Annual Report 2011 - Dundee International REIT

Annual Report 2011 - Dundee International REIT

Annual Report 2011 - Dundee International REIT

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

DUNDEE INTERNATIONAL <strong>2011</strong> <strong>Annual</strong> <strong>Report</strong><br />

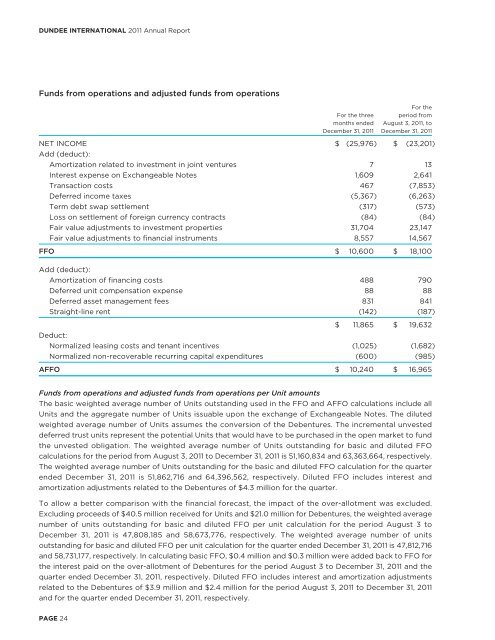

Funds from operations and adjusted funds from operations<br />

PAGE 24<br />

For the<br />

For the three period from<br />

months ended August 3, <strong>2011</strong>, to<br />

December 31, <strong>2011</strong> December 31, <strong>2011</strong><br />

NET INCOME $ (25,976) $ (23,201)<br />

Add (deduct):<br />

Amortization related to investment in joint ventures 7 13<br />

Interest expense on Exchangeable Notes 1,609 2,641<br />

Transaction costs 467 (7,853)<br />

Deferred income taxes (5,367) (6,263)<br />

Term debt swap settlement (317) (573)<br />

Loss on settlement of foreign currency contracts (84) (84)<br />

Fair value adjustments to investment properties 31,704 23,147<br />

Fair value adjustments to financial instruments 8,557 14,567<br />

FFO $ 10,600 $ 18,100<br />

Add (deduct):<br />

Amortization of financing costs 488 790<br />

Deferred unit compensation expense 88 88<br />

Deferred asset management fees 831 841<br />

Straight-line rent (142) (187)<br />

$ 11,865 $ 19,632<br />

Deduct:<br />

Normalized leasing costs and tenant incentives (1,025) (1,682)<br />

Normalized non-recoverable recurring capital expenditures (600) (985)<br />

AFFO $ 10,240 $ 16,965<br />

Funds from operations and adjusted funds from operations per Unit amounts<br />

The basic weighted average number of Units outstanding used in the FFO and AFFO calculations include all<br />

Units and the aggregate number of Units issuable upon the exchange of Exchangeable Notes. The diluted<br />

weighted average number of Units assumes the conversion of the Debentures. The incremental unvested<br />

deferred trust units represent the potential Units that would have to be purchased in the open market to fund<br />

the unvested obligation. The weighted average number of Units outstanding for basic and diluted FFO<br />

calculations for the period from August 3, <strong>2011</strong> to December 31, <strong>2011</strong> is 51,160,834 and 63,363,664, respectively.<br />

The weighted average number of Units outstanding for the basic and diluted FFO calculation for the quarter<br />

ended December 31, <strong>2011</strong> is 51,862,716 and 64,396,562, respectively. Diluted FFO includes interest and<br />

amortization adjustments related to the Debentures of $4.3 million for the quarter.<br />

To allow a better comparison with the financial forecast, the impact of the over-allotment was excluded.<br />

Excluding proceeds of $40.5 million received for Units and $21.0 million for Debentures, the weighted average<br />

number of units outstanding for basic and diluted FFO per unit calculation for the period August 3 to<br />

December 31, <strong>2011</strong> is 47,808,185 and 58,673,776, respectively. The weighted average number of units<br />

outstanding for basic and diluted FFO per unit calculation for the quarter ended December 31, <strong>2011</strong> is 47,812,716<br />

and 58,731,177, respectively. In calculating basic FFO, $0.4 million and $0.3 million were added back to FFO for<br />

the interest paid on the over-allotment of Debentures for the period August 3 to December 31, <strong>2011</strong> and the<br />

quarter ended December 31, <strong>2011</strong>, respectively. Diluted FFO includes interest and amortization adjustments<br />

related to the Debentures of $3.9 million and $2.4 million for the period August 3, <strong>2011</strong> to December 31, <strong>2011</strong><br />

and for the quarter ended December 31, <strong>2011</strong>, respectively.