Dealers' Choice - Media Communication Group

Dealers' Choice - Media Communication Group

Dealers' Choice - Media Communication Group

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

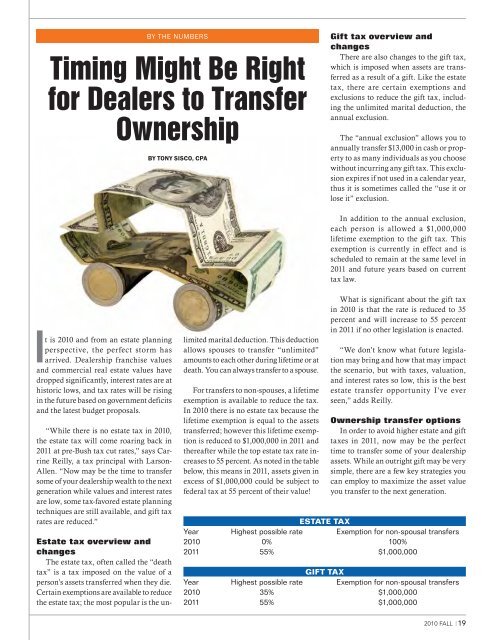

BY THE NUMBERSTiming Might Be Rightfor Dealers to TransferOwnershipBy Tony SisCO, CpaGift tax overview andchangesThere are also changes to the gift tax,which is imposed when assets are transferredas a result of a gift. Like the estatetax, there are certain exemptions andexclusions to reduce the gift tax, includingthe unlimited marital deduction, theannual exclusion.The “annual exclusion” allows you toannually transfer $13,000 in cash or propertyto as many individuals as you choosewithout incurring any gift tax. This exclusionexpires if not used in a calendar year,thus it is sometimes called the “use it orlose it” exclusion.In addition to the annual exclusion,each person is allowed a $1,000,000lifetime exemption to the gift tax. Thisexemption is currently in effect and isscheduled to remain at the same level in2011 and future years based on currenttax law.It is 2010 and from an estate planningperspective, the perfect storm hasarrived. Dealership franchise valuesand commercial real estate values havedropped significantly, interest rates are athistoric lows, and tax rates will be risingin the future based on government deficitsand the latest budget proposals.“While there is no estate tax in 2010,the estate tax will come roaring back in2011 at pre-Bush tax cut rates,” says CarrineReilly, a tax principal with Larson-Allen. “Now may be the time to transfersome of your dealership wealth to the nextgeneration while values and interest ratesare low, some tax-favored estate planningtechniques are still available, and gift taxrates are reduced.”Estate tax overview andchangesThe estate tax, often called the “deathtax” is a tax imposed on the value of aperson’s assets transferred when they die.Certain exemptions are available to reducethe estate tax; the most popular is the un-limited marital deduction. This deductionallows spouses to transfer “unlimited”amounts to each other during lifetime or atdeath. You can always transfer to a spouse.For transfers to non-spouses, a lifetimeexemption is available to reduce the tax.In 2010 there is no estate tax because thelifetime exemption is equal to the assetstransferred; however this lifetime exemptionis reduced to $1,000,000 in 2011 andthereafter while the top estate tax rate increasesto 55 percent. As noted in the tablebelow, this means in 2011, assets given inexcess of $1,000,000 could be subject tofederal tax at 55 percent of their value!What is significant about the gift taxin 2010 is that the rate is reduced to 35percent and will increase to 55 percentin 2011 if no other legislation is enacted.“We don’t know what future legislationmay bring and how that may impactthe scenario, but with taxes, valuation,and interest rates so low, this is the bestestate transfer opportunity I’ve everseen,” adds Reilly.Ownership transfer optionsIn order to avoid higher estate and gifttaxes in 2011, now may be the perfecttime to transfer some of your dealershipassets. While an outright gift may be verysimple, there are a few key strategies youcan employ to maximize the asset valueyou transfer to the next generation.ESTATE TAXYear Highest possible rate Exemption for non-spousal transfers2010 0% 100%2011 55% $1,000,000GIFT TAXYear Highest possible rate Exemption for non-spousal transfers2010 35% $1,000,0002011 55% $1,000,0002010 FALL ⎢19