- Page 1 and 2:

Management’sDiscussion and Analys

- Page 3 and 4:

Power Corporation of CanadaTABLE OF

- Page 5 and 6:

Power Corporation of CanadaPART APO

- Page 7 and 8:

OVERVIEWPower Corporation is a hold

- Page 9 and 10:

COMMUNICATIONS-MEDIASquare Victoria

- Page 11 and 12:

BASIS OF PRESENTATIONThe 2012 Conso

- Page 13 and 14:

CONTRIBUTIONTOOPERATINGEARNINGSFROM

- Page 15 and 16:

Other items in 2012 mainly comprise

- Page 17 and 18:

ASSETSUNDERADMINISTRATIONAssets und

- Page 19 and 20:

EQUITYNon‐participating shares of

- Page 21 and 22:

Issuance of non‐participating sha

- Page 23 and 24:

SUMMARY OF CRITICAL ACCOUNTING ESTI

- Page 25 and 26:

GOODWILLANDINTANGIBLESIMPAIRMENTTES

- Page 27 and 28:

IFRS 11 - Joint Arrangements Effect

- Page 29 and 30:

RISK FACTORSThere are certain risks

- Page 31 and 32:

During the fourth quarter of 2011,

- Page 33 and 34:

DISCLOSURE CONTROLS AND PROCEDURESB

- Page 35 and 36:

POWER CORPORATION OF CANADACONSOLID

- Page 37 and 38:

CONSOLIDATED STATEMENTS OF COMPREHE

- Page 39 and 40:

CONSOLIDATED STATEMENTS OF CASH FLO

- Page 41 and 42:

NOTE 2 BASIS OF PRESENTATION AND SU

- Page 43 and 44:

NOTE 2 BASIS OF PRESENTATION AND SU

- Page 45 and 46:

NOTE 2 BASIS OF PRESENTATION AND SU

- Page 47 and 48:

NOTE 2 BASIS OF PRESENTATION AND SU

- Page 49 and 50:

NOTE 2 BASIS OF PRESENTATION AND SU

- Page 51 and 52:

NOTE 2 BASIS OF PRESENTATION AND SU

- Page 53 and 54:

NOTE 2 BASIS OF PRESENTATION AND SU

- Page 55 and 56:

NOTE 3 CASH AND CASH EQUIVALENTSDec

- Page 57 and 58:

2011 BondsNOTE 4 INVESTMENTS (CONTI

- Page 59 and 60:

NOTE 5 FUNDS HELD BY CEDING INSURER

- Page 61 and 62:

NOTE 8 OTHER ASSETS (CONTINUED)Chan

- Page 63 and 64:

December 31, 2011NOTE 9 GOODWILL AN

- Page 65 and 66:

NOTE 10 SEGREGATED FUNDSINVESTMENTS

- Page 67 and 68:

NOTE 11 INSURANCE AND INVESTMENT CO

- Page 69 and 70:

NOTE 11 INSURANCE AND INVESTMENT CO

- Page 71 and 72:

NOTE 11 INSURANCE AND INVESTMENT CO

- Page 73 and 74:

NOTE 11 INSURANCE AND INVESTMENT CO

- Page 75 and 76:

NOTE 13 DEBENTURES AND DEBT INSTRUM

- Page 77 and 78:

NOTE 16 INCOME TAXESEFFECTIVE INCOM

- Page 79 and 80:

NOTE 17 STATED CAPITALISSUED AND OU

- Page 81 and 82:

NOTE 18 SHARE‐BASED COMPENSATION

- Page 83 and 84:

NOTE 20 CAPITAL MANAGEMENTAs a hold

- Page 85 and 86:

NOTE 21 RISK MANAGEMENT (CONTINUED)

- Page 87 and 88:

NOTE 21 RISK MANAGEMENT (CONTINUED)

- Page 89 and 90:

NOTE 21 RISK MANAGEMENT (CONTINUED)

- Page 91 and 92:

NOTE 21 RISK MANAGEMENT (CONTINUED)

- Page 93 and 94:

NOTE 21 RISK MANAGEMENT (CONTINUED)

- Page 95 and 96:

NOTE 21 RISK MANAGEMENT (CONTINUED)

- Page 97 and 98:

NOTE 21 RISK MANAGEMENT (CONTINUED)

- Page 99 and 100:

NOTE 24 PENSION PLANS AND OTHER POS

- Page 101 and 102:

NOTE 24 PENSION PLANS AND OTHER POS

- Page 103 and 104:

NOTE 25 DERIVATIVE FINANCIAL INSTRU

- Page 105 and 106:

NOTE 26 FAIR VALUE OF FINANCIAL INS

- Page 107 and 108:

NOTE 28 EARNINGS PER SHAREThe follo

- Page 109 and 110:

NOTE 30 COMMITMENTS AND GUARANTEESG

- Page 111 and 112:

NOTE 32 SUBSEQUENT EVENTSACQUISITIO

- Page 113 and 114:

NOTE 33 SEGMENTED INFORMATION (CONT

- Page 115 and 116:

To the Shareholders of Power Corpor

- Page 117 and 118:

Power Financial CorporationPART BMa

- Page 119 and 120:

OVERVIEWPower Financial, a subsidia

- Page 121 and 122:

BASISOFPRESENTATIONThe 2012 Consoli

- Page 123 and 124:

CONTRIBUTIONTOOPERATINGEARNINGSFROM

- Page 125 and 126:

RESULTSFROMCORPORATEACTIVITIESResul

- Page 127 and 128:

CONDENSEDSUPPLEMENTARYBALANCESHEETS

- Page 129 and 130:

The carrying value under the equity

- Page 131 and 132:

Financing activities during the twe

- Page 133 and 134:

SUMMARYOFCRITICALACCOUNTINGESTIMATE

- Page 135 and 136:

GOODWILLANDINTANGIBLESIMPAIRMENTTES

- Page 137 and 138:

IFRS 11 - Joint Arrangements Effect

- Page 139 and 140:

RISKFACTORSThere are certain risks

- Page 141 and 142:

During the fourth quarter of 2011,

- Page 143 and 144:

DISCLOSURECONTROLSANDPROCEDURESBase

- Page 145 and 146:

POWER FINANCIAL CORPORATIONCONSOLID

- Page 147 and 148:

CONSOLIDATED STATEMENTS OF COMPREHE

- Page 149 and 150:

CONSOLIDATED STATEMENTS OF CASH FLO

- Page 151 and 152:

NOTE 2 BASIS OF PRESENTATION AND SU

- Page 153 and 154:

NOTE 2 BASIS OF PRESENTATION AND SU

- Page 155 and 156:

NOTE 2 BASIS OF PRESENTATION AND SU

- Page 157 and 158:

NOTE 2 BASIS OF PRESENTATION AND SU

- Page 159 and 160:

NOTE 2 BASIS OF PRESENTATION AND SU

- Page 161 and 162:

NOTE 2 BASIS OF PRESENTATION AND SU

- Page 163 and 164:

NOTE 2 BASIS OF PRESENTATION AND SU

- Page 165 and 166:

NOTE 3 CASH AND CASH EQUIVALENTSDec

- Page 167 and 168:

NOTE 4 INVESTMENTS (CONTINUED)2011

- Page 169 and 170:

NOTE 5 FUNDS HELD BY CEDING INSURER

- Page 171 and 172:

NOTE 8 OTHER ASSETS (CONTINUED)It i

- Page 173 and 174:

NOTE 9 GOODWILL AND INTANGIBLE ASSE

- Page 175 and 176:

NOTE 11 INSURANCE AND INVESTMENT CO

- Page 177 and 178:

NOTE 11 INSURANCE AND INVESTMENT CO

- Page 179 and 180:

NOTE 11 INSURANCE AND INVESTMENT CO

- Page 181 and 182:

NOTE 11 INSURANCE AND INVESTMENT CO

- Page 183 and 184:

NOTE 13 DEBENTURES AND DEBT INSTRUM

- Page 185 and 186:

NOTE 15 OTHER LIABILITIESDecember 3

- Page 187 and 188:

NOTE 16 INCOME TAXES (CONTINUED)A d

- Page 189 and 190:

NOTE 17 STATED CAPITAL (CONTINUED)(

- Page 191 and 192:

NOTE 18 SHARE‐BASED COMPENSATION

- Page 193 and 194:

NOTE 20 CAPITAL MANAGEMENTAs a hold

- Page 195 and 196:

NOTE 21 RISK MANAGEMENT (CONTINUED)

- Page 197 and 198:

NOTE 21 RISK MANAGEMENT (CONTINUED)

- Page 199 and 200:

NOTE 21 RISK MANAGEMENT (CONTINUED)

- Page 201 and 202:

NOTE 21 RISK MANAGEMENT (CONTINUED)

- Page 203 and 204:

NOTE 21 RISK MANAGEMENT (CONTINUED)

- Page 205 and 206:

NOTE 21 RISK MANAGEMENT (CONTINUED)

- Page 207 and 208:

NOTE 22 OPERATING AND ADMINISTRATIV

- Page 209 and 210:

NOTE 24 PENSION PLANS AND OTHER POS

- Page 211 and 212:

NOTE 25 DERIVATIVE FINANCIAL INSTRU

- Page 213 and 214: NOTE 25 DERIVATIVE FINANCIAL INSTRU

- Page 215 and 216: NOTE 26 FAIR VALUE OF FINANCIAL INS

- Page 217 and 218: NOTE 28 EARNINGS PER SHAREThe follo

- Page 219 and 220: NOTE 30 COMMITMENTS AND GUARANTEESG

- Page 221 and 222: NOTE 32 SUBSEQUENT EVENTSACQUISITIO

- Page 223 and 224: NOTE 33 SEGMENTED INFORMATION (CONT

- Page 225 and 226: INDEPENDENT AUDITOR’S REPORTTo th

- Page 227 and 228: Great-West Lifeco Inc.PART CManagem

- Page 229 and 230: MANAGEMENT’S DISCUSSION AND ANALY

- Page 231 and 232: MANAGEMENT’S DISCUSSION AND ANALY

- Page 233 and 234: MANAGEMENT’S DISCUSSION AND ANALY

- Page 235 and 236: MANAGEMENT’S DISCUSSION AND ANALY

- Page 237 and 238: MANAGEMENT’S DISCUSSION AND ANALY

- Page 239 and 240: MANAGEMENT’S DISCUSSION AND ANALY

- Page 241 and 242: MANAGEMENT’S DISCUSSION AND ANALY

- Page 243 and 244: MANAGEMENT’S DISCUSSION AND ANALY

- Page 245 and 246: MANAGEMENT’S DISCUSSION AND ANALY

- Page 247 and 248: MANAGEMENT’S DISCUSSION AND ANALY

- Page 249 and 250: MANAGEMENT’S DISCUSSION AND ANALY

- Page 251 and 252: MANAGEMENT’S DISCUSSION AND ANALY

- Page 253 and 254: MANAGEMENT’S DISCUSSION AND ANALY

- Page 255 and 256: MANAGEMENT’S DISCUSSION AND ANALY

- Page 257 and 258: MANAGEMENT’S DISCUSSION AND ANALY

- Page 259 and 260: MANAGEMENT’S DISCUSSION AND ANALY

- Page 261 and 262: MANAGEMENT’S DISCUSSION AND ANALY

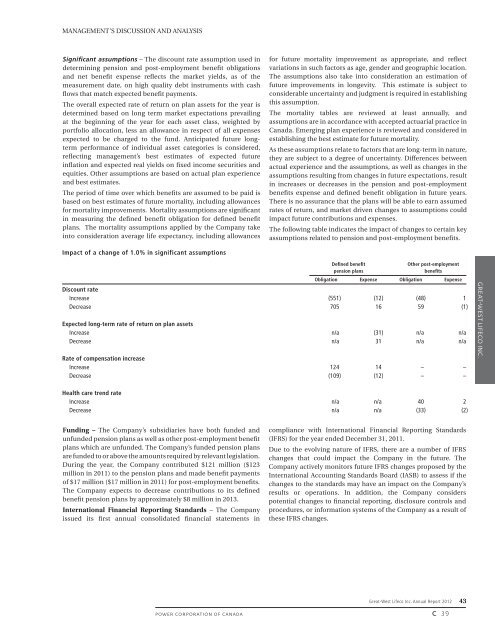

- Page 263: MANAGEMENT’S DISCUSSION AND ANALY

- Page 267 and 268: MANAGEMENT’S DISCUSSION AND ANALY

- Page 269 and 270: WEALTH MANAGEMENTThe Company provid

- Page 271 and 272: 2012 DEVELOPMENTS up 5% ov

- Page 273 and 274: MANAGEMENT’S DISCUSSION AND ANALY

- Page 275 and 276: Sales increased by $72 million to $

- Page 277 and 278: COMPETITIVE CONDITIONSFinancial Ser

- Page 279 and 280: MANAGEMENT’S DISCUSSION AND ANALY

- Page 281 and 282: MANAGEMENT’S DISCUSSION AND ANALY

- Page 283 and 284: MANAGEMENT’S DISCUSSION AND ANALY

- Page 285 and 286: MANAGEMENT’S DISCUSSION AND ANALY

- Page 287 and 288: MANAGEMENT’S DISCUSSION AND ANALY

- Page 289 and 290: MANAGEMENT’S DISCUSSION AND ANALY

- Page 291 and 292: MANAGEMENT’S DISCUSSION AND ANALY

- Page 293 and 294: CONSOLIDATED STATEMENTS OF EARNINGS

- Page 295 and 296: CONSOLIDATED BALANCE SHEETS(in Cana

- Page 297 and 298: CONSOLIDATED STATEMENTS OF CASH FLO

- Page 299 and 300: NOTES TO CONSOLIDATED FINANCIAL

- Page 301 and 302: NOTES TO CONSOLIDATED FINANCIAL STA

- Page 303 and 304: NOTES TO CONSOLIDATED FINANCIAL STA

- Page 305 and 306: NOTES TO CONSOLIDATED FINANCIAL STA

- Page 307 and 308: NOTES TO CONSOLIDATED FINANCIAL STA

- Page 309 and 310: NOTES TO CONSOLIDATED FINANCIAL STA

- Page 311 and 312: NOTES TO CONSOLIDATED FINANCIAL STA

- Page 313 and 314: NOTES TO CONSOLIDATED FINANCIAL STA

- Page 315 and 316:

NOTES TO CONSOLIDATED FINANCIAL STA

- Page 317 and 318:

NOTES TO CONSOLIDATED FINANCIAL STA

- Page 319 and 320:

NOTES TO CONSOLIDATED FINANCIAL STA

- Page 321 and 322:

NOTES TO CONSOLIDATED FINANCIAL STA

- Page 323 and 324:

NOTES TO CONSOLIDATED FINANCIAL STA

- Page 325 and 326:

NOTES TO CONSOLIDATED FINANCIAL STA

- Page 327 and 328:

NOTES TO CONSOLIDATED FINANCIAL STA

- Page 329 and 330:

NOTES TO CONSOLIDATED FINANCIAL STA

- Page 331 and 332:

NOTES TO CONSOLIDATED FINANCIAL STA

- Page 333 and 334:

NOTES TO CONSOLIDATED FINANCIAL STA

- Page 335 and 336:

NOTES TO CONSOLIDATED FINANCIAL STA

- Page 337 and 338:

NOTES TO CONSOLIDATED FINANCIAL STA

- Page 339 and 340:

NOTES TO CONSOLIDATED FINANCIAL STA

- Page 341 and 342:

NOTES TO CONSOLIDATED FINANCIAL STA

- Page 343 and 344:

NOTES TO CONSOLIDATED FINANCIAL STA

- Page 345 and 346:

NOTES TO CONSOLIDATED FINANCIAL STA

- Page 347 and 348:

NOTES TO CONSOLIDATED FINANCIAL STA

- Page 349 and 350:

NOTES TO CONSOLIDATED FINANCIAL STA

- Page 351 and 352:

NOTES TO CONSOLIDATED FINANCIAL STA

- Page 353 and 354:

NOTES TO CONSOLIDATED FINANCIAL STA

- Page 355 and 356:

INDEPENDENT AUDITOR’S REPORTTo th

- Page 357 and 358:

IGM Financial Inc.PART DManagement

- Page 359 and 360:

IGM Financial Inc.Summary of Consol

- Page 361 and 362:

TABLE 2: CONSOLIDATED OPERATING RES

- Page 363 and 364:

SUMMARY OF CHANGES IN TOTAL ASSETS

- Page 365 and 366:

TABLE 6: SELECTED ANNUAL INFORMATIO

- Page 367 and 368:

TABLE 7: SUMMARY OF QUARTERLY RESUL

- Page 369 and 370:

technology platform, bringing toget

- Page 371 and 372:

50% of their assets in Investors Pr

- Page 373 and 374:

deferred distributions in the form

- Page 375 and 376:

Review of Segment Operating Results

- Page 377 and 378:

TABLE 10 : MORTGAGE BANKING OPERATI

- Page 379 and 380:

Net Investment Income and OtherNet

- Page 381 and 382:

Sale of Mackenzie Subsidiaries• O

- Page 383 and 384:

TABLE 12: ASSETS UNDER MANAGEMENT B

- Page 385 and 386:

Review of Segment Operating Results

- Page 387 and 388:

associated with redemptions. Macken

- Page 389 and 390:

IGM Financial Inc.Consolidated Fina

- Page 391 and 392:

TABLE 17: INVESTMENT IN AFFILIATEth

- Page 393 and 394:

Cash FlowsTable 19 - Cash Flows is

- Page 395 and 396:

impact of all risks on the value of

- Page 397 and 398:

Risk ManagementThe Company is expos

- Page 399 and 400:

Long-Term Debt Maturity Schedule($

- Page 401 and 402:

eceives investment returns on the r

- Page 403 and 404:

Equity Price RiskThe Company is exp

- Page 405 and 406:

differences that may be as a result

- Page 407 and 408:

assets under management, and their

- Page 409 and 410:

year and income taxes recorded in p

- Page 411 and 412:

IAS 19 Employee BenefitsThe IASB is

- Page 413 and 414:

Other InformationTRANSACTIONS WITH

- Page 415 and 416:

Consolidated Financial Statements75

- Page 417 and 418:

Independent Auditor’s ReportTo th

- Page 419 and 420:

Consolidated Statements of Comprehe

- Page 421 and 422:

Consolidated Statements of Changes

- Page 423 and 424:

Notes to Consolidated Financial Sta

- Page 425 and 426:

2. SUMMARY OF SIGNIFICANT ACCOUNTIN

- Page 427 and 428:

2. SUMMARY OF SIGNIFICANT ACCOUNTIN

- Page 429 and 430:

3. DISCONTINUED OPERATIONSOn Novemb

- Page 431 and 432:

6. LOANSCONTRACTUAL MATURITY1 YEAR

- Page 433 and 434:

9. INVESTMENT IN AFFILIATEInvestmen

- Page 435 and 436:

11. GOODWILL AND INTANGIBLE ASSETS

- Page 437 and 438:

14. EMPLOYEE BENEFITS (continued)De

- Page 439 and 440:

15. INCOME TAXESIncome tax expense

- Page 441 and 442:

17. SHARE CAPITAL (continued)Normal

- Page 443 and 444:

19. SHARE-BASED PAYMENTS (continued

- Page 445 and 446:

21. RISK MANAGEMENT (continued)Cred

- Page 447 and 448:

21. RISK MANAGEMENT (continued)Cred

- Page 449 and 450:

22. DERIVATIVE FINANCIAL INSTRUMENT

- Page 451 and 452:

23. FAIR VALUE OF FINANCIAL INSTRUM

- Page 453 and 454:

23. FAIR VALUE OF FINANCIAL INSTRUM

- Page 455 and 456:

25. CONTINGENT LIABILITIES, COMMITM

- Page 457 and 458:

27. SEGMENTED INFORMATION (continue

- Page 459 and 460:

Pargesa Holding SAPART EPOWER CORPO

- Page 461 and 462:

Pargesa Group - Financial informati

- Page 463 and 464:

Economic analysis of Pargesa’s ne

- Page 465 and 466:

GDF SUEZGDF Suez, a world energy le

- Page 467 and 468:

CorporateInformationStock ListingsS