2010 REGISTRATION DOCUMENT (3.4 Mo) - Groupe Casino

2010 REGISTRATION DOCUMENT (3.4 Mo) - Groupe Casino

2010 REGISTRATION DOCUMENT (3.4 Mo) - Groupe Casino

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

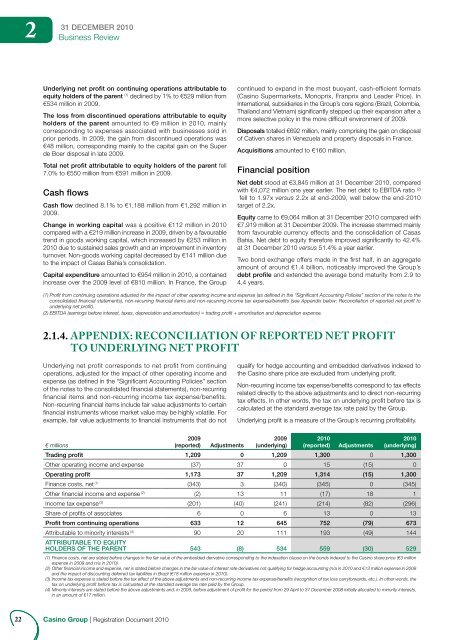

231 DECEMBER <strong>2010</strong>Business ReviewUnderlying net profit on continuing operations attributable toequity holders of the parent (1) declined by 1% to €529 million from€534 million in 2009.The loss from discontinued operations attributable to equityholders of the parent amounted to €9 million in <strong>2010</strong>, mainlycorresponding to expenses associated with businesses sold inprior periods. In 2009, the gain from discontinued operations was€48 million, corresponding mainly to the capital gain on the Superde Boer disposal in late 2009.Total net profit attributable to equity holders of the parent fell7.0% to €550 million from €591 million in 2009.Cash flowsCash flow declined 8.1% to €1,188 million from €1,292 million in2009.Change in working capital was a positive €112 million in <strong>2010</strong>compared with a €219 million increase in 2009, driven by a favourabletrend in goods working capital, which increased by €253 million in<strong>2010</strong> due to sustained sales growth and an improvement in inventoryturnover. Non-goods working capital decreased by €141 million dueto the impact of Casas Bahia’s consolidation.Capital expenditure amounted to €954 million in <strong>2010</strong>, a containedincrease over the 2009 level of €810 million. In France, the Groupcontinued to expand in the most buoyant, cash-efficient formats(<strong>Casino</strong> Supermarkets, <strong>Mo</strong>noprix, Franprix and Leader Price). InInternational, subsidiaries in the Group’s core regions (Brazil, Colombia,Thailand and Vietnam) significantly stepped up their expansion after amore selective policy in the more difficult environment of 2009.Disposals totalled €692 million, mainly comprising the gain on disposalof Cativen shares in Venezuela and property disposals in France.Acquisitions amounted to €160 million.Financial positionNet debt stood at €3,845 million at 31 December <strong>2010</strong>, comparedwith €4,072 million one year earlier. The net debt to EBITDA ratio (2)fell to 1.97x versus 2.2x at end-2009, well below the end-<strong>2010</strong>target of 2.2x.Equity came to €9,064 million at 31 December <strong>2010</strong> compared with€7,919 million at 31 December 2009. The increase stemmed mainlyfrom favourable currency effects and the consolidation of CasasBahia. Net debt to equity therefore improved significantly to 42.4%at 31 December <strong>2010</strong> versus 51.4% a year earlier.Two bond exchange offers made in the first half, in an aggregateamount of around €1.4 billion, noticeably improved the Group’sdebt profile and extended the average bond maturity from 2.9 to4.4 years.(1) Profi t from continuing operations adjusted for the impact of other operating income and expense (as defi ned in the “Signifi cant Accounting Policies” section of the notes to theconsolidated fi nancial statements), non-recurring fi nancial items and non-recurring income tax expense/benefi ts (see Appendix below: Reconciliation of reported net profi t tounderlying net profi t).(2) EBITDA (earnings before interest, taxes, depreciation and amortisation) = trading profi t + amortisation and depreciation expense.2.1.4. APPENDIX: RECONCILIATION OF REPORTED NET PROFITTO UNDERLYING NET PROFITUnderlying net profit corresponds to net profit from continuingoperations, adjusted for the impact of other operating income andexpense (as defined in the “Significant Accounting Policies” sectionof the notes to the consolidated financial statements), non-recurringfinancial items and non-recurring income tax expense/benefits.Non-recurring financial items include fair value adjustments to certainfinancial instruments whose market value may be highly volatile. Forexample, fair value adjustments to financial instruments that do notqualify for hedge accounting and embedded derivatives indexed tothe <strong>Casino</strong> share price are excluded from underlying profit.Non-recurring income tax expense/benefits correspond to tax effectsrelated directly to the above adjustments and to direct non-recurringtax effects. In other words, the tax on underlying profit before tax iscalculated at the standard average tax rate paid by the Group.Underlying profit is a measure of the Group’s recurring profitability.€ millions2009(reported)Adjustments2009(underlying)<strong>2010</strong>(reported)Adjustments<strong>2010</strong>(underlying)Trading profit 1,209 0 1,209 1,300 0 1,300Other operating income and expense (37) 37 0 15 (15) 0Operating profit 1,173 37 1,209 1,314 (15) 1,300Finance costs, net (1) (343) 3 (340) (345) 0 (345)Other financial income and expense (2) (2) 13 11 (17) 18 1Income tax expense (3) (201) (40) (241) (214) (82) (296)Share of profits of associates 6 0 6 13 0 13Profit from continuing operations 633 12 645 752 (79) 673Attributable to minority interests (4) 90 20 111 193 (49) 144ATTRIBUTABLE TO EQUITYHOLDERS OF THE PARENT 543 (8) 534 559 (30) 529(1) Finance costs, net are stated before changes in the fair value of the embedded derivative corresponding to the indexation clause on the bonds indexed to the <strong>Casino</strong> share price (€3 millionexpense in 2009 and n/a in <strong>2010</strong>).(2) Other fi nancial income and expense, net is stated before changes in the fair value of interest rate derivatives not qualifying for hedge accounting (n/a in <strong>2010</strong> and €13 million expense in 2009and the impact of discounting deferred tax liabilities in Brazil (€18 million expense in <strong>2010</strong>).(3) Income tax expense is stated before the tax effect of the above adjustments and non-recurring income tax expense/benefi ts (recognition of tax loss carryforwards, etc.). In other words, thetax on underlying profi t before tax is calculated at the standard average tax rate paid by the Group.(4) Minority interests are stated before the above adjustments and, in 2009, before adjustment of profi t for the period from 29 April to 31 December 2008 initially allocated to minority interests,in an amount of €17 million.22 <strong>Casino</strong> Group | Registration Document <strong>2010</strong>