tuw5P

tuw5P

tuw5P

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

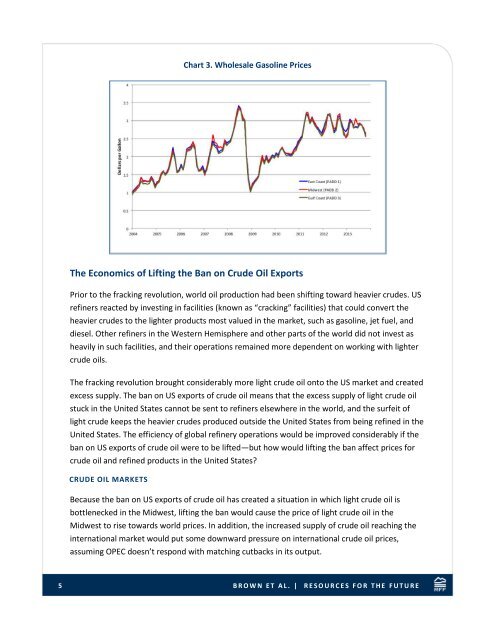

Chart 3. Wholesale Gasoline PricesThe Economics of Lifting the Ban on Crude Oil ExportsPrior to the fracking revolution, world oil production had been shifting toward heavier crudes. USrefiners reacted by investing in facilities (known as “cracking” facilities) that could convert theheavier crudes to the lighter products most valued in the market, such as gasoline, jet fuel, anddiesel. Other refiners in the Western Hemisphere and other parts of the world did not invest asheavily in such facilities, and their operations remained more dependent on working with lightercrude oils.The fracking revolution brought considerably more light crude oil onto the US market and createdexcess supply. The ban on US exports of crude oil means that the excess supply of light crude oilstuck in the United States cannot be sent to refiners elsewhere in the world, and the surfeit oflight crude keeps the heavier crudes produced outside the United States from being refined in theUnited States. The efficiency of global refinery operations would be improved considerably if theban on US exports of crude oil were to be lifted—but how would lifting the ban affect prices forcrude oil and refined products in the United States?CRUDE OIL MARKETSBecause the ban on US exports of crude oil has created a situation in which light crude oil isbottlenecked in the Midwest, lifting the ban would cause the price of light crude oil in theMidwest to rise towards world prices. In addition, the increased supply of crude oil reaching theinternational market would put some downward pressure on international crude oil prices,assuming OPEC doesn’t respond with matching cutbacks in its output.5 B R O W N E T A L . | R E S O U R C E S F O R T H E F U T U R E