- Page 151 and 152:

Consolidation by Investment Funds U

- Page 153 and 154:

Consolidation by Investment Funds U

- Page 155 and 156:

Consolidation by Investment Funds U

- Page 157 and 158:

Consolidation by Investment Funds U

- Page 159 and 160:

Consolidation by Investment Funds U

- Page 161:

Consolidation by Investment Funds U

- Page 164 and 165:

Financial Reporting by Investment F

- Page 166 and 167:

Financial Reporting by Investment F

- Page 168 and 169:

Financial Reporting by Investment F

- Page 170 and 171:

Financial Reporting by Investment F

- Page 172 and 173:

Financial Reporting by Investment F

- Page 174 and 175:

Financial Reporting by Investment F

- Page 177 and 178:

GLOSSARYThe terms defined in this G

- Page 179 and 180:

Glossaryadviser. See investment adv

- Page 181 and 182:

Glossarybroker. An agent, often a m

- Page 183 and 184:

Glossarytogether, support people in

- Page 185 and 186:

Glossaryequity. The net worth of a

- Page 187 and 188:

Glossaryinterest faced by the fund

- Page 189 and 190:

Glossaryfund corporation or a labou

- Page 191 and 192:

Glossarymortgage backed security (M

- Page 193 and 194:

Glossarypresent value. The current

- Page 195 and 196:

Glossaryrestricted security. A port

- Page 197 and 198:

Glossaryspread. A combination of a

- Page 199:

Glossaryindenture, that issues only

- Page 204:

The Canadian Institute of Chartered