impact of de-tariffication on profitability of non-life insurers

impact of de-tariffication on profitability of non-life insurers

impact of de-tariffication on profitability of non-life insurers

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

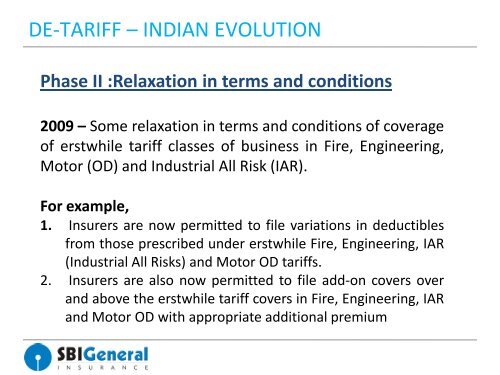

DE-TARIFF – INDIAN EVOLUTIONPhase II :Relaxati<strong>on</strong> in terms and c<strong>on</strong>diti<strong>on</strong>s2009 – Some relaxati<strong>on</strong> in terms and c<strong>on</strong>diti<strong>on</strong>s <str<strong>on</strong>g>of</str<strong>on</strong>g> coverage<str<strong>on</strong>g>of</str<strong>on</strong>g> erstwhile tariff classes <str<strong>on</strong>g>of</str<strong>on</strong>g> business in Fire, Engineering,Motor (OD) and Industrial All Risk (IAR).For example,1. Insurers are now permitted to file variati<strong>on</strong>s in <str<strong>on</strong>g>de</str<strong>on</strong>g>ductiblesfrom those prescribed un<str<strong>on</strong>g>de</str<strong>on</strong>g>r erstwhile Fire, Engineering, IAR(Industrial All Risks) and Motor OD tariffs.2. Insurers are also now permitted to file add-<strong>on</strong> covers overand above the erstwhile tariff covers in Fire, Engineering, IARand Motor OD with appropriate additi<strong>on</strong>al premium