Vanguard International Growth Fund Prospectus Investor and Admiral

Vanguard International Growth Fund Prospectus Investor and Admiral

Vanguard International Growth Fund Prospectus Investor and Admiral

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

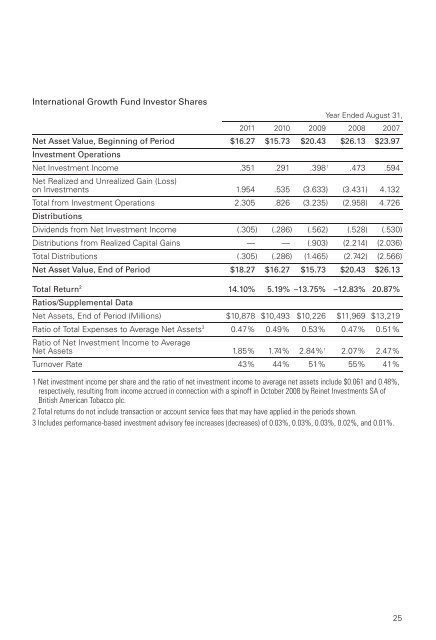

<strong>International</strong> <strong>Growth</strong> <strong>Fund</strong> <strong>Investor</strong> Shares<br />

Year Ended August 31,<br />

2011 2010 2009 2008 2007<br />

Net Asset Value, Beginning of Period $16.27 $15.73 $20.43 $26.13 $23.97<br />

Investment Operations<br />

Net Investment Income .351 .291 .398 1 Net Realized <strong>and</strong> Unrealized Gain (Loss)<br />

.473 .594<br />

on Investments 1.954 .535 (3.633) (3.431) 4.132<br />

Total from Investment Operations<br />

Distributions<br />

2.305 .826 (3.235) (2.958) 4.726<br />

Dividends from Net Investment Income (.305) (.286) (.562) (.528) (.530)<br />

Distributions from Realized Capital Gains — — (.903) (2.214) (2.036)<br />

Total Distributions (.305) (.286) (1.465) (2.742) (2.566)<br />

Net Asset Value, End of Period $18.27 $16.27 $15.73 $20.43 $26.13<br />

Total Return 2 Ratios/Supplemental Data<br />

14.10% 5.19% –13.75% –12.83% 20.87%<br />

Net Assets, End of Period (Millions) $10,878 $10,493 $10,226 $11,969 $13,219<br />

Ratio of Total Expenses to Average Net Assets3 Ratio of Net Investment Income to Average<br />

0.47% 0.49% 0.53% 0.47% 0.51%<br />

Net Assets 1.85% 1.74% 2.84% 1 2.07% 2.47%<br />

Turnover Rate 43% 44% 51% 55% 41%<br />

1 Net investment income per share <strong>and</strong> the ratio of net investment income to average net assets include $0.061 <strong>and</strong> 0.48%,<br />

respectively, resulting from income accrued in connection with a spinoff in October 2008 by Reinet Investments SA of<br />

British American Tobacco plc.<br />

2 Total returns do not include transaction or account service fees that may have applied in the periods shown.<br />

3 Includes performance-based investment advisory fee increases (decreases) of 0.03%, 0.03%, 0.03%, 0.02%, <strong>and</strong> 0.01%.<br />

25