SGI CANADA Policy Booklet - Your Easy Read Special Coverages

SGI CANADA Policy Booklet - Your Easy Read Special Coverages

SGI CANADA Policy Booklet - Your Easy Read Special Coverages

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

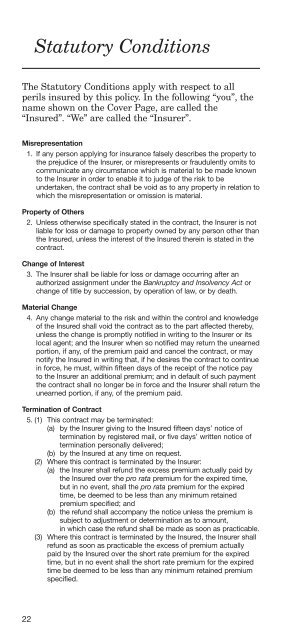

Statutory ConditionsThe Statutory Conditions apply with respect to allperils insured by this policy. In the following “you”, thename shown on the Cover Page, are called the“Insured”. “We” are called the “Insurer”.Misrepresentation1. If any person applying for insurance falsely describes the property tothe prejudice of the Insurer, or misrepresents or fraudulently omits tocommunicate any circumstance which is material to be made knownto the Insurer in order to enable it to judge of the risk to beundertaken, the contract shall be void as to any property in relation towhich the misrepresentation or omission is material.Property of Others2. Unless otherwise specifically stated in the contract, the Insurer is notliable for loss or damage to property owned by any person other thanthe Insured, unless the interest of the Insured therein is stated in thecontract.Change of Interest3. The Insurer shall be liable for loss or damage occurring after anauthorized assignment under the Bankruptcy and Insolvency Act orchange of title by succession, by operation of law, or by death.Material Change4. Any change material to the risk and within the control and knowledgeof the Insured shall void the contract as to the part affected thereby,unless the change is promptly notified in writing to the Insurer or itslocal agent; and the Insurer when so notified may return the unearnedportion, if any, of the premium paid and cancel the contract, or maynotify the Insured in writing that, if he desires the contract to continuein force, he must, within fifteen days of the receipt of the notice payto the Insurer an additional premium; and in default of such paymentthe contract shall no longer be in force and the Insurer shall return theunearned portion, if any, of the premium paid.Termination of Contract5. (1) This contract may be terminated:(a) by the Insurer giving to the Insured fifteen days’ notice oftermination by registered mail, or five days’ written notice oftermination personally delivered;(b) by the Insured at any time on request.(2) Where this contract is terminated by the Insurer:(a) the Insurer shall refund the excess premium actually paid bythe Insured over the pro rata premium for the expired time,but in no event, shall the pro rata premium for the expiredtime, be deemed to be less than any minimum retainedpremium specified; and(b) the refund shall accompany the notice unless the premium issubject to adjustment or determination as to amount,in which case the refund shall be made as soon as practicable.(3) Where this contract is terminated by the Insured, the Insurer shallrefund as soon as practicable the excess of premium actuallypaid by the Insured over the short rate premium for the expiredtime, but in no event shall the short rate premium for the expiredtime be deemed to be less than any minimum retained premiumspecified.22