Global Integration Business Consultants project - gibc

Global Integration Business Consultants project - gibc

Global Integration Business Consultants project - gibc

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Executive<br />

Summary<br />

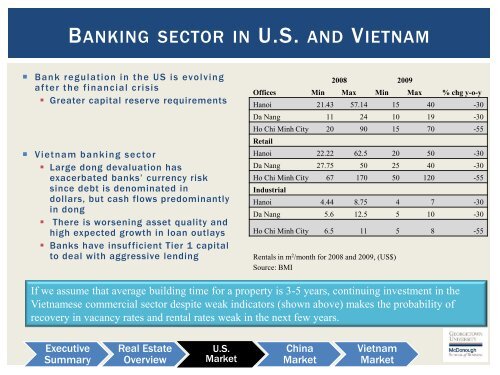

BANKING SECTOR IN U.S. AND VIETNAM<br />

� Bank regulation in the US is evolving<br />

af ter the financial crisis<br />

� Greater capital reserve requirements<br />

� Vietnam banking sector<br />

� Large dong devaluation has<br />

exacerbated banks‟ currency risk<br />

since debt is denominated in<br />

dollars, but cash flows predominantly<br />

in dong<br />

� There is worsening asset quality and<br />

high expected growth in loan outlays<br />

� Banks have insufficient Tier 1 capital<br />

to deal with aggressive lending<br />

Real Estate<br />

Overview<br />

U.S.<br />

Market<br />

China<br />

Market<br />

2008 2009<br />

Offices Min Max Min Max % chg y-o-y<br />

Hanoi 21.43 57.14 15 40 -30<br />

Da Nang 11 24 10 19 -30<br />

Ho Chi Minh City 20 90 15 70 -55<br />

Retail<br />

Hanoi 22.22 62.5 20 50 -30<br />

Da Nang 27.75 50 25 40 -30<br />

Ho Chi Minh City 67 170 50 120 -55<br />

Industrial<br />

Hanoi 4.44 8.75 4 7 -30<br />

Da Nang 5.6 12.5 5 10 -30<br />

Ho Chi Minh City 6.5 11 5 8 -55<br />

Rentals in m 2 /month for 2008 and 2009, (US$)<br />

Source: BMI<br />

If we assume that average building time for a property is 3-5 years, continuing investment in the<br />

Vietnamese commercial sector despite weak indicators (shown above) makes the probability of<br />

recovery in vacancy rates and rental rates weak in the next few years.<br />

Vietnam<br />

Market