IFRS at a Glance - IAS 38: Intangible Assets - BDO International

IFRS at a Glance - IAS 38: Intangible Assets - BDO International

IFRS at a Glance - IAS 38: Intangible Assets - BDO International

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

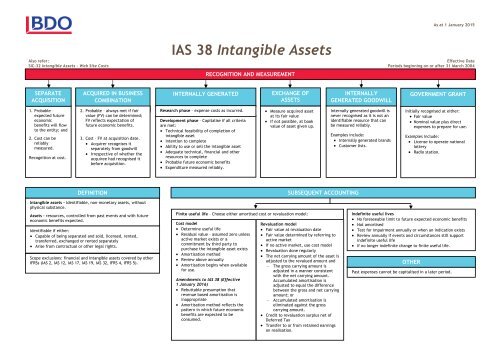

As <strong>at</strong> 1 January 2015Also refer:SIC-32 <strong>Intangible</strong> <strong>Assets</strong> – Web Site Costs<strong>IAS</strong> <strong>38</strong> <strong>Intangible</strong> <strong>Assets</strong>RECOGNITION AND MEASUREMENTEffective D<strong>at</strong>ePeriods beginning on or after 31 March 2004SEPARATEACQUISITIONACQUIRED IN BUSINESSCOMBINATIONINTERNALLY GENERATEDEXCHANGE OFASSETSINTERNALLYGENERATED GOODWILLGOVERNMENT GRANT1. Probable –expected futureeconomicbenefits will flowto the entity; and2. Cost can be2. Probable – always met if fairvalue (FV) can be determined;FV reflects expect<strong>at</strong>ion offuture economic benefits.3. Cost – FV <strong>at</strong> acquisition d<strong>at</strong>e.Specific reliably quantit<strong>at</strong>ive disclosure Acquirer requirements:recognises itmeasured.separ<strong>at</strong>ely from goodwill Irrespective of whether theRecognition <strong>at</strong> cost.acquiree had recognised itbefore acquisition.Research phase – expense costs as incurred.Development phase – Capitalise if all criteriaare met: Technical feasibility of completion ofintangible asset Intention to complete Ability to use or sell the intangible asset Adequ<strong>at</strong>e technical, financial and otherresources to complete Probable future economic benefits Expenditure measured reliably. Measure acquired asset<strong>at</strong> its fair value If not possible, <strong>at</strong> bookvalue of asset given up.Internally gener<strong>at</strong>ed goodwill isnever recognised as it is not anidentifiable resource th<strong>at</strong> canbe measured reliably.Examples include: Internally gener<strong>at</strong>ed brands Customer lists.Initially recognised <strong>at</strong> either: Fair value Nominal value plus directexpenses to prepare for use.Examples include: License to oper<strong>at</strong>e n<strong>at</strong>ionallottery Radio st<strong>at</strong>ion.DEFINITIONSUBSEQUENT ACCOUNTING<strong>Intangible</strong> assets - identifiable, non-monetary assets, withoutphysical substance.<strong>Assets</strong> - resources, controlled from past events and with futureeconomic benefits expected.Identifiable if either: Capable of being separ<strong>at</strong>ed and sold, licensed, rented,transferred, exchanged or rented separ<strong>at</strong>ely Arise from contractual or other legal rights.Scope exclusions: financial and intangible assets covered by other<strong>IFRS</strong>s (<strong>IAS</strong> 2, <strong>IAS</strong> 12, <strong>IAS</strong> 17, <strong>IAS</strong> 19, <strong>IAS</strong> 32, <strong>IFRS</strong> 4, <strong>IFRS</strong> 5).Finite useful life – Choose either amortised cost or revalu<strong>at</strong>ion model:Cost model Determine useful life Residual value – assumed zero unlessactive market exists or acommitment by third party topurchase the intangible asset exists Amortis<strong>at</strong>ion method Review above annually Amortis<strong>at</strong>ion begins when availablefor use.Amendments to <strong>IAS</strong> <strong>38</strong> (Effective1 January 2016) Rebuttable presumption th<strong>at</strong>revenue based amortis<strong>at</strong>ion isinappropri<strong>at</strong>e Amortis<strong>at</strong>ion method reflects thep<strong>at</strong>tern in which future economicbenefits are expected to beconsumed.Revalu<strong>at</strong>ion model Fair value <strong>at</strong> revalu<strong>at</strong>ion d<strong>at</strong>e Fair value determined by referring toactive market If no active market, use cost model Revalu<strong>at</strong>ion done regularly The net carrying amount of the asset isadjusted to the revalued amount and The gross carrying amount isadjusted in a manner consistentwith the net carrying amount.Accumul<strong>at</strong>ed amortis<strong>at</strong>ion isadjusted to equal the differencebetween the gross and net carryingamount; or Accumul<strong>at</strong>ed amortis<strong>at</strong>ion iselimin<strong>at</strong>ed against the grosscarrying amount. Credit to revalu<strong>at</strong>ion surplus net ofDeferred Tax Transfer to or from retained earningson realis<strong>at</strong>ion.Indefinite useful lives No foreseeable limit to future expected economic benefits Not amortised Test for impairment annually or when an indic<strong>at</strong>ion exists Review annually if events and circumstances still supportindefinite useful life If no longer indefinite change to finite useful life.OTHERPast expenses cannot be capitalised in a l<strong>at</strong>er period.