Wednesday, May 23, 2012 - City of Kalamazoo

Wednesday, May 23, 2012 - City of Kalamazoo

Wednesday, May 23, 2012 - City of Kalamazoo

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

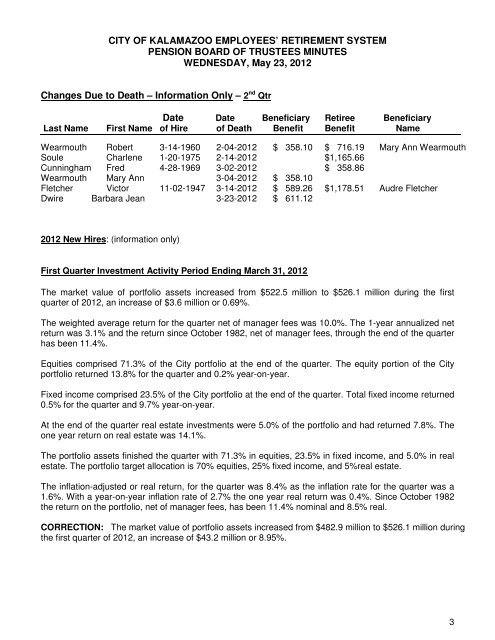

CITY OF KALAMAZOO EMPLOYEES’ RETIREMENT SYSTEMPENSION BOARD OF TRUSTEES MINUTESWEDNESDAY, <strong>May</strong> <strong>23</strong>, <strong>2012</strong>Changes Due to Death – Information Only – 2 nd QtrDate Date Beneficiary Retiree BeneficiaryLast Name First Name <strong>of</strong> Hire <strong>of</strong> Death Benefit Benefit NameWearmouth Robert 3-14-1960 2-04-<strong>2012</strong> $ 358.10 $ 716.19 Mary Ann WearmouthSoule Charlene 1-20-1975 2-14-<strong>2012</strong> $1,165.66Cunningham Fred 4-28-1969 3-02-<strong>2012</strong> $ 358.86Wearmouth Mary Ann 3-04-<strong>2012</strong> $ 358.10Fletcher Victor 11-02-1947 3-14-<strong>2012</strong> $ 589.26 $1,178.51 Audre FletcherDwire Barbara Jean 3-<strong>23</strong>-<strong>2012</strong> $ 611.12<strong>2012</strong> New Hires: (information only)First Quarter Investment Activity Period Ending March 31, <strong>2012</strong>The market value <strong>of</strong> portfolio assets increased from $522.5 million to $526.1 million during the firstquarter <strong>of</strong> <strong>2012</strong>, an increase <strong>of</strong> $3.6 million or 0.69%.The weighted average return for the quarter net <strong>of</strong> manager fees was 10.0%. The 1-year annualized netreturn was 3.1% and the return since October 1982, net <strong>of</strong> manager fees, through the end <strong>of</strong> the quarterhas been 11.4%.Equities comprised 71.3% <strong>of</strong> the <strong>City</strong> portfolio at the end <strong>of</strong> the quarter. The equity portion <strong>of</strong> the <strong>City</strong>portfolio returned 13.8% for the quarter and 0.2% year-on-year.Fixed income comprised <strong>23</strong>.5% <strong>of</strong> the <strong>City</strong> portfolio at the end <strong>of</strong> the quarter. Total fixed income returned0.5% for the quarter and 9.7% year-on-year.At the end <strong>of</strong> the quarter real estate investments were 5.0% <strong>of</strong> the portfolio and had returned 7.8%. Theone year return on real estate was 14.1%.The portfolio assets finished the quarter with 71.3% in equities, <strong>23</strong>.5% in fixed income, and 5.0% in realestate. The portfolio target allocation is 70% equities, 25% fixed income, and 5%real estate.The inflation-adjusted or real return, for the quarter was 8.4% as the inflation rate for the quarter was a1.6%. With a year-on-year inflation rate <strong>of</strong> 2.7% the one year real return was 0.4%. Since October 1982the return on the portfolio, net <strong>of</strong> manager fees, has been 11.4% nominal and 8.5% real.CORRECTION: The market value <strong>of</strong> portfolio assets increased from $482.9 million to $526.1 million duringthe first quarter <strong>of</strong> <strong>2012</strong>, an increase <strong>of</strong> $43.2 million or 8.95%.3