Audited Financial Statements - Sutter Health

Audited Financial Statements - Sutter Health

Audited Financial Statements - Sutter Health

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

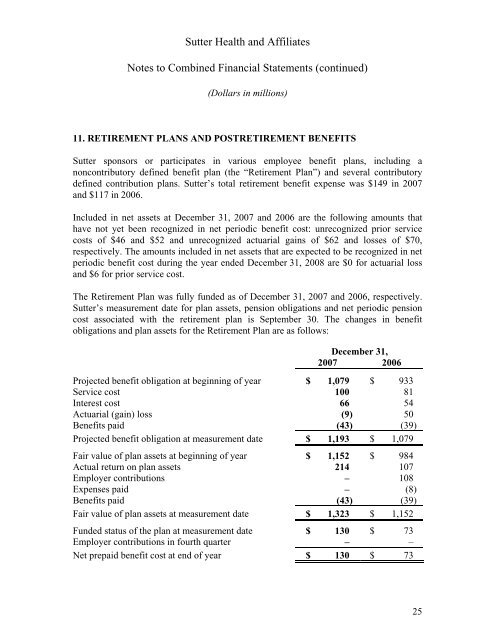

<strong>Sutter</strong> <strong>Health</strong> and AffiliatesNotes to Combined <strong>Financial</strong> <strong>Statements</strong> (continued)(Dollars in millions)11. RETIREMENT PLANS AND POSTRETIREMENT BENEFITS<strong>Sutter</strong> sponsors or participates in various employee benefit plans, including anoncontributory defined benefit plan (the “Retirement Plan”) and several contributorydefined contribution plans. <strong>Sutter</strong>’s total retirement benefit expense was $149 in 2007and $117 in 2006.Included in net assets at December 31, 2007 and 2006 are the following amounts thathave not yet been recognized in net periodic benefit cost: unrecognized prior servicecosts of $46 and $52 and unrecognized actuarial gains of $62 and losses of $70,respectively. The amounts included in net assets that are expected to be recognized in netperiodic benefit cost during the year ended December 31, 2008 are $0 for actuarial lossand $6 for prior service cost.The Retirement Plan was fully funded as of December 31, 2007 and 2006, respectively.<strong>Sutter</strong>’s measurement date for plan assets, pension obligations and net periodic pensioncost associated with the retirement plan is September 30. The changes in benefitobligations and plan assets for the Retirement Plan are as follows:December 31,2007 2006Projected benefit obligation at beginning of year $ 1,079 $ 933Service cost 100 81Interest cost 66 54Actuarial (gain) loss (9) 50Benefits paid (43) (39)Projected benefit obligation at measurement date $ 1,193 $ 1,079Fair value of plan assets at beginning of year $ 1,152 $ 984Actual return on plan assets 214 107Employer contributions – 108Expenses paid – (8)Benefits paid (43) (39)Fair value of plan assets at measurement date $ 1,323 $ 1,152Funded status of the plan at measurement date $ 130 $ 73Employer contributions in fourth quarter – –Net prepaid benefit cost at end of year $ 130 $ 7325