Notes - Genesis Housing Association

Notes - Genesis Housing Association

Notes - Genesis Housing Association

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

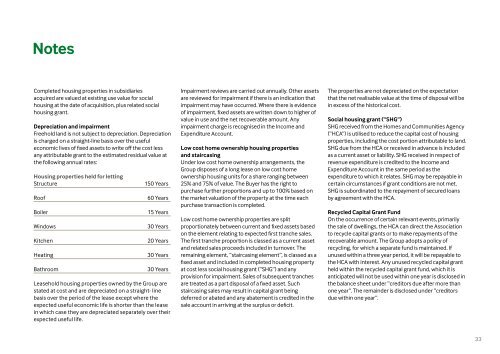

<strong>Notes</strong>Completed housing properties in subsidiariesacquired are valued at existing use value for socialhousing at the date of acquisition, plus related socialhousing grant.Depreciation and impairmentFreehold land is not subject to depreciation. Depreciationis charged on a straight-line basis over the usefuleconomic lives of fixed assets to write off the cost lessany attributable grant to the estimated residual value atthe following annual rates:<strong>Housing</strong> properties held for lettingStructureRoofBoilerWindowsKitchenHeatingBathroom150 Years60 Years15 Years30 Years20 Years30 Years30 YearsLeasehold housing properties owned by the Group arestated at cost and are depreciated on a straight- linebasis over the period of the lease except where theexpected useful economic life is shorter than the leasein which case they are depreciated separately over theirexpected useful life.Impairment reviews are carried out annually. Other assetsare reviewed for impairment if there is an indication thatimpairment may have occurred. Where there is evidenceof impairment, fixed assets are written down to higher ofvalue in use and the net recoverable amount. Anyimpairment charge is recognised in the Income andExpenditure Account.Low cost home ownership housing propertiesand staircasingUnder low cost home ownership arrangements, theGroup disposes of a long lease on low cost homeownership housing units for a share ranging between25% and 75% of value. The Buyer has the right topurchase further proportions and up to 100% based onthe market valuation of the property at the time eachpurchase transaction is completed.Low cost home ownership properties are splitproportionately between current and fixed assets basedon the element relating to expected first tranche sales.The first tranche proportion is classed as a current assetand related sales proceeds included in turnover. Theremaining element, “staircasing element”, is classed as afixed asset and included in completed housing propertyat cost less social housing grant (“SHG”) and anyprovision for impairment. Sales of subsequent tranchesare treated as a part disposal of a fixed asset. Suchstaircasing sales may result in capital grant beingdeferred or abated and any abatement is credited in thesale account in arriving at the surplus or deficit.The properties are not depreciated on the expectationthat the net realisable value at the time of disposal will bein excess of the historical cost.Social housing grant (“SHG”)SHG received from the Homes and Communities Agency(“HCA”) is utilised to reduce the capital cost of housingproperties, including the cost portion attributable to land.SHG due from the HCA or received in advance is includedas a current asset or liability. SHG received in respect ofrevenue expenditure is credited to the Income andExpenditure Account in the same period as theexpenditure to which it relates. SHG may be repayable incertain circumstances if grant conditions are not met.SHG is subordinated to the repayment of secured loansby agreement with the HCA.Recycled Capital Grant FundOn the occurrence of certain relevant events, primarilythe sale of dwellings, the HCA can direct the <strong>Association</strong>to recycle capital grants or to make repayments of therecoverable amount. The Group adopts a policy ofrecycling, for which a separate fund is maintained. Ifunused within a three year period, it will be repayable tothe HCA with interest. Any unused recycled capital grantheld within the recycled capital grant fund, which it isanticipated will not be used within one year is disclosed inthe balance sheet under “creditors due after more thanone year”. The remainder is disclosed under “creditorsdue within one year”.33