ANNUAL REPORT 2005.qxd - Herald

ANNUAL REPORT 2005.qxd - Herald

ANNUAL REPORT 2005.qxd - Herald

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

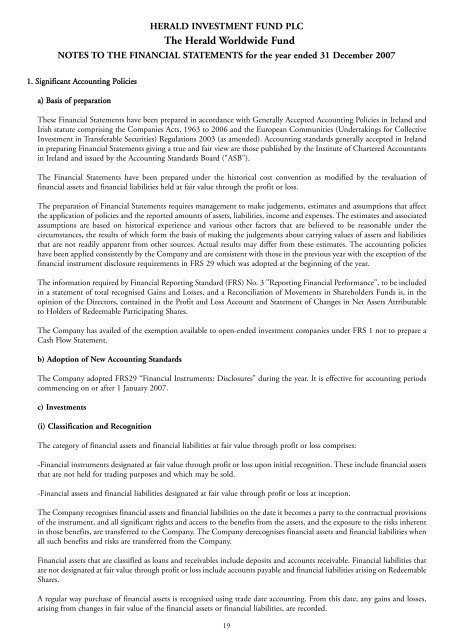

HERALD INVESTMENT FUND PLCThe <strong>Herald</strong> Worldwide FundNOTES TO THE FINANCIAL STATEMENTS for the year ended 31 December 20071. Significant Accounting Policiesa) Basis of preparationThese Financial Statements have been prepared in accordance with Generally Accepted Accounting Policies in Ireland andIrish statute comprising the Companies Acts, 1963 to 2006 and the European Communities (Undertakings for CollectiveInvestment in Transferable Securities) Regulations 2003 (as amended). Accounting standards generally accepted in Irelandin preparing Financial Statements giving a true and fair view are those published by the Institute of Chartered Accountantsin Ireland and issued by the Accounting Standards Board ("ASB").The Financial Statements have been prepared under the historical cost convention as modified by the revaluation offinancial assets and financial liabilities held at fair value through the profit or loss.The preparation of Financial Statements requires management to make judgements, estimates and assumptions that affectthe application of policies and the reported amounts of assets, liabilities, income and expenses. The estimates and associatedassumptions are based on historical experience and various other factors that are believed to be reasonable under thecircumstances, the results of which form the basis of making the judgements about carrying values of assets and liabilitiesthat are not readily apparent from other sources. Actual results may differ from these estimates. The accounting policieshave been applied consistently by the Company and are consistent with those in the previous year with the exception of thefinancial instrument disclosure requirements in FRS 29 which was adopted at the beginning of the year.The information required by Financial Reporting Standard (FRS) No. 3 "Reporting Financial Performance", to be includedin a statement of total recognised Gains and Losses, and a Reconciliation of Movements in Shareholders Funds is, in theopinion of the Directors, contained in the Profit and Loss Account and Statement of Changes in Net Assets Attributableto Holders of Redeemable Participating Shares.The Company has availed of the exemption available to open-ended investment companies under FRS 1 not to prepare aCash Flow Statement.b) Adoption of New Accounting StandardsThe Company adopted FRS29 “Financial Instruments: Disclosures” during the year. It is effective for accounting periodscommencing on or after 1 January 2007.c) Investments(i) Classification and RecognitionThe category of financial assets and financial liabilities at fair value through profit or loss comprises:-Financial instruments designated at fair value through profit or loss upon initial recognition. These include financial assetsthat are not held for trading purposes and which may be sold.-Financial assets and financial liabilities designated at fair value through profit or loss at inception.The Company recognises financial assets and financial liabilities on the date it becomes a party to the contractual provisionsof the instrument, and all significant rights and access to the benefits from the assets, and the exposure to the risks inherentin those benefits, are transferred to the Company. The Company derecognises financial assets and financial liabilities whenall such benefits and risks are transferred from the Company.Financial assets that are classified as loans and receivables include deposits and accounts receivable. Financial liabilities thatare not designated at fair value through profit or loss include accounts payable and financial liabilities arising on RedeemableShares.A regular way purchase of financial assets is recognised using trade date accounting. From this date, any gains and losses,arising from changes in fair value of the financial assets or financial liabilities, are recorded.19